Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

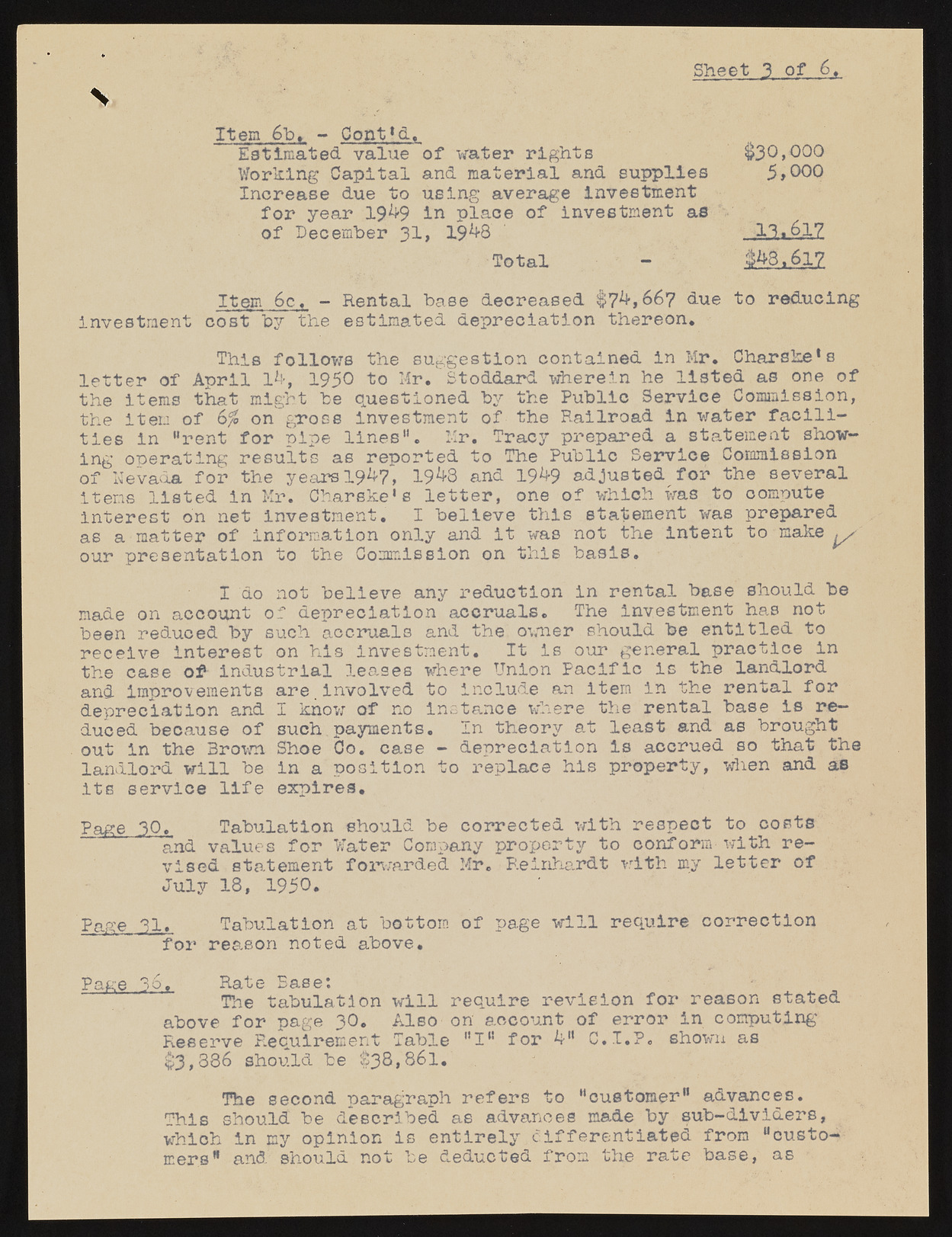

Item 6b» - Pont*<1, Estimated value of water rights Working Capital and material and supplies Increase due to using average investment for year 19^9 in place of investment as of December 31, 19^8 Total - Item 6c, - Rental base decreased $7^,667 due investment cost by the estimated depreciation thereon. This follows the suggestion contained in Mr, letter of April lA, 1950 to Mr, Stoddard wherein he listed as one of the items that might be questioned by the Public Service Commission, the item of 6% on gross Investment of the Railroad in water facilities in "rent for pipe lines". Mr. Tracy prepared a statement showing operating results as reported to The Public Service Commission of Nevada for the years 19^7, 19^8 and 19^9 adjusted for the several items listed in Mr. Charske'8 letter, one of which was to compute interest on net investment, I believe this statement was prepared as a matter of information only and it was not the intent to make y our presentation to the Commission on this basis. I do not believe any reduction in rental base should be made on account of depreciation accruals. The investment has not been reduced by such accruals and the owner should be entitled to receive interest on his investment. It Is our general practice In the case of1 industrial leases where Union Pacific is the landlord and improvements are.involved to include an item in the rental for depreciation and I know of no instance where' the rental base is reduced because of such payments. In theory at least and as brought out in the Brown Shoe Co. case - depreciation is accrued so that the landlord will be in a position to replace his property, when and as Its service life expires. Page 30. Tabulation should be corrected with respect to costs and values for Water Company property to conform' with revised statement forwarded Mr. Reinhardt with my letter of July 18, 1950. Page 31. Tabulation at bottom of page will require correction for reason noted above. Page 36. Rate Base: The tabulation will require revision for reason stated above for page 30. Also on account of error in computing Reserve Reculremerit Table "I" for 4" C.I.P. shown as $3,386 should be $38,861. The second paragraph refers to "customer" advances. This should be described as advances made by sub-dividers, which In my opinion is entirely differentiated from "customers" and should not be deducted from the rate base, as Sheet 3 of 6. $30,000 5,000 13.617 ^3,617 to reducing Charske1 s