Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

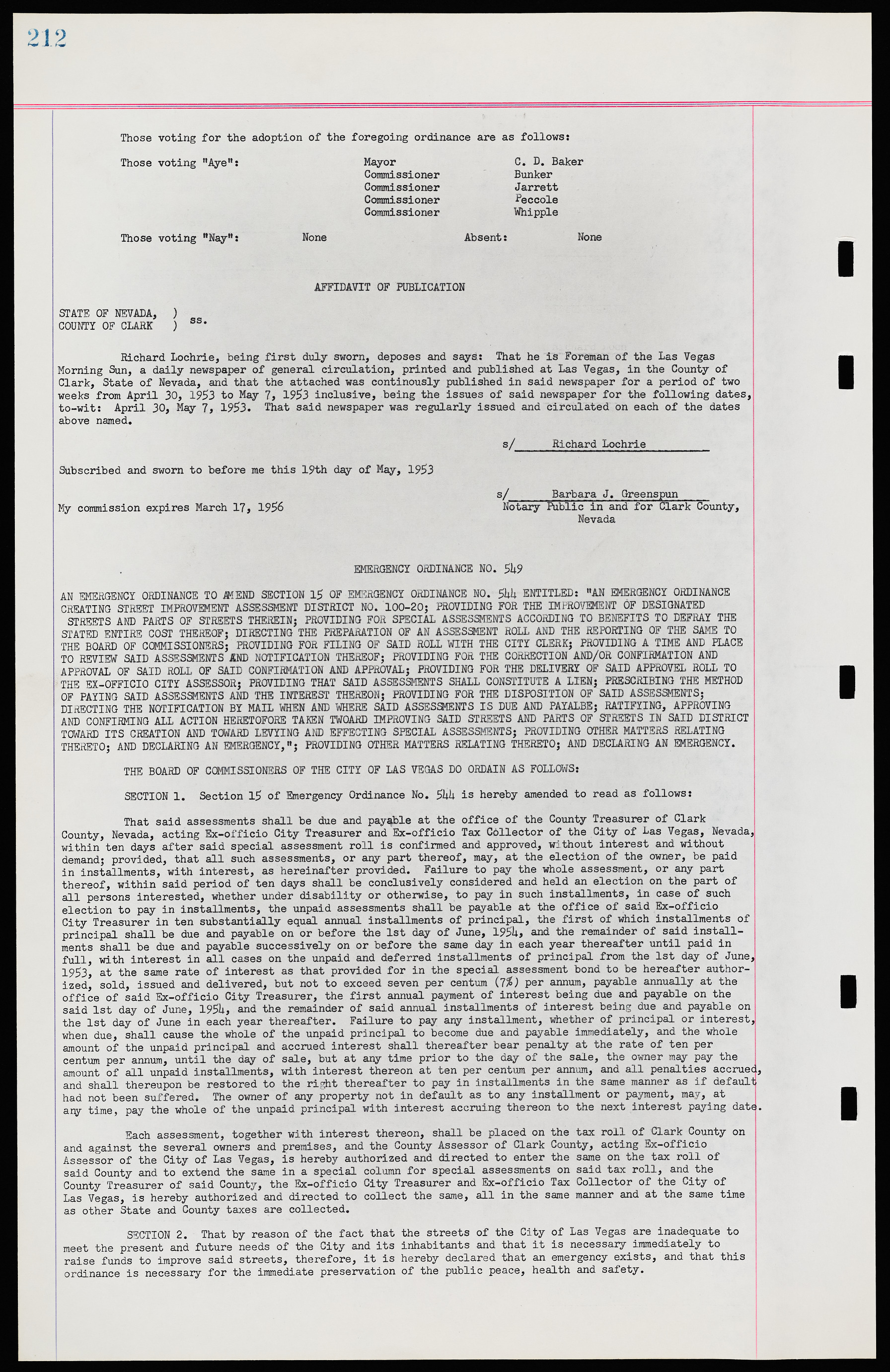

Those voting "Aye": Mayor C. D. Baker Commissioner Biinker Commissioner Jarrett Commissioner Peccole Commissioner Whipple Those voting "Nay": None Absent: None AFFIDAVIT OF PUBLICATION STATE OF NEVADA, ) COUNTY OF CLARK ) SS* Richard Lochrie, being first duly sworn, deposes and says: That he is Foreman of the Las Vegas Morning Sun, a daily newspaper of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of two weeks from April 30, 1953 to May 7, 1953 inclusive, being the issues of said newspaper for the following dates, to-wit: April 30, May 7, 1953. That said newspaper was regularly issued and circulated on each of the dates above named. s/______Richard Lochrie__________ Subscribed and sworn to before me this 19th day of May, 1953 s/ Barbara J. Greenspun_____ My commission expires March 17, 1956 Notary Public in and for Clark County, Nevada EMERGENCY ORDINANCE NO. 549 AN EMERGENCY ORDINANCE TO AMEND SECTION 15 OF EMERGENCY ORDINANCE NO. 344 ENTITLED: "AN EMERGENCY ORDINANCE CREATING STREET IMPROVEMENT ASSESSMENT DISTRICT NO. 100-20; PROVIDING FOR THE IMPROVEMENT OF DESIGNATED STREETS AND PARTS OF STREETS THEREIN PROVIDING FOR SPECIAL ASSESSMENTS ACCORDING TO BENEFITS TO DEFRAY THE STATED ENTIRE COST THEREOF; DIRECTING THE PREPARATION OF AN ASSESSMENT ROLL AND THE REPORTING OF THE SAME TO THE BOARD OF COMMISSIONERS; PROVIDING FOR FILING OF SAID ROLL WITH THE CITY CLERK; PROVIDING A TIME AND PLACE TO REVIEW SAID ASSESSMENTS AND NOTIFICATION THEREOF; PROVIDING FOR THE CORRECTION AND/OR CONFIRMATION AND APPROVAL OF SAID ROLL OF SAID CONFIRMATION AND APPROVAL; PROVIDING FOR THE DELIVERY OF SAID APPROVE ROLL TO THE EX-OFFICIO CITY ASSESSOR; PROVIDING THAT SAID ASSESSMENTS SHALL CONSTITUTE A LIEN; PRESCRIBING THE METHOD OF PAYING SAID ASSESSMENTS AND THE INTEREST THEREON; PROVIDING FOR THE DISPOSITION OF SAID ASSESSMENTS; DIRECTING THE NOTIFICATION BY MAIL WHEN AND WHERE SAID ASSESSMENTS IS DUE AND PAYABLE; RATIFYING, APPROVING AND CONFIRMING ALL ACTION HERETOFORE TAKEN TOWARD IMPROVING SAID STREETS AND PARTS OF STREETS IN SAID DISTRICT TOWARD ITS CREATION AND TOWARD LEVYING AND EFFECTING SPECIAL ASSESSMENTS; PROVIDING OTHER MATTERS RELATING THERETO; AND DECLARING AN EMERGENCY,"; PROVIDING OTHER MATTERS RELATING THERETO; AND DECURING AN EMERGENCY. THE BOARD OF COMMISSIONERS OF THE CITY OF US VEGAS DO ORDAIN AS FOLLOWS: SECTION 1. Section 13 of Emergency Ordinance No. 544 is hereby amended to read as follows: That said assessments shall be due and payable at the office of the County Treasurer of Clark County, Nevada, acting Ex-officio City Treasurer and Ex-officio Tax Collector of the City of Las Vegas, Nevada, within ten days after said special assessment roll is confirmed and approved, without interest and without demand; provided, that all such assessments, or any part thereof, may, at the election of the owner, be paid in installments, with interest, as hereinafter provided. Failure to pay the whole assessment, or any part thereof, within said period of ten days shall be conclusively considered and held an election on the part of all persons interested, whether under disability or otherwise, to pay in such installments, in case of such election to pay in installments, the unpaid assessments shall be payable at the office of said Ex-officio City Treasurer in ten substantially equal annual installments of principal, the first of which installments of principal shall be due and payable on or before the 1st day of June, 1954 and the remainder of said installments shall be due and payable successively on or before the same day in each year thereafter until paid in full, with interest in all cases on the unpaid and deferred installments of principal from the 1st day of June, 1953, at the same rate of interest as that provided for in the special assessment bond to be hereafter authorized, sold, issued and delivered, but not to exceed seven per centum (7%) per annum, payable annually at the office of said Ex-officio City Treasurer, the first annual payment of interest being due and payable on the said 1st day of June, 1954, and the remainder of said annual installments of interest being due and payable on the 1st day of June in each year thereafter. Failure to pay any installment, whether of principal or interest, when due, shall cause the whole of the unpaid principal to become due and payable immediately, and the whole amount of the unpaid principal and accrued interest shall thereafter bear penalty at the rate of ten per centum per annum, until the day of sale, but at any time prior to the day of the sale, the owner may pay the amount of all unpaid installments, with interest thereon at ten per centum per annum, and all penalties accrued, and shall thereupon be restored to the right thereafter to pay in installments in the same manner as if default had not been suffered. The owner of any property not in default as to any installment or payment, may, at any time, pay the whole of the unpaid principal with interest accruing thereon to the next interest paying date. Each assessment, together with interest thereon, shall be placed on the tax roll of Clark County on and against the several owners and premises, and the County Assessor of Clark County, acting Ex-officio Assessor of the City of Las Vegas, is hereby authorized and directed to enter the same on the tax roll of said County and to extend the same in a special column for special assessments on said tax roll, and the County Treasurer of said County, the Ex-officio City Treasurer and Ex-officio Tax Collector of the City of Las Vegas, is hereby authorized and directed to collect the same, all in the same manner and at the same time as other State and County taxes are collected. SECTION 2. That by reason of the fact that the streets of the City of Las Vegas are inadequate to meet the present and future needs of the City and its inhabitants and that it is necessary immediately to raise funds to improve said streets, therefore, it is hereby declared that an emergency exists, and that this ordinance is necessary for the immediate preservation of the public peace, health and safety. Those voting for the adoption of the foregoing ordinance are as follows: