Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

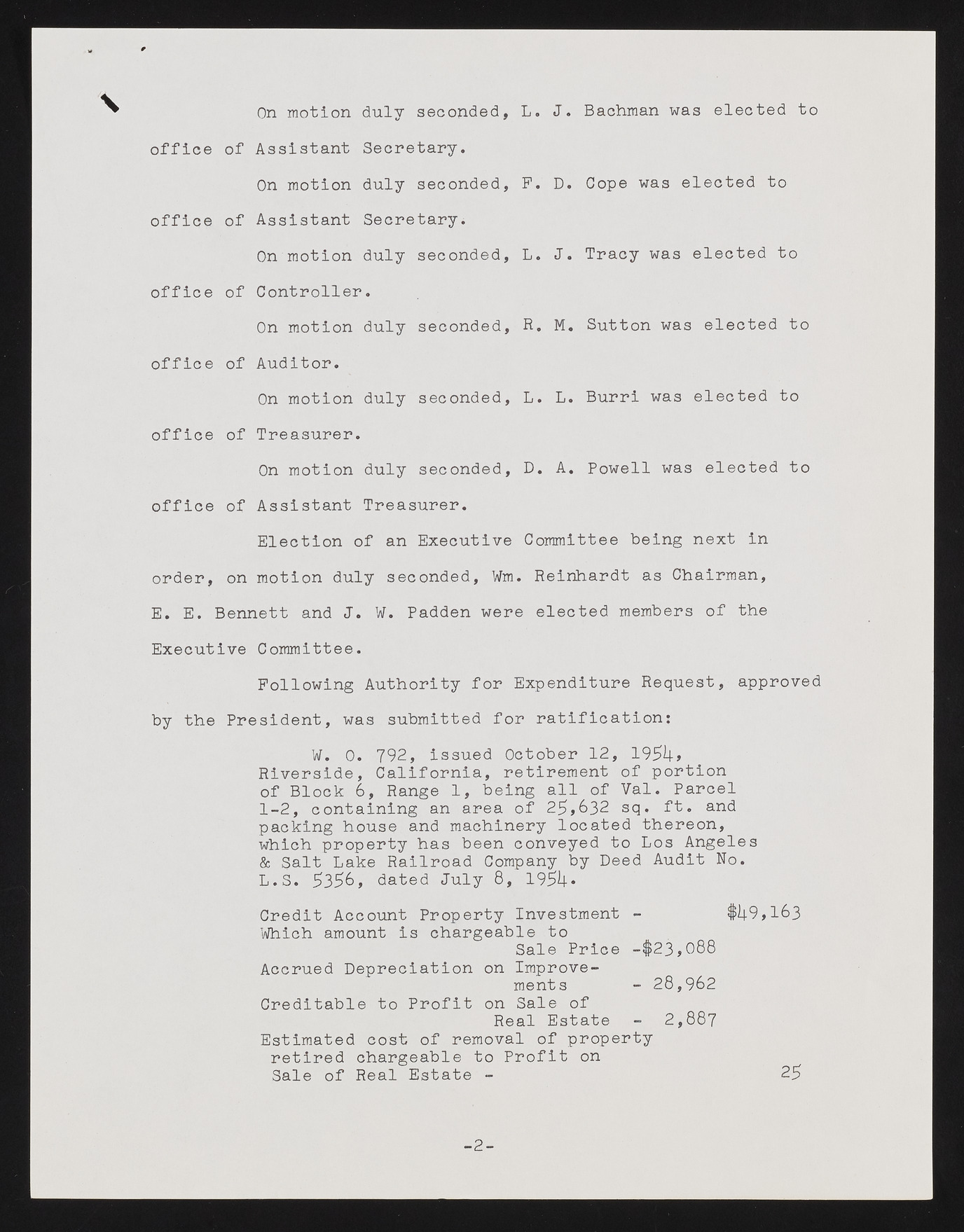

* \ On motion duly seconded, L. J. Bachman was elected to office of Assistant Secretary. On motion duly seconded, F. D. Cope was elected to office of Assistant Secretary. On motion duly seconded, L. J. Tracy was elected to office of Controller. On motion duly seconded, R. M. Sutton was elected to office of Auditor. On motion duly seconded, L. L. Burri was elected to office of Treasurer. On motion duly seconded, D. A. Powell was elected to office of Assistant Treasurer. Election of an Executive Committee being next in order, on motion duly seconded, Wm. Reinhardt as Chairman, E. E. Bennett and J. W. Padden were elected members of the Executive Committee. Following Authority for Expenditure Request, approved by the President, was submitted for ratification: W. 0. 792, issued October 12, 1954* Riverside, California, retirement of portion of Block 6, Range 1, being all of Val. Parcel 1-2, containing an area of 25»632 sq. ft. and packing house and machinery located thereon, which property has been conveyed to Los Angeles & Salt Lake Railroad Company by Deed Audit No. L.S. 5356, dated July 8, 1951+. Credit Account Property Investment - $i|9,l63 Which amount is chargeable to Sale Price -f>23>088 Accrued Depreciation on Improvements - 28,962 Creditable to Profit on Sale of Real Estate - 2,887 Estimated cost of removal of property retired chargeable to Profit on Sale of Real Estate - 25 -2-