Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

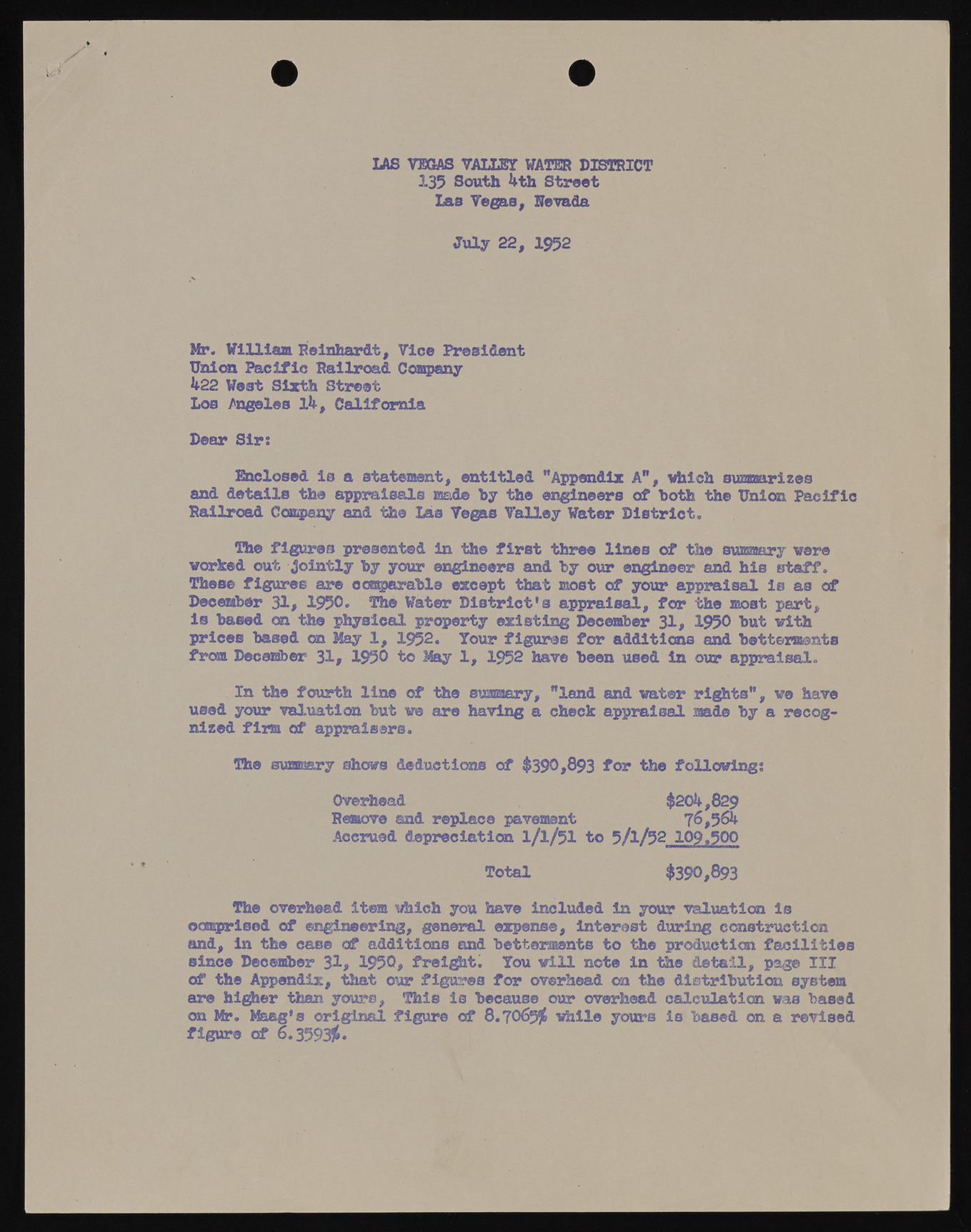

LAS VEGAS VALLEY WATER DISTRICT 13? South 4th Street Las Vegas, Nevada July 22, 1952 Mr. William Reinhardt, Vice President Union Pacific Railroad Company 422 West Sixth Street Los Angeles 14, California Dear Sirs Enclosed is a statement, entitled "Appendix A", which summarizes and details the appraisals made hy the engineers of both the Union Pacific Railroad Company and the Las Vegas Valley Water District. The figures presented in the first three lines of the summary were worked out jointly hy your engineers and hy our engineer and his staff. These figures are comparable except that most of your appraisal is as of December 31, 1950* The Water District's appraisal, for the most part, is based on the physical property existing December 31, 1950 but with prices based on May 1, 1952. Your figures for additions and betterments from December 31, 1950 to May 1, 1952 have been used in our appraisal. In the fourth line of the summary, "land and water rights", we have used your valuation but we are having a check appraisal made by a recognized firm of appraisers. The summary shows deductions of $390,893 for the following: Overhead $204,829 Remove and replace pavement 76,564 Accrued depreciation 1/1/51 to 5/1/52 109.500 Total $390,893 The overhead item which you have included in your valuation is comprised of engineering, general expense, interest during construction and, in the case of additions and betterments to the production facilities since December 31, 1950, freight. You will note in the detail, page III of the Appendix, that our figures for overhead on the distribution system are higher than yours, This is because our overhead calculation was based on Mr. Maag's original figure of 8.706556 while yours is based on a revised figure of 6.35930.