Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

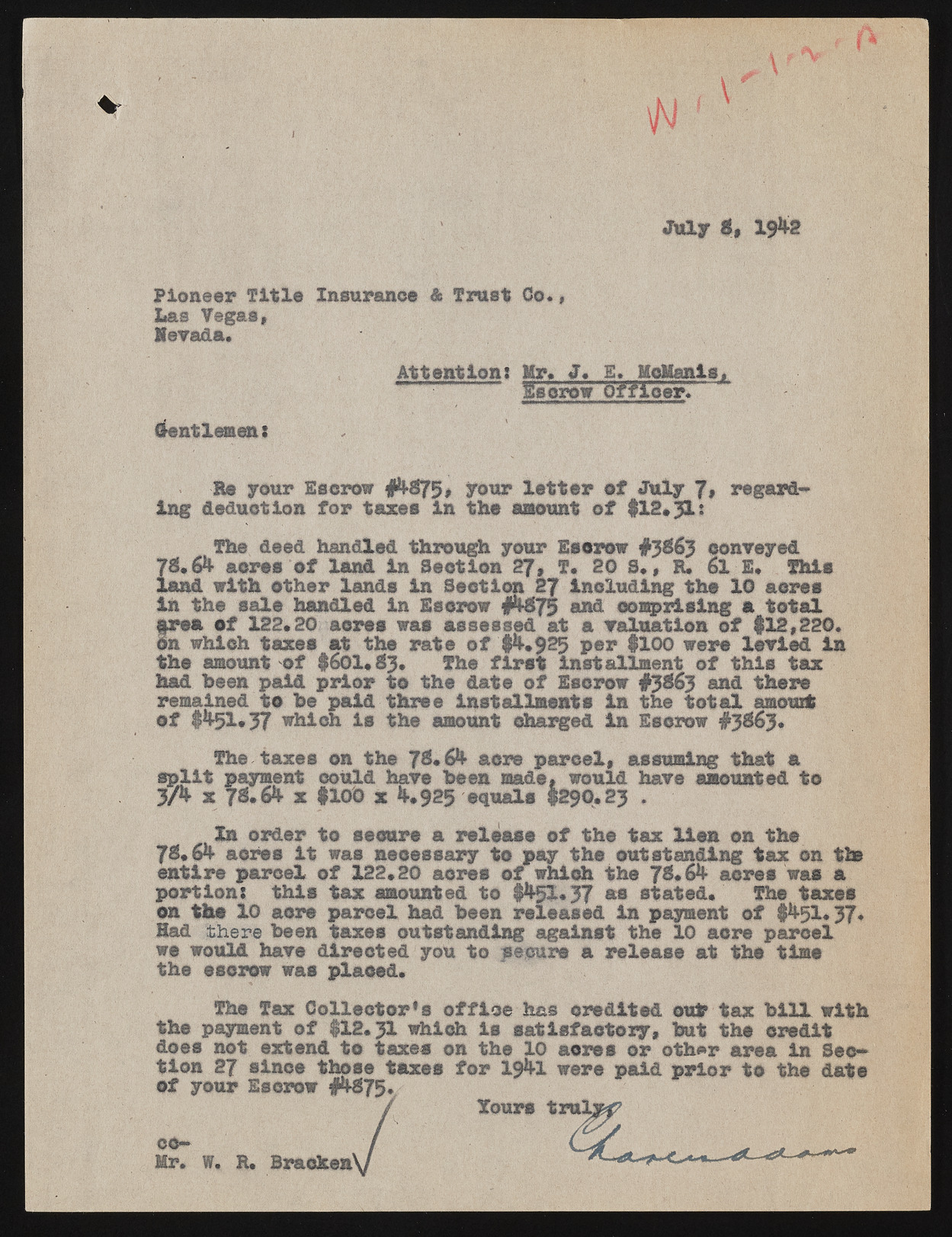

Pioneer Title Insurance & Trust Co*, Las Vegas, Nevada. July 3, 19*2 Attention; Mr* J* Melania, iiserow Officer* Gentlemen: He your Escrow #%375» 3rour letter of July 7* regarding deduction for taxes in the amount of $12*33.$ The deed handled through your Escrow #32563 conveyed 73,6% acres of land In Section 27* 10 •## R* 6l E. This land with other lands in Section 27 including the 10 acres in the sale handled in Escrow #%375 end comprising a total area of 122*20 acres was assessed at a valuation of $12,220. on which taxes at the rate of ?*•925 per $100 were levied In the amount of #601*33* The first Installment of this tax had been paid prior to the date of Esorow #3663 and there remained to be paid three Installments In the total amouit of $%5>1*37 whleh is the amount charged in Esorow #3663* The taxes on the 73* 6% acre parcel, assuming that a split payment could have been made, would have amounted to jA x 73.6% x $100 x M25 equals $290.23 * In order to secure a release of the tax lien on the 73*6% acres It was necessary to pay the outstanding tax on the entire parcel of 122*20 acres of which the 73*6% acres was a portion; this tax amounted to $%§1«37 as stated. The taxes on ths 10 acre parcel had been released in payment of $%5X* 37. Had there been taxes outstanding against the 10 acre parcel w# would have directed you to secure a release at the time the escrow was placed. The Tax Collector's office has credited outr tax bill with the payment of $12,31 which Is satisfactory, but ths credit does not extend to taxes on the 10 acres or oth»r area in Sec* tion 27 since those taxes for 19%1 were paid prior to the date of your Esorow #%375v lours trulj / Bfm - co- Mr. W, H* Bracken^