Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

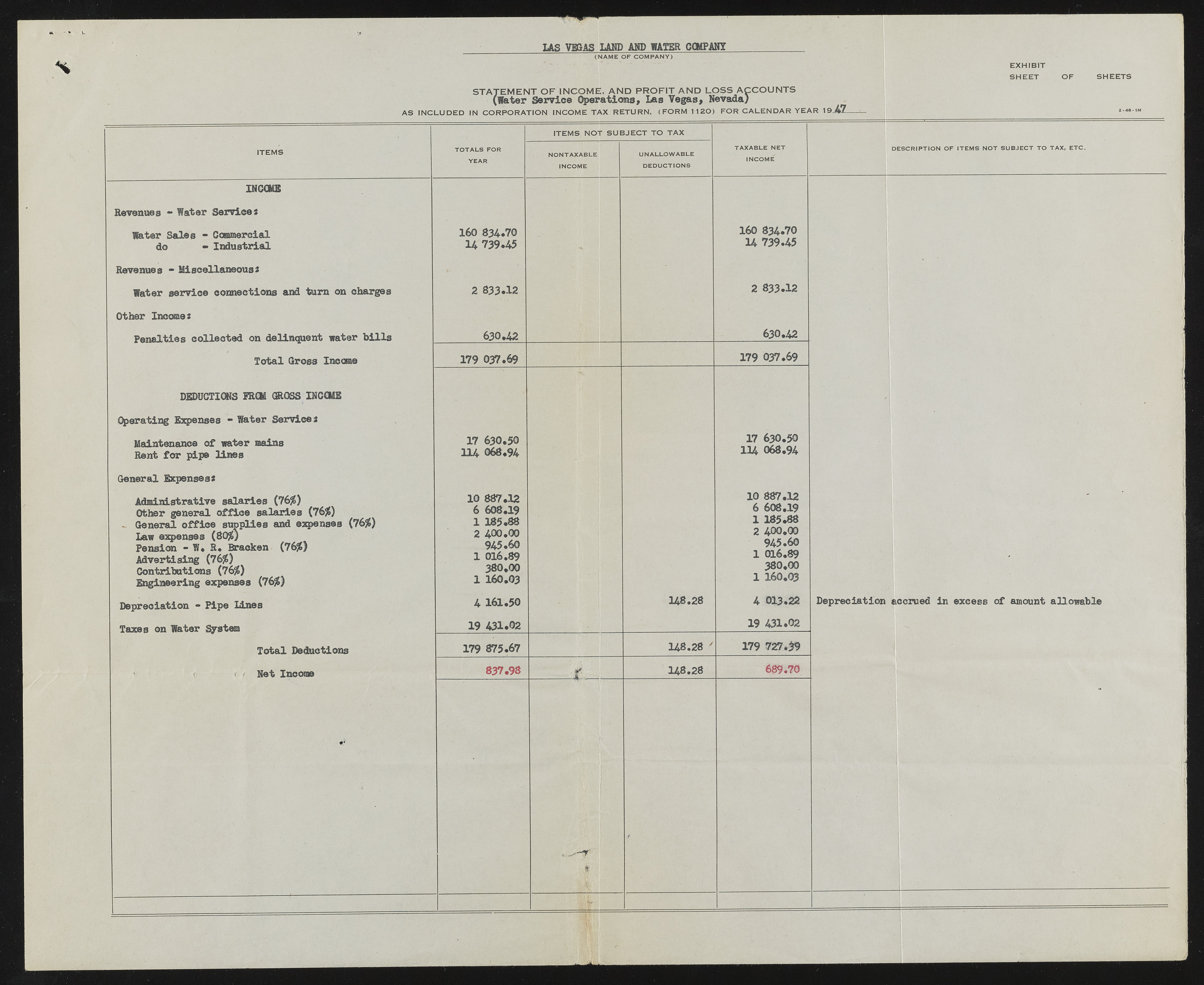

IAS VEGAS LAUD ASP WATER C&SPANY (N A M E O F C O M P A N Y ) EXHIBIT S H E E T O F S H E E TS STATEM ENT O F INCOME, A N D PROFIT A N D LO SS A C C O U N T S (Water Service Operations, Las Vegas, Nevada) A S IN C LU D E D IN C O R P O R A T IO N INCOM E T A X R E TU R N , (F O R M 1 1 2 0 ) F O R C A L E N D A R Y E A R 19-42- ITEM S INCOGS Revenues - Water Services Water Sales - Commercial do - Industrial Revenues " Miscellaneouss Water service connections and turn on charges Other Incomes Penalties collected on delinquent eater bills Total Gross Income DEDUCTIONS FROM GROSS INCOME Operating Expenses a Water Services Maintenance of eater mains Rent for pipe lines General Expenses* Administrative salaries (76$) Other general office salaries (76$) - General office supplies and expenses (76$) Lae expenses (80$) Pension - W. R. Bracken (76$) Advertising (76$) Contributions (76$) Engineering expenses (76$) Depreciation - Pipe Lines Taxes on Water System Total Deductions t if Net Income T O T A L S FO R Y E A R 160 834*70 H 739.45 2 833.12 630,42 179 037.69 17 630.50 114 068,94 10 887.12 6 608.19 12 418050..0808 945.60 1 016.89 380.00 1 160.03 4 161.50 19 431.02 179 875.67 837.98 ITEM S N O T S U B JE C T TO T A X N O N T A X A B L E IN CO M E U N A L L O W A B L E D E D U C T IO N S M- * - r ? uni i 148.28 148.28 y 148.28 T A X A B L E N E T i n c o m e ' 160 834.70 14 739.45 2 833.12 630.42 179 037.69 17 630.50 114 068.94 10 887.12 6 608.19 1 185.88 2 400.00 945.60 1 016.89 380.00 1 160.Q3 4 013.22 19 431.02 179 727*39 689.70 D E S C R IP T IO N O F IT E M S N O T S U B JE C T T O TA X , E T C . Depreciation accrued in exeess of amount allowable