Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

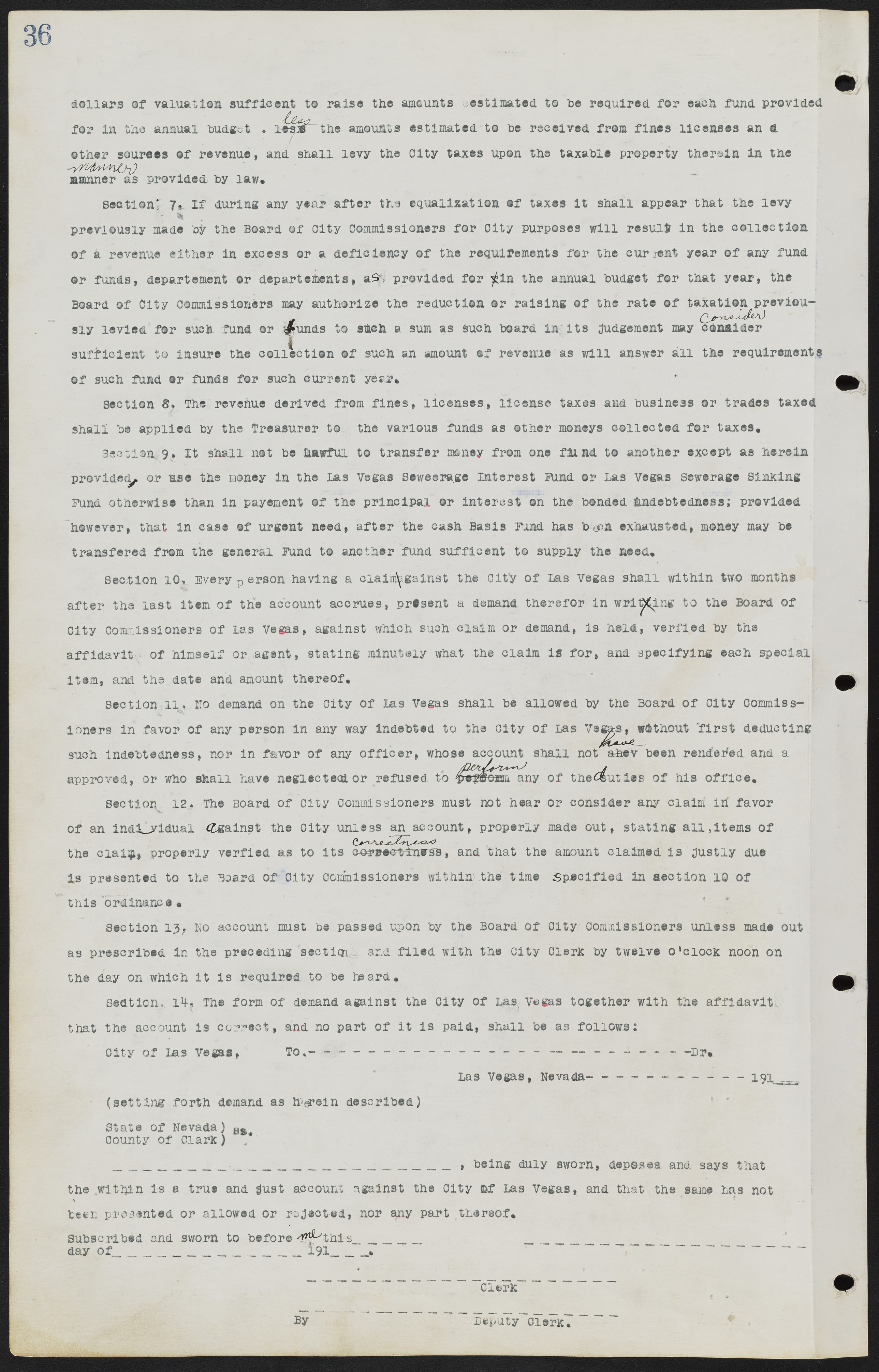

dollars of valuation sufficient to raise the amounts estimated to be required for each fund provided for in the annual budget less the amounts estimated to be received from fines licenses and other sources of revenue, and shall levy the City taxes upon the taxable property therein in the manner as provided by law. Section 7. If during any year after the equalization of taxes it shall appear that the levy previously made by the Board of City Commissioners for City purposes will result in the collection of a revenue either in excess or a deficiency of the requirements for the current year of any fund or funds, department or departments, provided for in the annual budget for that year, the Board of City Commissioners may authorize the reduction or raising of the rate of taxation previously levied for such fund or funds to such a sum as such board in its judgement may consider sufficient to insure the collection of such an amount of revenue as will answer all the requirements of such fund or funds for such current year. Section 8. The revenue derived from fines, licenses, license taxes and business or trades taxed shall be applied by the Treasurer to the various funds as other moneys collected for taxes. Section 9. It shall not be lawful to transfer money from one fund to another except as herein provided, or use the money in the Las Vegas Sewerage Interest Fund or Las Vegas Sewerage Sinking Fund otherwise than in payment of the principal or interest on the bonded indebtedness; provided however, that in case of urgent need, after the cash Basis Fund has been exhausted, money may be transferred from the general Fund to another fund sufficient to supply the need. Section 10. Every person having a claim against the City of Las Vegas shall within two months after the last item of the account accrues, present a demand therefor in writing to the Board of City Commissioners of Las Vegas, against which such claim or demand, is held, verified by the affidavit of himself or agent, stating minutely what the claim is for, and specifying each special item, and the date and amount thereof. Section 11. No demand on the City of Las Vegas shall be allowed by the Board of City Commissioners in favor of any person in any way indebted to the City of Las Vegas without first deducting such indebtedness, nor in favor of any officer, whose account shall not have been rendered and a approved, or who shall have neglected or refused to perform any of the duties of his office. Section 12. The Board of City Commissioners must not hear or consider any claim in favor of an individual against the City unless an account, properly made out, stating all items of the claim properly verified as to its correctness, and that the amount claimed is justly due is presented to the Board of City Commissioners within the time specified in section 10 of this ordinance. Section 13, No account must be passed upon by the Board of City Commissioners unless made out as prescribed in the preceding section and filed with the City Clerk by twelve o'clock noon on the day on which it is required to be heard. Section 14. The form of demand against the City of Las Vegas together with the affidavit that the account is correct, and no part of it is paid, shall be as follows: City of Las Vegas, To,--------------- - — — ------ -Dr. Las Vegas, Nevada- -------- 191 — (setting forth demand as herein described) State of Nevada) ss. County of Clark) ____________________________________________________, being duly sworn, deposes and says that the within is a true and just account against the City of Las Vegas, and that the same has not been presented or allowed or rejected, nor any part thereof. Subscribed and sworn to before me this___________ ________________________________ day of_____________________________191______. Clerk By Deputy Clerk.