Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

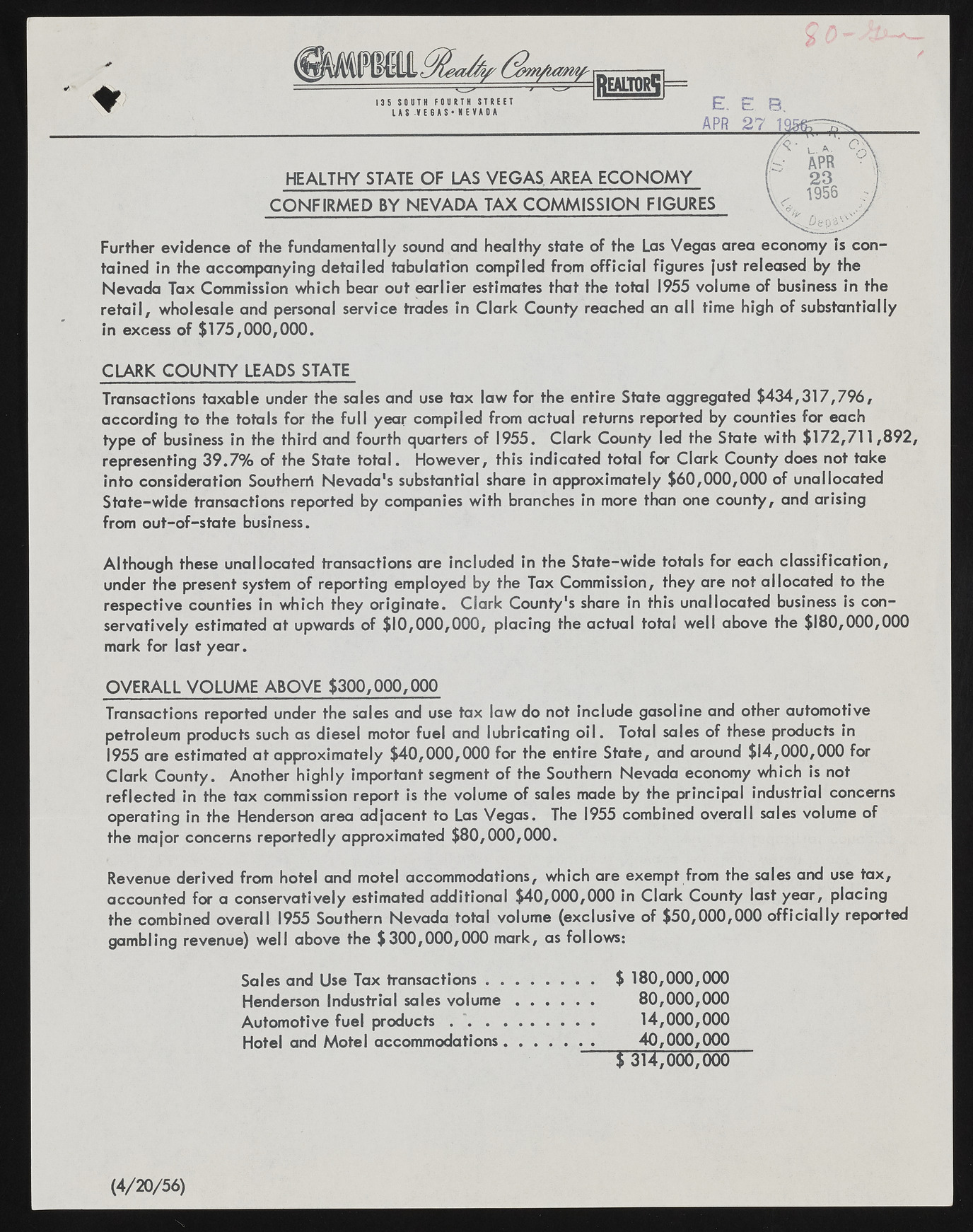

Further evidence of the fundamentally sound and healthy state of the Las Vegas area economy Is contained in the accompanying detailed tabulation compiled from official figures just released by the Nevada Tax Commission which bear out earlier estimates that the total 1955 volume of business in the retail, wholesale and personal service trades in Clark County reached an all time high of substantially in excess of $175,000,000. CLARK COUNTY LEADS STATE Transactions taxable under the sales and use tax law for the entire State aggregated $434,317,796, according to the totals for the full year compiled from actual returns reported by counties for each type of business in the third and fourth quarters of 1955. Clark County led the State with $172,711,892, representing 39.7% of the State total. However, this indicated total for Clark County does not take into consideration Southerri Nevada's substantial share in approximately $60,000,000 of unallocated State-wide transactions reported by companies with branches in more than one county, and arising from out-of-state business. Although these unallocated transactions are included in the State-wide totals for each classification, under the present system of reporting employed by the Tax Commission, they are not allocated to the respective counties in which they originate. Clark County's share in this unallocated business is conservatively estimated at upwards of $10,000,000, placing the actual total well above the $180,000,000 mark for last year. OVERALL VOLUME ABOVE $300,000,000 Transactions reported under the sales and use tax law do not include gasoline and other automotive petroleum products such as diesel motor fuel and lubricating oil. Total sales of these products in 1955 are estimated at approximately $40,000,000 for the entire State, and around $14,000,000 for Clark County. Another highly important segment of the Southern Nevada economy which is not reflected in the tax commission report is the volume of sales made by the principal industrial concerns operating in the Henderson area adjacent to Las Vegas. The 1955 combined overall sales volume of the major concerns reportedly approximated $80,000,000. Revenue derived from hotel and motel accommodations, which are exempt from the sales and use tax, accounted for a conservatively estimated additional $40,000,000 in Clark County last year, placing the combined overall 1955 Southern Nevada total volume (exclusive of $50,000,000 officially reported gambling revenue) well above the $300,000,000 mark, as follows: Sales and Use Tax transactions...................... $ 180,000,000 Henderson Industrial sales volume................ 80,000,000 Automotive fuel products .............................. 14,000,000 Hotel and Motel accommodations................... 40,000,000 $ 314,000,000 (4/20/56)