Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

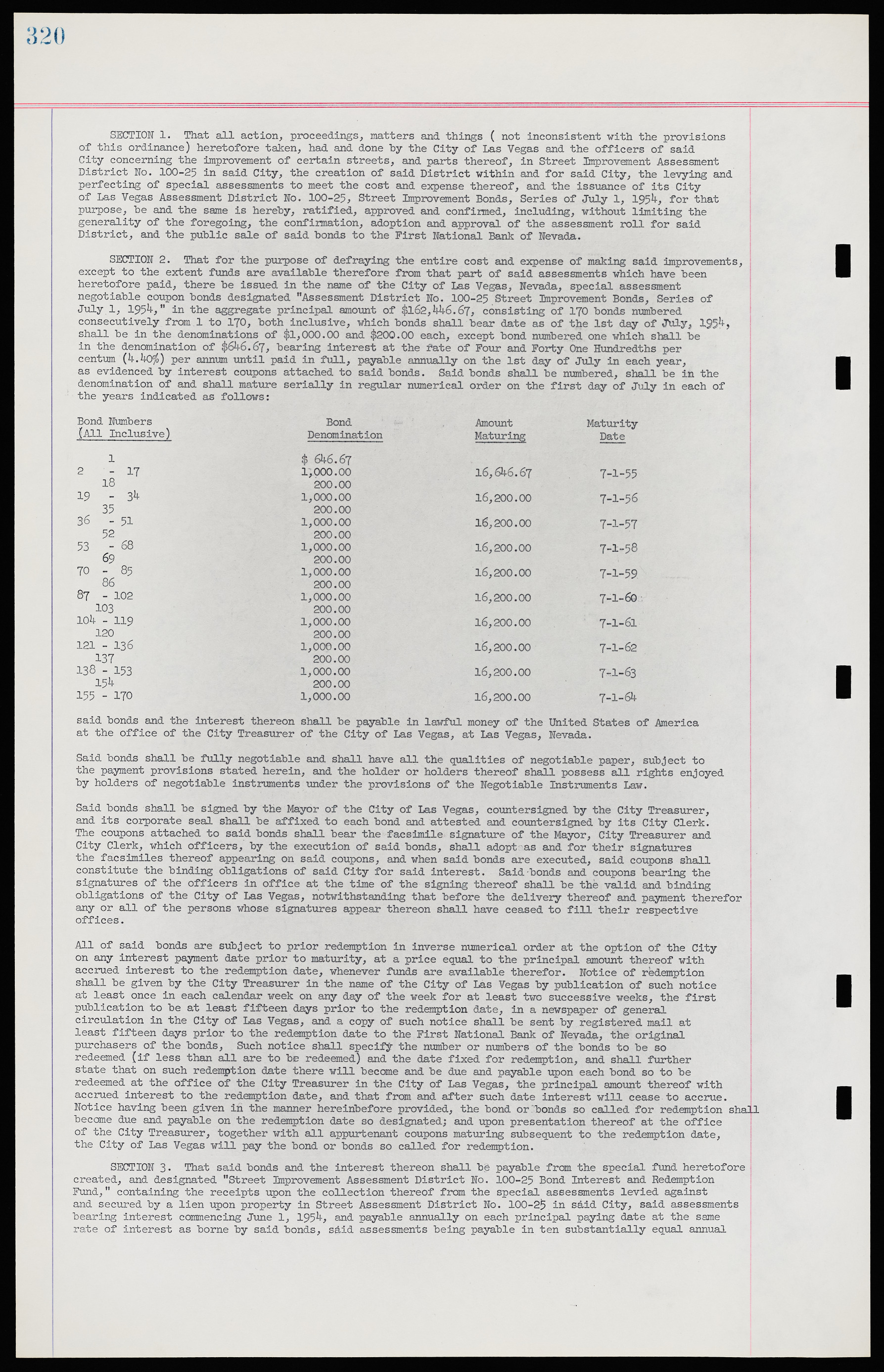

SECTION 1. That all action, proceedings, matters and things ( not inconsistent with the provisions of this ordinance) heretofore taken, had and done by the City of Las Vegas and the officers of said City concerning the improvement of certain streets, and parts thereof, in Street Improvement Assessment District No. 100-25 in said City, the creation of said District within and for said City, the levying and perfecting of special assessments to meet the cost and expense thereof, and the issuance of its City of Las Vegas Assessment District No. 100-25, Street Improvement Bonds, Series of July 1, 1954, for that purpose, be and the same is hereby, ratified, approved and confirmed, including, without limiting the generality of the foregoing, the confirmation, adoption and approval of the assessment roll for said District, and the public sale of said bonds to the First National Bank of Nevada. SECTION 2. That for the purpose of defraying the entire cost and expense of making said improvements, except to the extent funds are available therefore from that part of said assessments which have been heretofore paid, there be issued in the name of the City of Las Vegas, Nevada, special assessment negotiable coupon bonds designated "Assessment District No. 100-25 Street Improvement Bonds, Series of July 1, 1954," in the aggregate principal amount of $162,446.67, consisting of 170 bonds numbered consecutively from 1 to 170, both inclusive, which bonds shall bear date as of the 1st day of July, 1954, shall be in the denominations of $1,000.00 and $200.00 each, except bond numbered one which shall be in the denomination of $646.67, bearing interest at the fate of Four and Forty One Hundredths per centum (4.40%) per annum until paid in full, payable annually on the 1st day of July in each year, as evidenced by interest coupons attached to said bonds. Said bonds shall be numbered, shall be in the denomination of and shall mature serially in regular numerical order on the first day of July in each of the years indicated as follows: Bond Numbers Bond Amount Maturity (All Inclusive) Denomination Maturing Date 1 $ 646.67 2 - 17 1,000.00 16,646.67 7-1-55 18 200.00 19 - 34 1,000.00 16,200.00 7-1-56 35 200.00 36-51 1,000.00 16,200.00 7-1-57 52 200.00 53 - 68 1,000.00 16,200.00 7-1-58 69 200.00 70-85 1,000.00 16,200.00 7-1-59 86 200.00 87 - 102 1,000.00 16,200.00 7-1-60 103 200.00 104 - 119 1,000.00 16,200.00 7-1-61 120 200.00 121 - 136 1,000.00 16,200.00 7-1-62 137 200.00 138 - 153 1,000.00 16,200.00 7-1-63 154 200.00 155 - 170 1,000.00 16,200.00 7-1-64 said bonds and the interest thereon shall be payable in lawful money of the United States of America at the office of the City Treasurer of the City of Las Vegas, at Las Vegas, Nevada. Said bonds shall be fully negotiable and shall have all the qualities of negotiable paper, subject to the payment provisions stated herein, and the holder or holders thereof shall possess al1 rights enjoyed by holders of negotiable instruments under the provisions of the Negotiable Instruments Law. Said bonds shall be signed by the Mayor of the City of Las Vegas, countersigned by the City Treasurer, and its corporate seal shall be affixed to each bond and attested and countersigned by its City Clerk. The coupons attached to said bonds shall bear the facsimile signature of the Mayor, City Treasurer and City Clerk, which officers, by the execution of said bonds, shall adopt as and for their signatures the facsimiles thereof appearing on said coupons, and when said bonds are executed, said coupons shall constitute the binding obligations of said City for said interest. Said bonds and coupons bearing the signatures of the officers in office at the time of the signing thereof shall be the valid and binding obligations of the City of Las Vegas, notwithstanding that before the delivery thereof and payment therefor any or all of the persons whose signatures appear thereon shall have ceased to fill their respective offices. All of said bonds are subject to prior redemption in inverse numerical order at the option of the City on any interest payment date prior to maturity, at a price equal to the principal amount thereof with accrued interest to the redemption date, whenever funds are available therefor. Notice of redemption shall be given by the City Treasurer in the name of the City of Las Vegas by publication of such notice at least once in each calendar week on any day of the week for at least two successive weeks, the first publication to be at least fifteen days prior to the redemption date, in a newspaper of general circulation in the City of Las Vegas, and a copy of such notice shall be sent by registered mail at least fifteen days prior to the redemption date to the First National Bank of Nevada, the original purchasers of the bonds, Such notice shall specify the number or numbers of the bonds to be so redeemed (if less than all are to be redeemed) and the date fixed for redemption, and shall further state that on such redemption date there will become and be due and payable upon each bond so to be redeemed at the office of the City Treasurer in the City of Las Vegas, the principal amount thereof with accrued interest to the redemption date, and that from and after such date interest will cease to accrue. Notice having been given in the manner hereinbefore provided, the bond or bonds so called for redemption shal1 became due and payable on the redemption date so designated; and upon presentation thereof at the office of the City Treasurer, together with all appurtenant coupons maturing subsequent to the redemption date, the City of Las Vegas will pay the bond or bonds so called for redemption. SECTION 3. That said bonds and the interest thereon shall be payable from the special fund heretofore created, and designated "Street Improvement Assessment District No. 100-25 Bond Interest and Redemption Fund," containing the receipts upon the collection thereof from the special assessments levied against and secured by a lien upon property in Street Assessment District No. 100-25 in said City, said assessments bearing interest commencing June 1, 1954, and payable annually on each principal paying date at the same rate of interest as borne by said bonds, said assessments being payable in ten substantially equal annual