Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

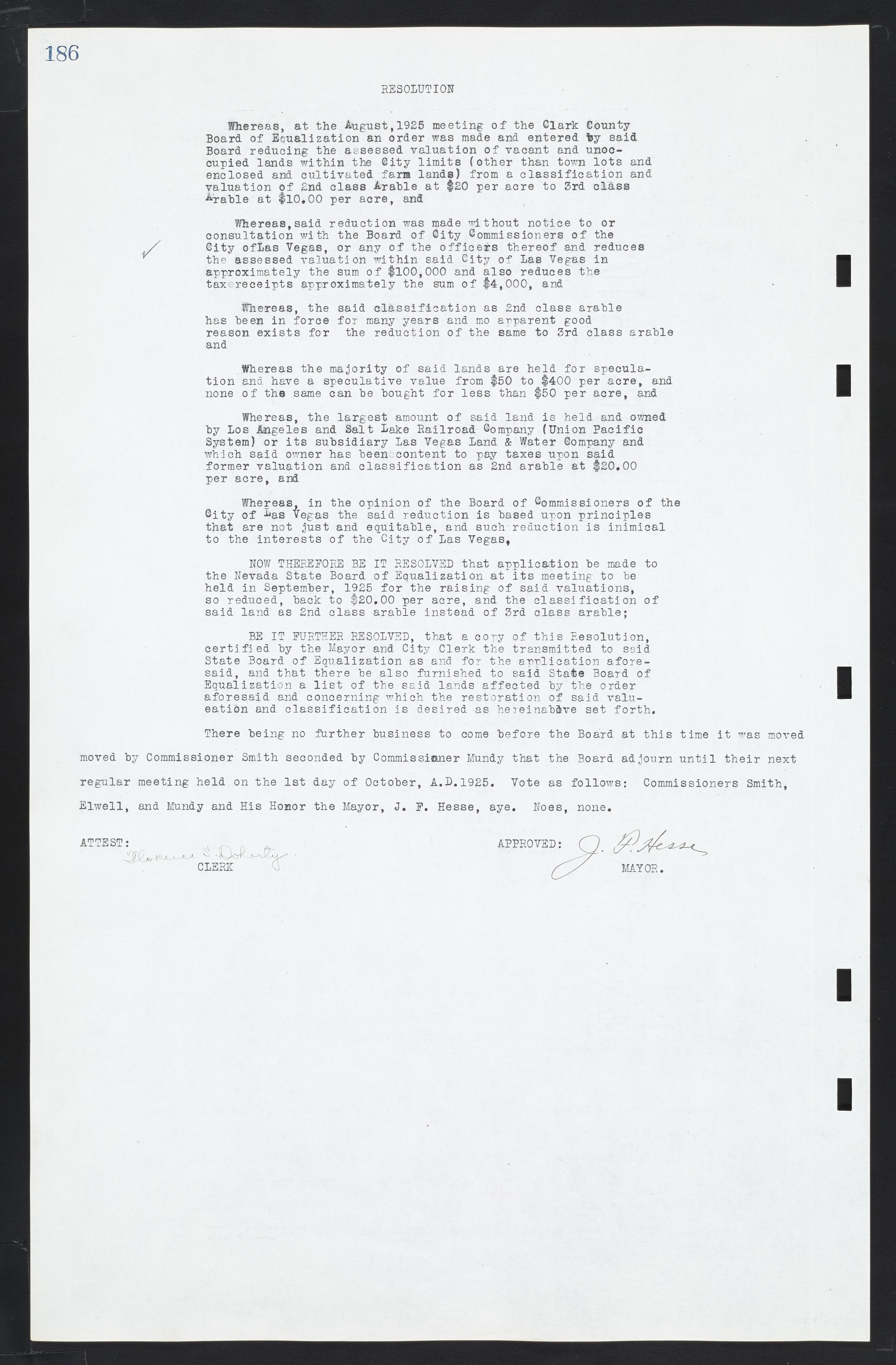

RESOLUTION Whereas, at the August, 1925 meeting of the Clark County Board of Equalization an order was made and entered by said Board reducing the assessed valuation of vacant and unoccupied lands within the City limits (other than town lots and enclosed and cultivated farm lands) from a classification and valuation of 2nd class Arable at $20 per acre to 3rd class Arable at $10.00 per acre, and Whereas, said reduction was made without notice to or consultation with the Board of City Commissioners of the City of Las Vegas, or any of the officers thereof and reduces the assessed valuation within said City of Las Vegas in approximately the sum of $100,000 and also reduces the tax receipts approximately the sum of $4,000, and Whereas, the said classification as 2nd class arable has been in force for many years and mo apparent good reason exists for the reduction of the same to 3rd class arable and Whereas the majority of said lands are held for speculation and have a speculative value from $50 to $400 per acre, and none of the same can be bought for less than $50 per acre, and Whereas, the largest amount of said land is held and owned by Los Angeles and Salt Lake Railroad Company (Union Pacific System) or its subsidiary Las Vegas Land & Water Company and which said owner has been content to pay taxes upon said former valuation and classification as 2nd arable at $20.00 per acre, and Whereas, in the opinion of the Board of Commissioners of the City of Las Vegas the said reduction is based upon principles that are not just and equitable, and such reduction is inimical to the interests of the City of Las Vegas, NOW THEREFORE BE IT RESOLVED that application be made to the Nevada State Board of Equalization at its meeting to be held in September, 1925 for the raising of said valuations, so reduced, back to $20.00 per acre, and the classification of said land as 2nd class arable instead of 3rd class arable; BE IT FURTHER RESOLVED, that a copy of this Resolution, certified by the Mayor and City Clerk the transmitted to said State Board of Equalization as and for the application aforesaid, and that there be also furnished to said State Board of Equalization a list of the said lands affected by the order aforesaid and concerning which the restoration of said valuation and classification is desired as hereinabove set forth. There being no further business to come before the Board at this time it was moved moved by Commissioner Smith seconded by Commissioner Mundy that the Board adjourn until their next regular meeting held on the 1st day of October, A.D. 1925. Vote as follows: Commissioners Smith, Elwell, and Mundy and His Honor the Mayor, J. F. Hesse, aye. Noes, none.