Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

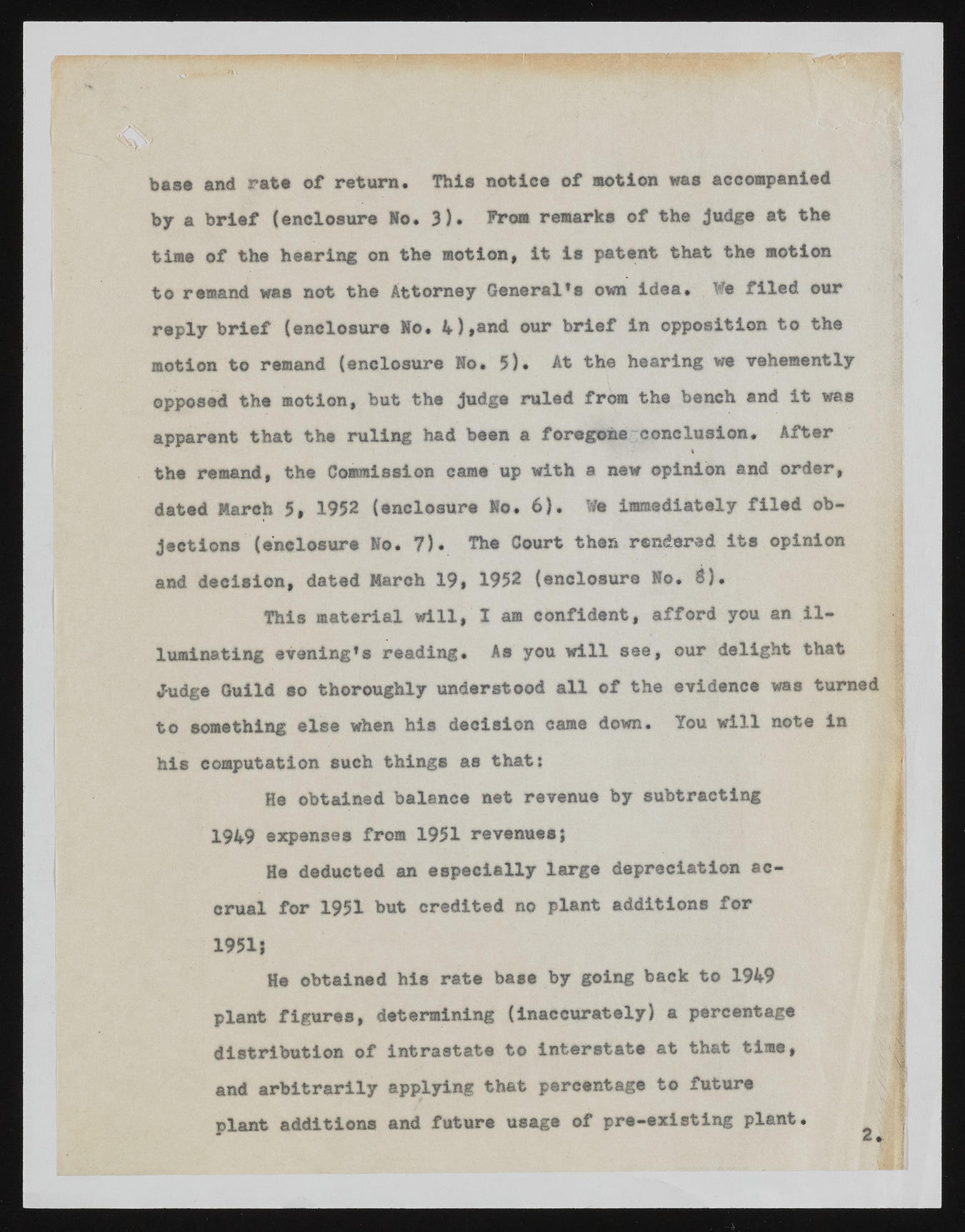

base and rata of return. This notice of motion was accompanied by a brief (enclosure Mo. 3). From remarks of the Judge at the time of the hearing on the motion, it la patent that the motion to remand was not the Attorney General*a own idea. We filed our reply brief (enclosure Mo. 4),and our brief in opposition to the motion to remand (enclosure No. 5)* At the hearing we vehemently opposed the motion, but the judge ruled from the bench and it was apparent that the ruling had been a foregone conclusion. After i the remand, the Commission came up with a new opinion and order, dated March 5, 1952 (enclosure No. 6). We immediately filed objections (enclosure No. 7). The Court then rendered its opinion and decision, dated March 19, 1952 (enclosure No. 8). Judge Guild so thoroughly understood all of the evidence was turned to something else when his decision came down. Tou will note in This material will, I am confident, afford you an illuminating evening’s reading. As you will see, our delight that his computation such things as that: He obtained balance net revenue by subtracting 1949 expenses from 1951 revenues} He deducted an especially large depreciation accrual for 1951 but credited no plant additions for 1951} He obtained his rate base by going back to 1949 plant figures, determining (inaccurately) a percentage distribution of intrastate to interstate at that time, and arbitrarily applying that percentage to future plant additions and future usage of W pre-existing plant.