Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

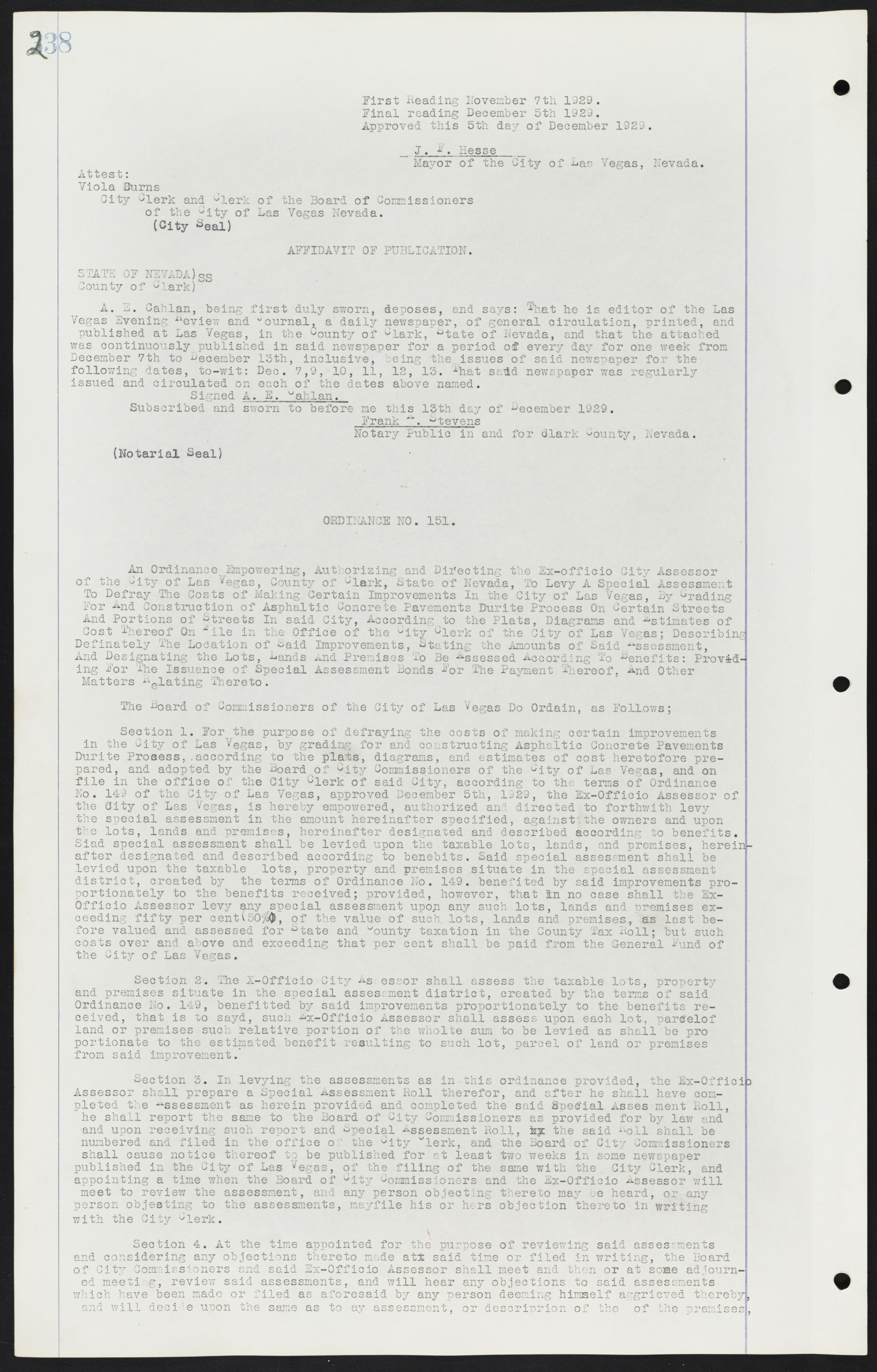

First Reading November 7th 1929. Final reading December 5th 1929. Approved this 5th day of December 1929. J. B. Hesse Mayor of the City of Las Vegas, Nevada. Attest: Viola Burns City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas Nevada. (City Seal) AFFIDAVIT OF PUBLICATION. STATE OF NEVADA) ss County of Clark) A. E. Cahlan, being first duly sworn, deposes, and says: That he is editor of the Las Vegas Evening Review and Journal, a daily newspaper, of general circulation, printed, and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of every day for one week from December 7th to December 13th, inclusive, being the issues of said newspaper for the following dates, to-wit: Dec. 7, 9, 10, 11, 12, 13. That said newspaper was regularly issued and circulated on each of the dates above named. Signed A. E. Cahlan. Subscribed and sworn to before me this 13th day of December 1929. Frank A. Stevens Notary Public in and for Clark County, Nevada. (Notarial Seal) ORDINANCE NO. 151. An Ordinance Empowering, Authorizing and Directing the Ex-officio City Assessor of the City of Las Vegas, County of Clark, State of Nevada, To Levy A Special Assessment To Defray The Costs of Making Certain Improvements In the City of Las Vegas, By Grading For And Construction of Asphaltic Concrete Pavements Durite Process On Certain Streets And Portions of Streets In said City, According to the Plats, Diagrams and estimates of Cost hereof On File the Office of the City Clerk of the City of Las Vegas; Describing Definitely the Location of Said Improvements, Stating the Amounts of Said assessment, And Designating the Lots, Lands And Premises To Be Assessed According To Benefits: Providing For The Issuance of Special Assessment Bonds For The Payment Thereof, And Other Matters Relating Thereto. The Board of Commissioners of the City of Las Vegas Do Ordain, as Follows; Section 1. For the purpose of defraying the costs of making certain improvements in the City of Las Vegas, by grading for and constructing Asphaltic Concrete Pavements Durite Process, according to the plats, diagrams, and estimates of cost heretofore prepared, and adopted by the Board of City Commissioners of the City of Las Vegas, and on file in the office of the City Clerk of said City, according to the terms of Ordinance No. 149 of the City of Las Vegas, approved December 5th, 1929, the Ex-Officio Assessor of the City of Las Vegas, is hereby empowered, authorized and directed to forthwith levy the special assessment in the amount hereinafter specified, against the owners and upon the lots, lands and premises, hereinafter designated and described according to benefits. Said special assessment shall be levied upon the taxable lots, lands, and premises, hereinafter designated and described according to benefits. Said special assessment shall be levied upon the taxable lots, property and premises situate in the special assessment district, created by the terms of Ordinance No. 149. benefited by said improvements proportionately to the benefits received; provided, however, that in no case shall the Ex-Officio assessor levy any special assessment upon any such lots, lands and premises exceeding fifty per cent (50%), of the value of such lots, lands and premises, as last before valued and assessed for State and County taxation in the County Tax Roll; but such costs over and above and exceeding that per cent shall be paid from the General Fund of the City of Las Vegas. Section 2. The Ex-Officio City Assessor shall assess the taxable lots, property and premises situate in the special assessment district, created by the terms of said Ordinance No. 149, benefitted by said improvements proportionately to the benefits received, that is to say, such Ex-Officio Assessor shall assess upon each lot, parcel of land or premises such relative, portion of the whole sum to be levied as shall be proportionate to the estimated benefit resulting to such lot, parcel of land or premises from said improvement. Section 3. In levying the assessments as in this ordinance provided, the Ex-Officio Assessor shall prepare a Special Assessment Roll therefor, and after he shall have completed the assessment as herein provided and completed the said Special Assessment Roll, he shall report the same to the Board of City Commissioners as provided for by law and and upon receiving such report and Special Assessment Roll, the said Roll shall be numbered and filed in the office of the City Clerk, and the Board of City Commissioners notice thereof to be published for at least two weeks in some newspaper published in the City of Las Vegas, of the filing of the same with the City Clerk, and appointing a time when the Board of City Commissioners and the Ex-Officio assessor will meet to review the assessment, and any person objecting thereto may be heard, or any person objecting to the assessments, may file his or hers objection thereto in writing with the City Clerk. Section 4. At the time appointed for the purpose of reviewing said assessments and considering any objections thereto made at said time or filed in writing, the Board of City Commissioners and said Ex-Officio Assessor shall meet and then or at some adjourned meeting, review said assessments, and will hear any objections to said assessments which have been made or filed as aforesaid by any person deeming himself aggrieved thereby and will decide upon the same as to ay assessment, or description of the of the premises,