Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

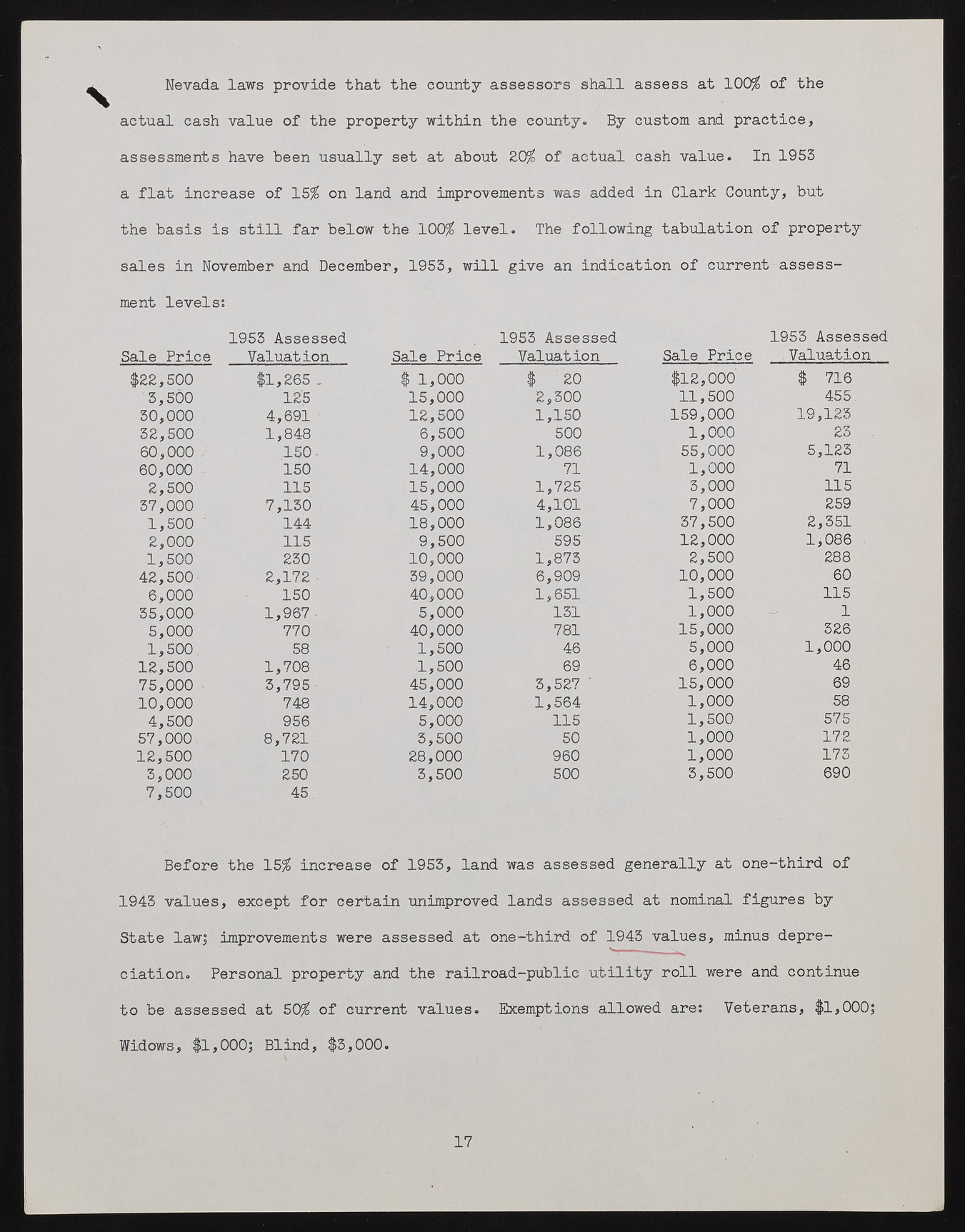

Nevada laws provide that the county assessors shall assess at 100$ of the actual cash value of the property within the county. By custom and practice, assessments have been usually set at about £0$ of actual cash value. In 1953 a flat increase of 15$ on land and improvements was added in Clark County, but the basis is still far below the 100$ level. The following tabulation of property sales in November and December, 1953, will give an indication of current assessment levels: Sale Price 1953 Assessed Valuation Sale Price 1953 Assessed Valuation Sale Price 1953 Assessed Valuation $££,500 $1,£65 . $ 1,000 $ £0 $1£,000 $ 716 3,500 1£5 15,000 £,300 11,500 455 30,000 4,691 1£,500 1,150 159,000 19,1£3 3£,500 1,848 6,500 500 1,000 £3 60,000 . 150- 9,000 1,086 55,000 5,1£3 60,000 150 14,000 71 1,000 71 £,500 115 15,000 1,7£5 3,000 115 37,000 7,130 45,000 4,101 7,000 £59 1,500 ' 144 18,000 1,086 37,500 £,351 £,000 115 9,500 595 1£,000 1,086 1,500 £30 10,000 1,873 £,500 £88 4£,500 £,17£ • 39,000 6,909 10,000 60 6,000 150 40,000 1,651 1,500 115 35,000 1,967 - 5,000 131 1,000 1 5,000 770 40,000 781 15,000 3£6 1,500 58 1,500 46 5,000 1,000 1£,500 1,708 1,500 69 6,000 46 75,000 3,795- 45,000 3,5£7 ' 15,000 69 10,000 748 14,000 1,564 1,000 58 4,500 956 5,000 115 1,500 575 57,000. 8,7£1- 3,500 50 1,000 17 £ 1£,500 170 £8,000 960 1,000 173 3,000 £50 3,500 500 3,500 690 7,500 45 Before the 15$ increase of 1953, land was assessed generally at one-third of 1943 values, except for certain unimproved lands assessed at nominal figures by State law; improvements were assessed at one-third of 1943 values, minus depreciation. Personal property and the railroad-public utility roll were and continue to be assessed at 50$ of current values. Exemptions allowed are: Veterans, $1,000; Widows, $1,000; Blind, $3,000. 17