Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

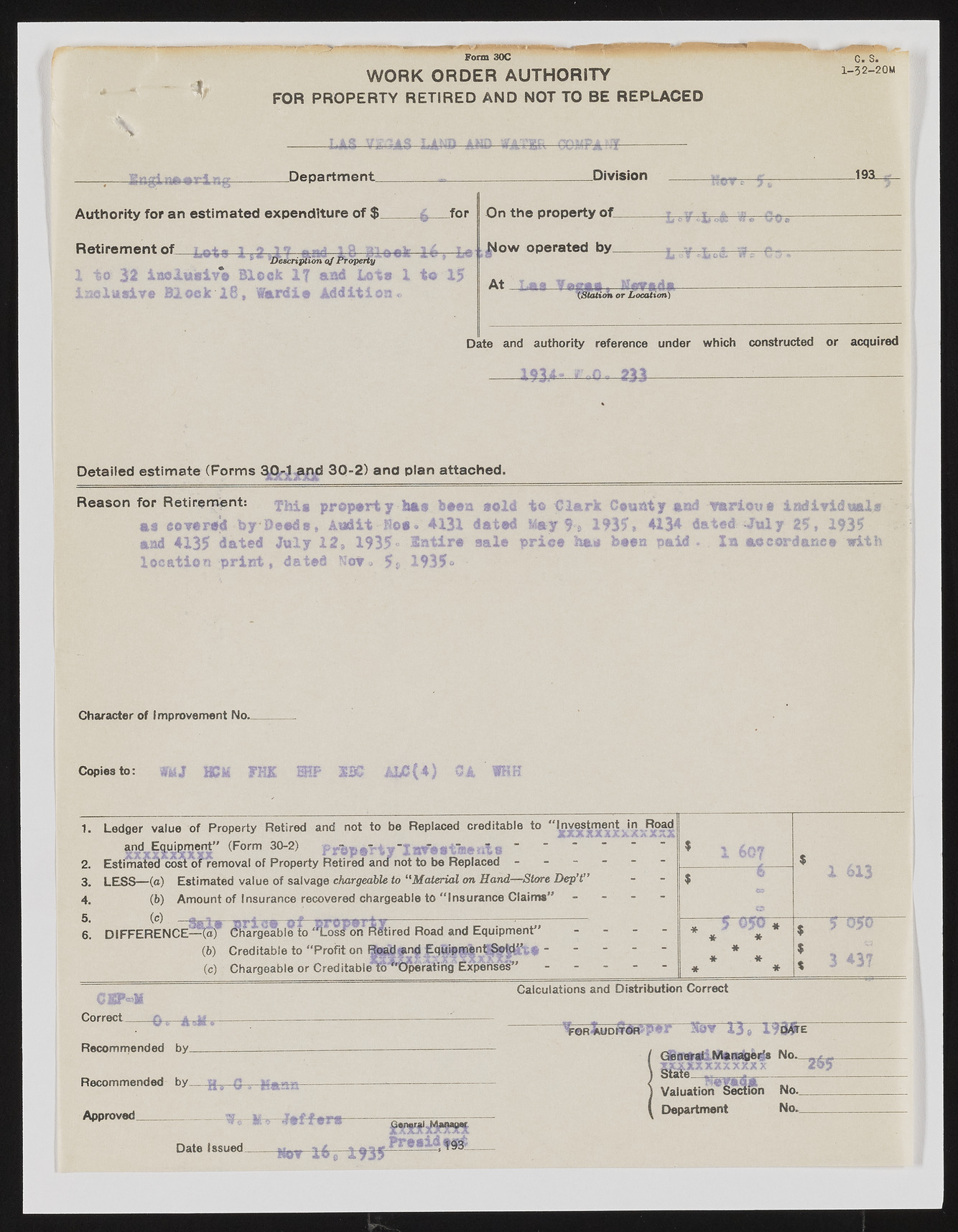

Form 30C WORK ORDER AUTHORITY FOR PROPERTY RETIRED AND NOT TO BE REPLACED c. s. 1—32—20M AS LAND 'A .Department. .Division .193. Authority for an estimated expenditure of $ ? for Retirement of £ *I?e&riffionoifProperty ^ 1 111 4 Meals 4 w Jft *»«*! aisivo Block 17 and Lots 1 to 15 inclusive 82« t>ek 18, Wardie Addition« On the property of. Now operated by. «? V 0 a At M {Station or Location) Date and authority reference under which constructed or acquired -----1934- ^0* 233----------------------------------------- Detailed estimate (Forms BQ^Japd 30-2) ana plan attached. Reason for Retirement: X“his property has been sold to Clark County yurioua as covered by Deeds, Audit Noe« 4131 dated M»y 1935» 4134 dated -Jul and 4135 dated July 12, 1935- ? Intire sale price We been paid . In aec location print, dated Nov® 5j.l935® Character of Improvement No. Copies to: m3 HCM FHK EBP SBC AL0{4) 1. Ledger value of Property Retired and not to be Replaced creditable to “Irivest m e n t•. fte?d ixdxiiu^Sr5jnc” (Form 30"2) Prbp eTt 7 "I nve st®e nt a............................ 2. Estimated cost oFremoval of Property Retired and not to be Replaced ------ 3. LESS—(0) Estimated value of salvage chargeable to “Material on Hand—Store Dep’t” 4. (b) Amount of Insurance recovered chargeable to “Insurance Claims" - R (r\ — « a ' * a % $ $ Wa \->A/ ----ffy -- A WtfiM M U 6. DIFFERENCE-^a; Chargeable to ''Loss on Retired Road and Equipment" - (b) Creditable to "Profit on Bp0$n0 Equipment Sold”- - - - - (c) Chargeable or Creditable to^'tjperating'Expenses” ----- 5 050 * * * * * * * * $ 5 o50 ? .. a % Calculations and Distribution Correct Correct Q __g----------------------------------------------------------------------------- Recommended hy...... - - ; ^———? ?? . ?*, .------- . Recommended by—H» C . Ha as-------------------------------------------------- Approved—__-------u, Jeff ere-------------- Date Issued--------tkrr l^> , 1935 Pr^8—------ J'teRlkUD^«H>per Sav 13» I9d#v ! General Manager’s No. „, ,... ximtxxxxxxxx 265 State__.___________________ Valuation Section No. Department No.--------