Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

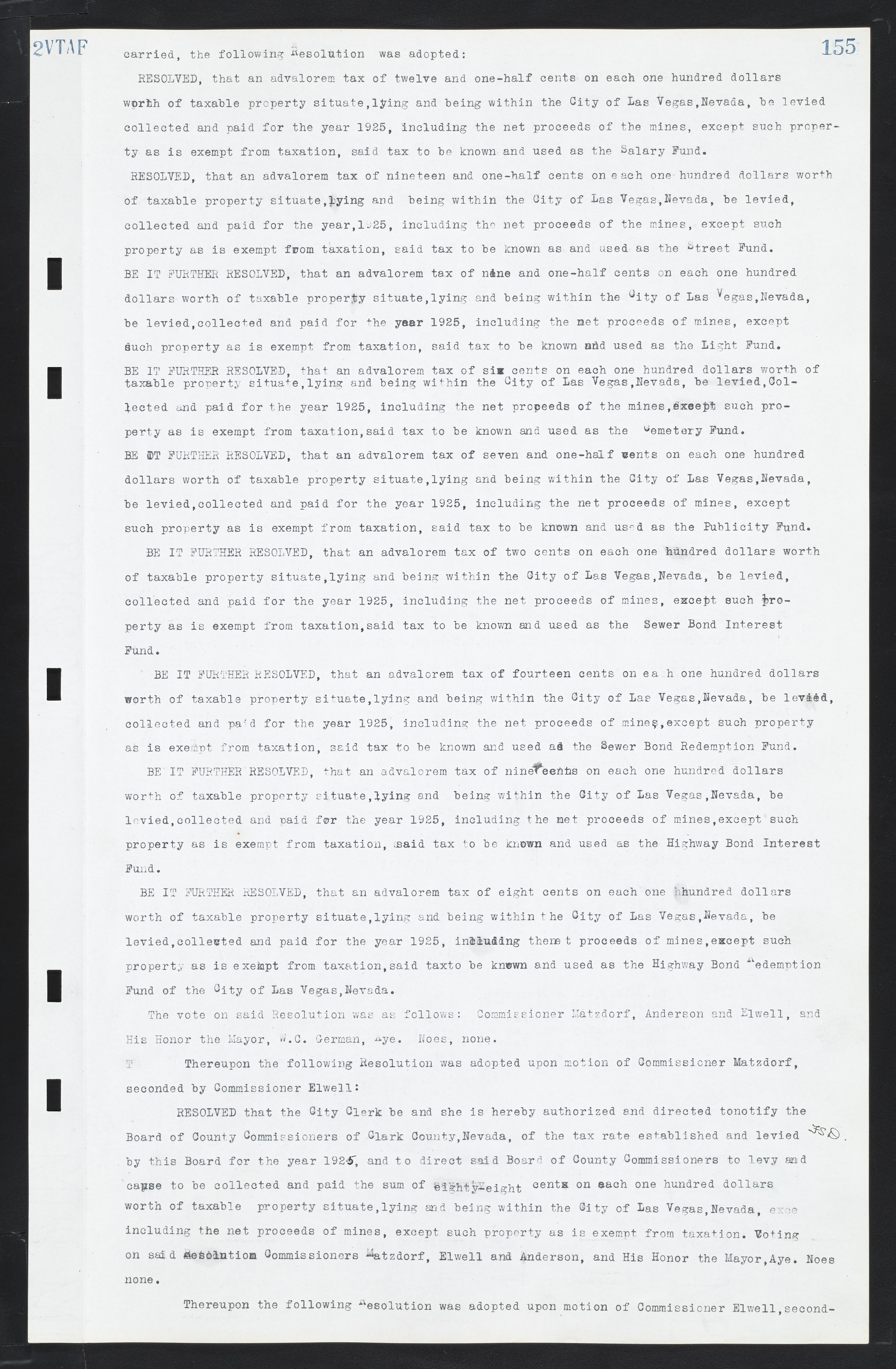

carried, the following Resolution was adopted: RESOLVED, that an ad valorem tax of twelve and one-half cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied collected and paid for the year 1925, including the net proceeds of the mines, except such property as is exempt from taxation, said tax to be known and used as the Salary Fund. RESOLVED, that an ad valorem tax of nineteen and one-half cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year, 1925, including the net proceeds of the mines, except such property as is exempt from taxation, said tax to be known as and used as the Street Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of nine and one-half cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the met proceeds of mines, except such property as is exempt from taxation, said tax to be known add used as the Light Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of six cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, Collected and paid for the year 1925, including the net proceeds of the mines, except such property as is exempt from taxation, said tax to be known and used as the Cemetery Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of seven and one-half cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known and used as the Publicity Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of two cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known and used as the Sewer Bond Interest Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of fourteen cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known and used as the Sewer Bond Redemption Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of nine cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known and used as the Highway Bond Interest Fund. BE IT FURTHER RESOLVED, that an ad valorem tax of eight cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, be levied, collected and paid for the year 1925, including the net proceeds of mines, except such property as is exempt from taxation, said tax to be known and used as the Highway Bond Redemption Fund of the City of Las Vegas, Nevada. The vote on said Resolution was as follows: Commissioner Matzdorf, Anderson and Elwell, and His Honor the Mayor, W.C. German, Aye. Noes, none. Thereupon the following Resolution was adopted upon motion of Commissioner Matzdorf, seconded by Commissioner Elwell: RESOLVED that the City Clerk be and she is hereby authorized and directed to notify the Board of County Commissioners of Clark County, Nevada, of the tax rate established and levied by this Board for the year 1925, and to direct said Board of County Commissioners to levy and cause to be collected and paid the sum of eighty-eight cents on each one hundred dollars worth of taxable property situate, lying and being within the City of Las Vegas, Nevada, including the net proceeds of mines, except such property as is exempt from taxation. Voting on said Resolution Commissioners Matzdorf, Elwell and Anderson, and His Honor the Mayor, Aye. Noes none. Thereupon the following Resolution was adopted upon motion of Commissioner Elwell, second-