Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

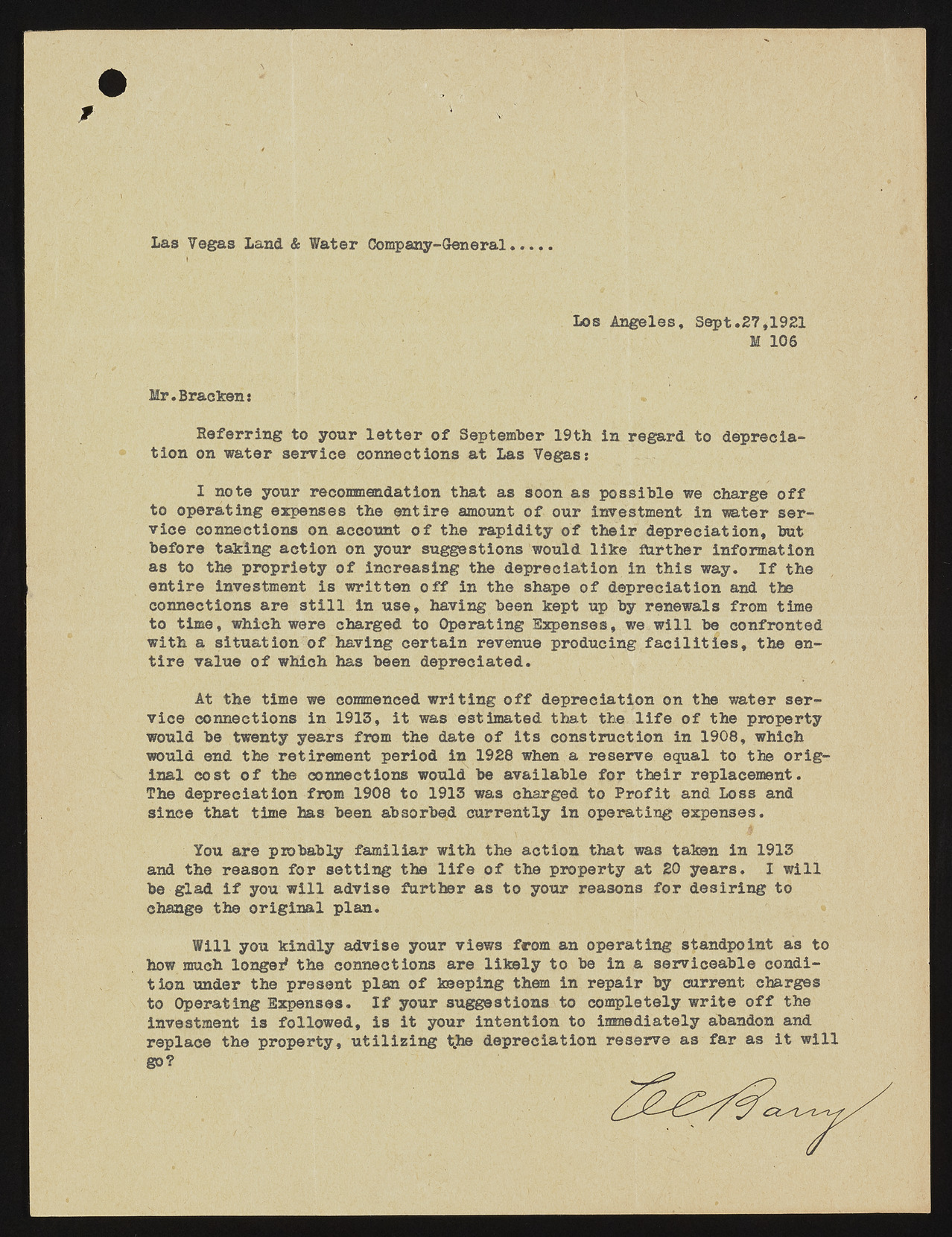

Las Vegas Land & Water Company-General Los Angeles, Sept.27*1921 M 106 Mr. Bracken: Referring to your letter of September 19th in regard to depreciation on water service connections at Las Vegas: I note your recommendation that as soon as possible we charge off to operating expenses the entire amount of our investment in water service connections on account of the rapidity of their depreciation, but before taking action on your suggestions would like farther information as to the propriety of increasing the depreciation in this way. If the entire investment is written off in the shape of depreciation and tbs connections are still in use, having been kept up by renewals from time to time, which were charged to Operating Expenses, we will be confronted with a situation of having certain revenue producing facilities, the entire value of which has been depreciated. At the time we commenced writing off depreciation on the water service connections in 1913, it was estimated that the life of the property would be twenty years from the date of its construction in 1908, which would end the retirement period in 1928 when a reserve equal to the original cost of the connections would be available for their replacement. The depreciation from 1908 to 1913 was charged to Profit and Loss and since that time has been absorbed currently in operating expenses. You are probably familiar with the action that was taken in 1913 and the reason for setting the life of the property at 20 years. I will be glad if you will advise further as to your reasons for desiring to change the original plan. Will you kindly advise your views from an operating standpoint as to how much longer* the connections are likely to be In a serviceable condition under the present plan of keeping them in repair by current charges to Operating Expenses. If your suggestions to completely write off the investment is followed, is it your intention to iasnediately abandon and replace the property, utilizing the depreciation reserve as far as it will go?