Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

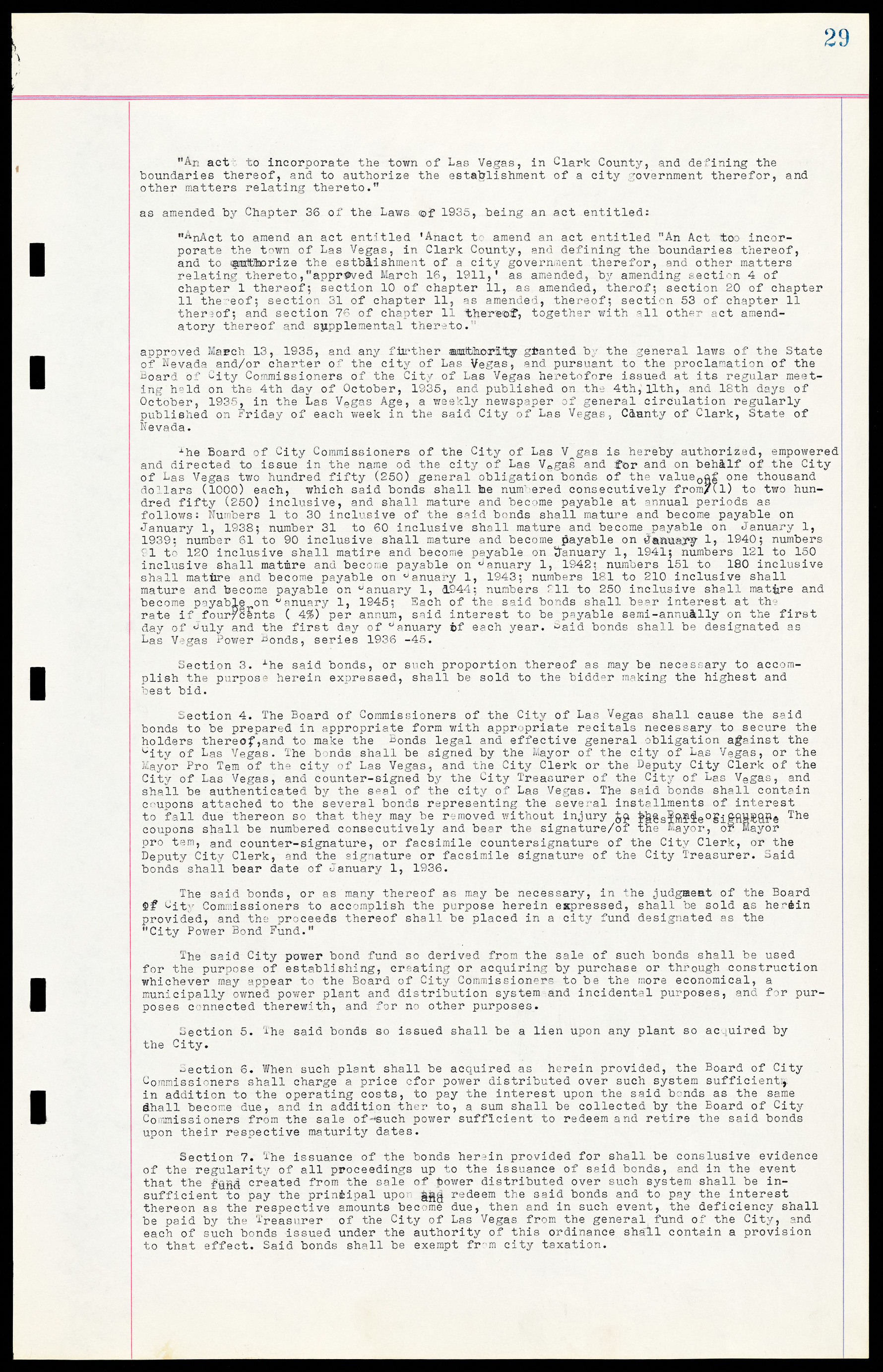

An act to incorporate the town of Las Vegas, in Clark County, and defining the boundaries thereof, and to authorize the establishment of a city government therefor, and other matters relating thereto. as amended by Chapter 36 of the Laws of 1935, being an act entitled: "An Act to amend an act entitled 'An act to amend an act entitled "An Act to incorporate the town of Las Vegas, in Clark County, and defining the boundaries thereof, and to authorize the establishment of a city government therefor, and other matters relating thereto," approved March 16, 1911,' as amended, by amending section 4 of chapter 1 thereof; section 10 of chapter 11, as amended, thereof; section 20 of chapter 11 thereof; section 31 of chapter 11, as amended, thereof; section 53 of chapter 11 thereof; and section 76 of chapter 11 thereof, together with all other act amendatory thereof and supplemental thereto." approved March 13, 1935, and any further authority granted by the general laws of the State of Nevada and/or charter of the city of Las Vegas, and pursuant to the proclamation of the Board of City Commissioners of the City of Las Vegas heretofore issued at its regular meeting held on the 4th day of October, 1935, and published on the 4th, 11th, and 18th days of October, 1935, in the Las Vegas Age, a weekly newspaper of general circulation regularly published on Friday of each week in the said City of Las Vegas, County of Clark, State of Nevada. The Board of City Commissioners of the City of Las V gas is hereby authorized, empowered and directed to issue in the name of the city of Las Vegas and for and on behalf of the City of Las Vegas two hundred fifty (250) general obligation bonds of the value of one thousand dollars (1000) each, which said bonds shall he numbered consecutively from one (1) to two hundred fifty (250) inclusive, and shall mature and become payable at annual periods as follows: Numbers 1 to 30 inclusive of the said bonds shall mature and become payable on January 1, 1938; number 31 to 60 inclusive shall mature and become payable on January 1, 1939; number 61 to 90 inclusive shall mature and become payable on January 1, 1940; numbers 91 to 120 inclusive shall mature and become payable on January 1, 1941; numbers 121 to 150 inclusive shall mature and become payable on January 1, 1942; numbers 151 to 180 inclusive shall mature and become payable on January 1, 1943; numbers 181 to 210 inclusive shall mature and become payable on January 1, 1944; numbers 211 to 250 inclusive shall mature and become payable on January 1, 1945; Each of the said bonds shall bear interest at the rate if four percents (4%) per annum, said interest to be payable semi-annually on the first day of July and the first day of January of each year. Said bonds shall be designated as Las Vegas Power Bonds, series 1936 -45. Section 3. The said bonds, or such proportion thereof as may be necessary to accomplish the purpose herein expressed, shall be sold to the bidder making the highest and best bid. Section 4. The Board of Commissioners of the City of Las Vegas shall cause the said bonds to be prepared in appropriate form with appropriate recitals necessary to secure the holders thereof, and to make the Bonds legal and effective general obligation against the City of Las Vegas. The bonds shall be signed by the Mayor of the city of Las Vegas, or the Mayor Pro Tem of the city of Las Vegas, and the City Clerk or the Deputy City Clerk of the City of Las Vegas, and counter-signed by the City Treasurer of the City of Las Vegas, and shall be authenticated by the seal of the city of Las Vegas. The said bonds shall contain coupons attached to the several bonds representing the several installments of interest to fall due thereon so that they may be removed without injury to the Bond or coupon. The coupons shall be numbered consecutively and bear the signature or facsimile signature of the Mayor, or Mayor pro tem, and counter-signature, or facsimile countersignature of the City Clerk, or the Deputy City Clerk, and the signature or facsimile signature of the City Treasurer. Said bonds shall bear date of January 1, 1936. The said bonds, or as many thereof as may be necessary, in the judgment of the Board City Commissioners to accomplish the purpose herein expressed, shall be sold as herein provided, and the proceeds thereof shall be placed in a city fund designated as the "City Power Bond Fund." The said City power bond fund so derived from the sale of such bonds shall be used for the purpose of establishing, creating or acquiring by purchase or through construction whichever may appear to the Board of City Commissioners to be the more economical, a municipally owned power plant and distribution system and incidental purposes, and for purposes connected therewith, and for no other purposes. Section 5. The said bonds so issued shall be a lien upon any plant so acquired by the City. Section 6. When such plant shall be acquired as herein provided, the Board of City Commissioners shall charge a price for power distributed over such system sufficient, in addition to the operating costs, to pay the interest upon the said bonds as the same shall become due, and in addition thereto, a sum shall be collected by the Board of City Commissioners from the sale of such power sufficient to redeem and retire the said bonds upon their respective maturity dates. Section 7. The issuance of the bonds herein provided for shall be conclusive evidence of the regularity of all proceedings up to the issuance of said bonds, and in the event that the created from the sale of power distributed over such system shall be insufficient to pay the principal upon redeem the said bonds and to pay the interest thereon as the respective amounts become due, then and in such event, the deficiency shall be paid by the Treasurer of the City of Las Vegas from the general fund of the City, and each of such bonds issued under the authority of this ordinance shall contain a provision to that effect. Said bonds shall be exempt from city taxation.