Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

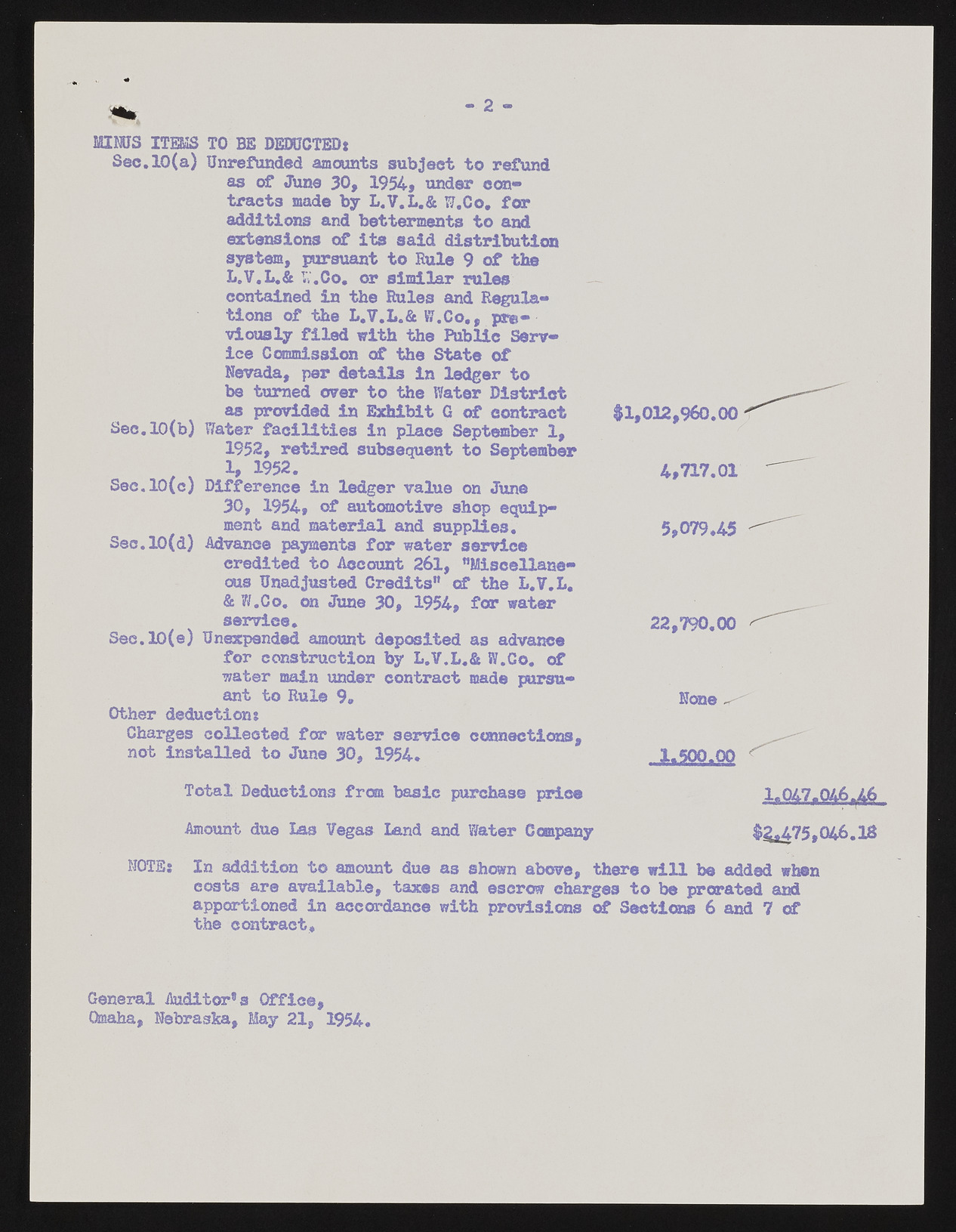

2 MINUS ITEMS TO BE DEDUCTED* Sec.10(a) Unrefunded amounts subject to refund as of June 30, 1954* under contracts made by L.V.L.& 77.Co. for additions and betterments to and extensions of its said distribution system, pursuant to Rule 9 of the L.V.L.& 77. Co. or similar rules contained in the Rules and Regulations of the L.V.L.& W.Co., previously filed with the Public Service Commission of the State of Nevada, per details in ledger to be turned over to the Water District as provided in Exhibit G of contract Sec.10(b) Water facilities in place September 1, 1952, retired subsequent to September 1, 1952. Sec.lO(c) Difference in ledger value on June 30, 1954, of automotive shop equipment and material and supplies. Sec.10(d) Advance payments for water service credited to Account 261, ”Miscellane-ous Unadjusted Credits” cf the L.V.L. & W.Co. on June 30, 1954, for water service. Sec.10(e) Unexpended amount deposited as advance for construction by L.V.L.fit W.Co. of water main under contract made pursuant to Rule 9. Other deductions Charges collected for water service connections, not installed to June 30, 1954. $ 1, 012, 960.00 4,717.01 22,790.00 1.500.00 Total Deductions from basic purchase price 1.0A7.<V.^.A6 Amount due Las Vegas Land and Water Company $2.475.046.18 NOTE: In addition to amount due as shown above, there will be added when costs are available, taxes and escrow charges to be prorated apportioned in accordance with provisions of Sections 6 and 7 of the contract. General Auditor’s Office, Omaha, Nebraska, May 21, 1954.