Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

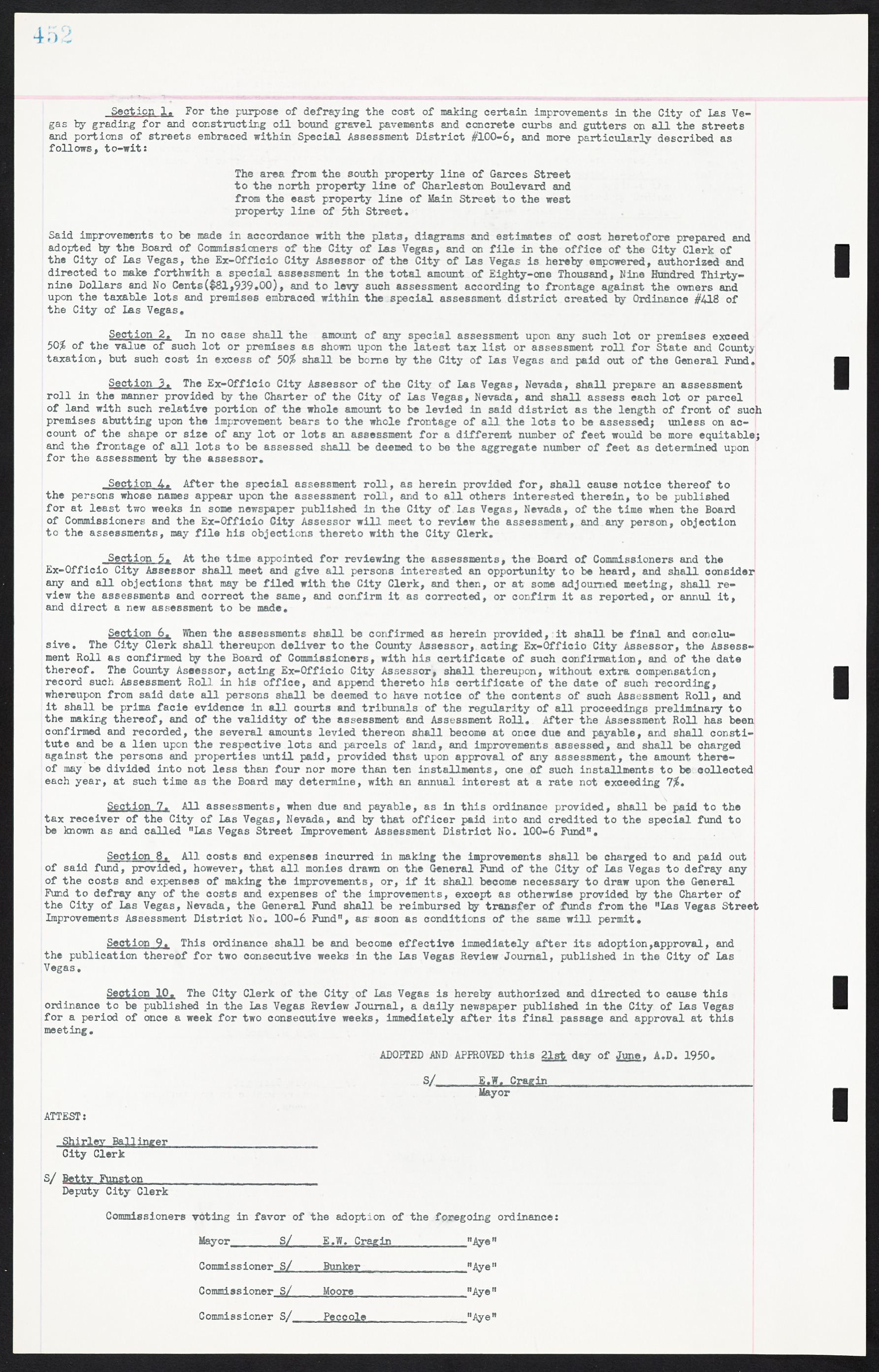

Section 1. For the purpose of defraying the cost of making certain improvements in the City of Las Vegas by grading for and constructing oil bound gravel pavements and concrete curbs and gutters on all the streets and portions of streets embraced within Special Assessment District #100-6, and more particularly described as follows, to-wit: The area from the south property line of Garces Street to the north property line of Charleston Boulevard and from the east property line of Main Street to the west property line of 5th Street. Said improvements to be made in accordance with the plats, diagrams and estimates of cost heretofore prepared and adopted by the Board of Commissioners of the City of Las Vegas, and on file in the office of the City Clerk of the City of Las Vegas, the Ex-Officio City Assessor of the City of Las Vegas is hereby empowered, authorized and directed to make forthwith a special assessment in the total amount of Eighty-one Thousand, Nine Hundred Thirty- nine Dollars and No Cents ($81,939.00), and to levy such assessment according to frontage against the owners and upon the taxable lots and premises embraced within the special assessment district created by Ordinance #418 of the City of Las Vegas. Section 2. In no case shall the amount of any special assessment upon any such lot or premises exceed 50% of the value of such lot or premises as shown upon the latest tax list or assessment roll for State and County taxation, but such cost in excess of 50% shall be borne by the City of Las Vegas and paid out of the General Fund. Section 3. The Ex-Officio City Assessor of the City of Las Vegas, Nevada, shall prepare an assessment roll in the manner provided by the Charter of the City of Las Vegas, Nevada, and shall assess each lot or parcel of land with such relative portion of the whole amount to be levied in said district as the length of front of such premises abutting upon the improvement bears to the whole frontage of all the lots to be assessed; unless on account of the shape or size of any lot or lots an assessment for a different number of feet would be more equitable; and the frontage of all lots to be assessed shall be deemed to be the aggregate number of feet as determined upon for the assessment by the assessor. Section 4. After the special assessment roll, as herein provided for, shall cause notice thereof to the persons whose names appear upon the assessment roll, and to all others interested therein, to be published for at least two weeks in some newspaper published in the City of Las Vegas, Nevada, of the time when the Board of Commissioners and the Ex-Officio City Assessor will meet to review the assessment, and any person, objection to the assessments, may file his objections thereto with the City Clerk. Section 5. At the time appointed for reviewing the assessments, the Board of Commissioners and the Ex-Officio City Assessor shall meet and give all persons interested an opportunity to be heard, and shall consider any and all objections that may be filed with the City Clerk, and then, or at some adjourned meeting, shall review the assessments and correct the same, and confirm it as corrected, or confirm it as reported, or annul it, and direct a new assessment to be made. Section 6. When the assessments shall be confirmed as herein provided, it shall be final and conclusive. The City Clerk shall thereupon deliver to the County Assessor, acting Ex-Officio City Assessor, the Assessment Roll as confirmed by the Board of Commissioners, with his certificate of such confirmation, and of the date thereof. The County Assessor, acting Ex-Officio City Assessor, shall thereupon, without extra compensation, record such Assessment Roll in his office, and append thereto his certificate of the date of such recording, whereupon from said date all persons shall be deemed to have notice of the contents of such Assessment Roll, and it shall be prima facie evidence in all courts and tribunals of the regularity of all proceedings preliminary to the making thereof, and of the validity of the assessment and Assessment Roll. After the Assessment Roll has been confirmed and recorded, the several amounts levied thereon shall become at once due and payable, and shall constitute and be a lien upon the respective lots and parcels of land, and improvements assessed, and shall be charged against the persons and properties until paid, provided that upon approval of any assessment, the amount thereof may be divided into not less than four nor more than ten installments, one of such installments to be collected each year, at such time as the Board may determine, with an annual interest at a rate not exceeding 7%. Section 7. All assessments, when due and payable, as in this ordinance provided, shall be paid to the tax receiver of the City of Las Vegas, Nevada, and by that officer paid into and credited to the special fund to be known as and called "Las Vegas Street Improvement Assessment District No. 100-6 Fund". Section 8. All costs and expenses incurred in making the improvements shall be charged to and paid out of said fund, provided, however, that all monies drawn on the General Fund of the City of Las Vegas to defray any of the costs and expenses of making the improvements, or, if it shall become necessary to draw upon the General Fund to defray any of the costs and expenses of the improvements, except as otherwise provided by the Charter of the City of Las Vegas, Nevada, the General Fund shall be reimbursed by transfer of funds from the "Las Vegas Street Improvements Assessment District No. 100-6 Fund", as soon as conditions of the same will permit. Section 9. This ordinance shall be and become effective immediately after its adoption, approval, and the publication thereof for two consecutive weeks in the Las Vegas Review Journal, published in the City of Las Vegas. Section 10. The City Clerk of the City of Las Vegas is hereby authorized and directed to cause this ordinance to be published in the Las Vegas Review Journal, a daily newspaper published in the City of Las Vegas for a period of once a week for two consecutive weeks, immediately after its final passage and approval at this meeting. ADOPTED AND APPROVED this 21st day of June, A.D. 1950. S/_____E. W. Cragin___________________________ Mayor ATTEST: Shirley Ballinger____________________ City Clerk S/ Betty Funston_______________________ Deputy City Clerk Commissioners voting in favor of the adoption of the foregoing ordinance: Mayor S/ E.W. Cragin "Aye" Commissioner S/___Bunker "Aye" Commissioner S/___Moore "Aye " Commissioner S/ Peccole "Aye"