Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

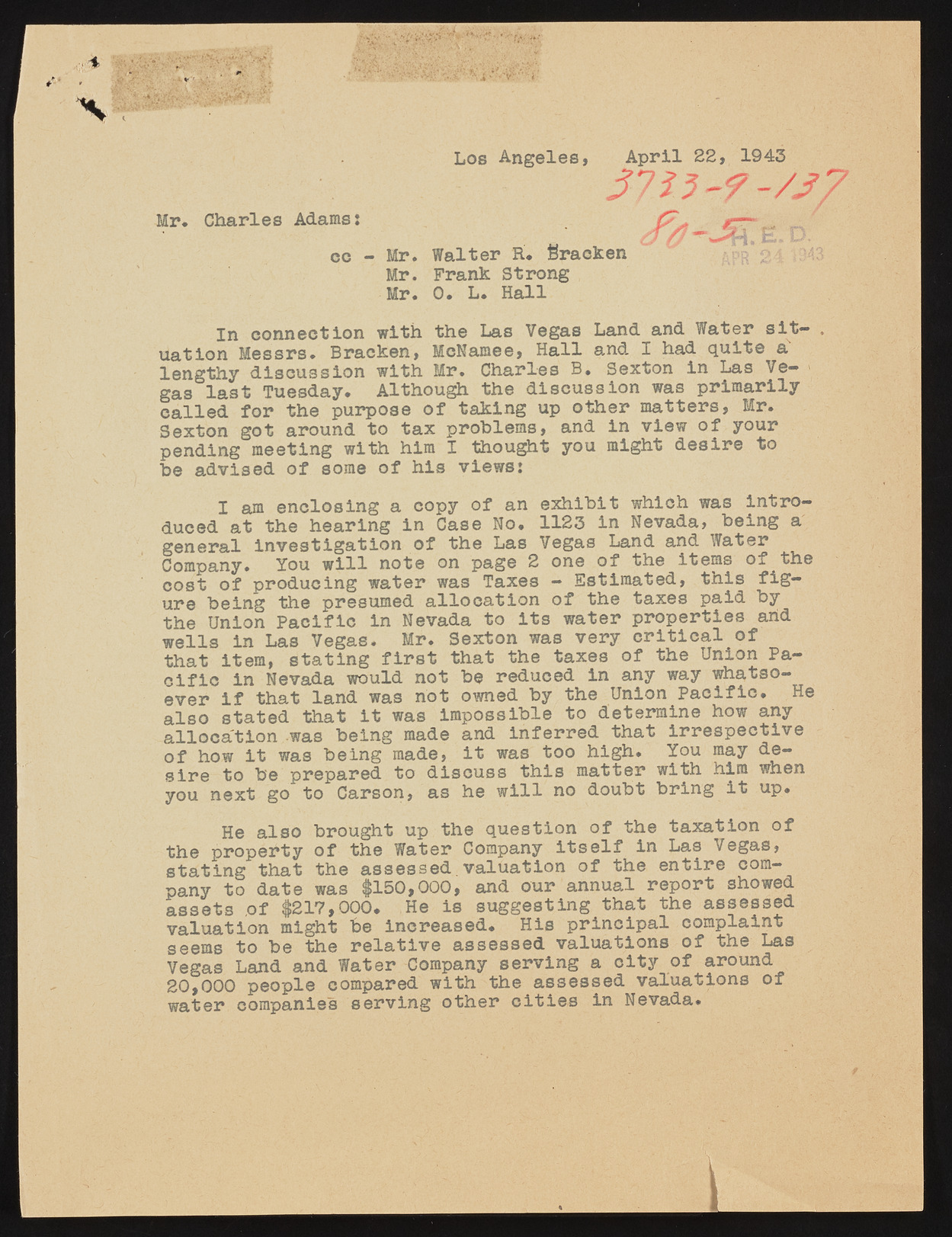

Los Angeles, -/j Mr* Charles Adams: jg-r- ' ec - Mr. Walter R. Rracken —?’-^*1. E. D. Mr. Frank Strong Mr. 0* L. Hall In connection with the Las Vegas Land and Water situation Messrs. Bracken, McNamee, Hall and I had quite a lengthy discussion with Mr. Charles B. Sexton in Las Ve— 1 gas last Tuesday* Although the discussion was primarily called for the purpose of taking up other matters, Mr. Sexton got around to tax problems, and in view of your pending meeting with him I thought you might desire to be advised of some of his views: I am enclosing a copy of an exhibit which was introduced at the hearing in Case No. 1123 in Nevada, being a general investigation of the Las Vegas Land and Water Company. You will note on page 2 one of the items of the cost of producing water was Taxes - Estimated, this figure being the presumed allocation of the taxes paid by the Union Pacific in Nevada to its water properties arid wells in Las Vegas. Mr. Sexton was very critical of that item, stating first that the taxes of the Union Pacific in Nevada would not be reduced in any way whatsoever if that land was not owned by the Union Pacific. He also stated that it was impossible to determine how any allocation was being made and Inferred that irrespective of how it was being made, it was too high. You may de— sire to be prepared to discuss this matter with him when you next go to Carson, as he will no doubt bring it up. He also brought up the question of the taxation of the property of the Water Company Itself in Las Vegas, stating that the assessed valuation of the entire company to date was #150,000, and our annual report showed assets of #217,000. He is suggesting that the assessed valuation might be Increased. His principal complaint seems to be the relative assessed valuations of the Las Vegas Land and Water Company serving a city of around 20,000 people compared with the assessed valuations of water companies serving other cities in Nevada. April 22, 1943