Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

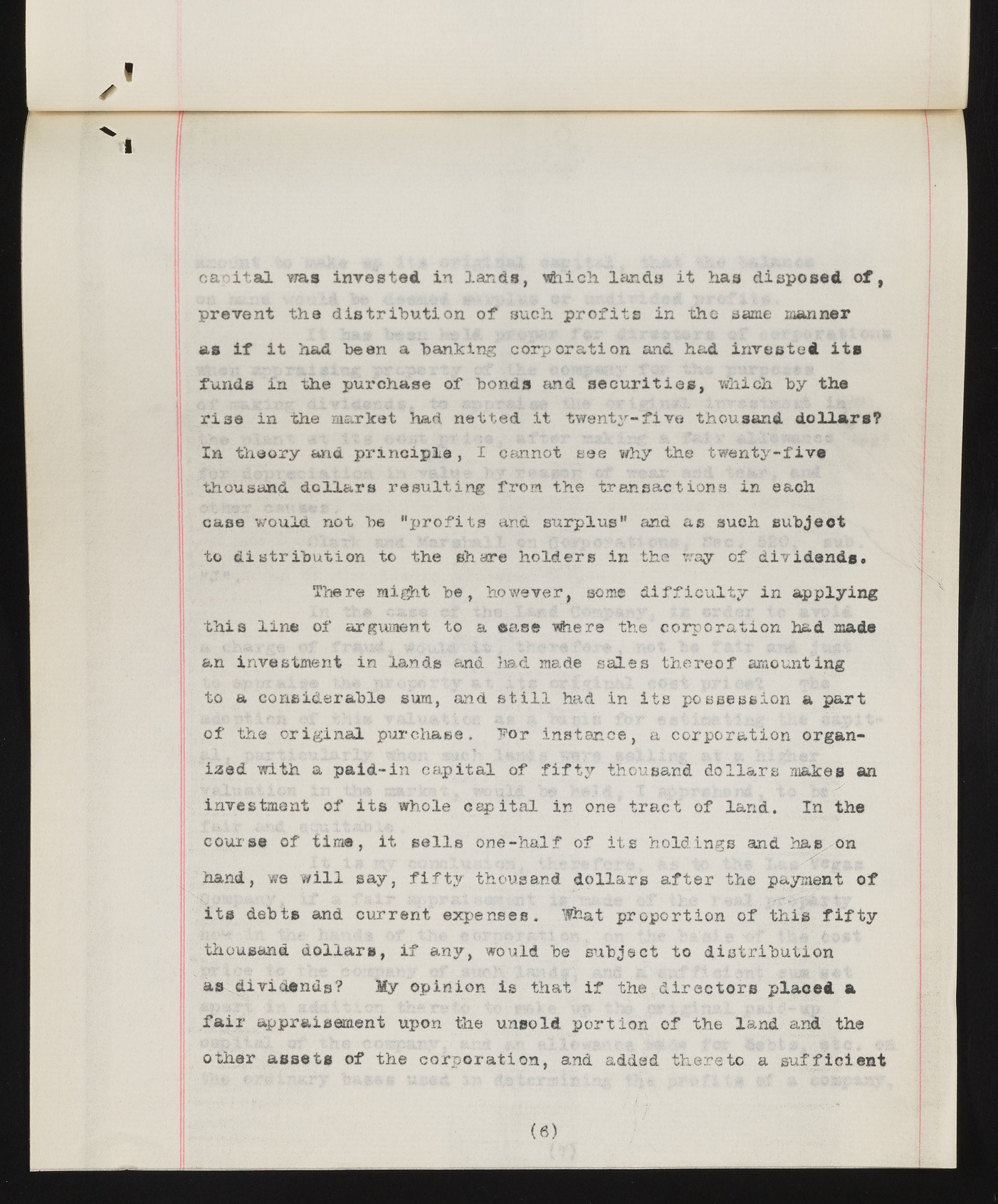

capital was invested in lands, which lands it has disposed of, prevent the distribution of such profits in the same manner as if it had "been a "banking corporation and had invested its funds in the purchase of bonds and securities, which by the rise in the market had netted it twenty-five thousand dollars? In theory and principle, I cannot see why the twenty-five thousand dollars resulting from the transactions in each case would not be "profits and surplus" and as such subject to distribution to the share holders in the way of dividends. There might be, however, some difficulty in applying this line of argument to a ease where the corporation had made an investment in lands and had made sales thereof amounting to a considerable sura, and still had in its possession a part of the original purchase. "For instance, a corporation organised with a paid-in capital of fifty thousand dollars makes an investment of its whole capital in one tract of land. In the course of time, it sells one-half of its holdings and has on hand, we will say, fifty thousand dollars after the payment of its debts and current expenses. What proportion of this fifty thousand dollars, if any, would be subject to distribution as dividends? My opinion is that if the directors placed a fair appraisement upon the unsold portion of the land and the other assets of the corporation, and added thereto a sufficient (6)