Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

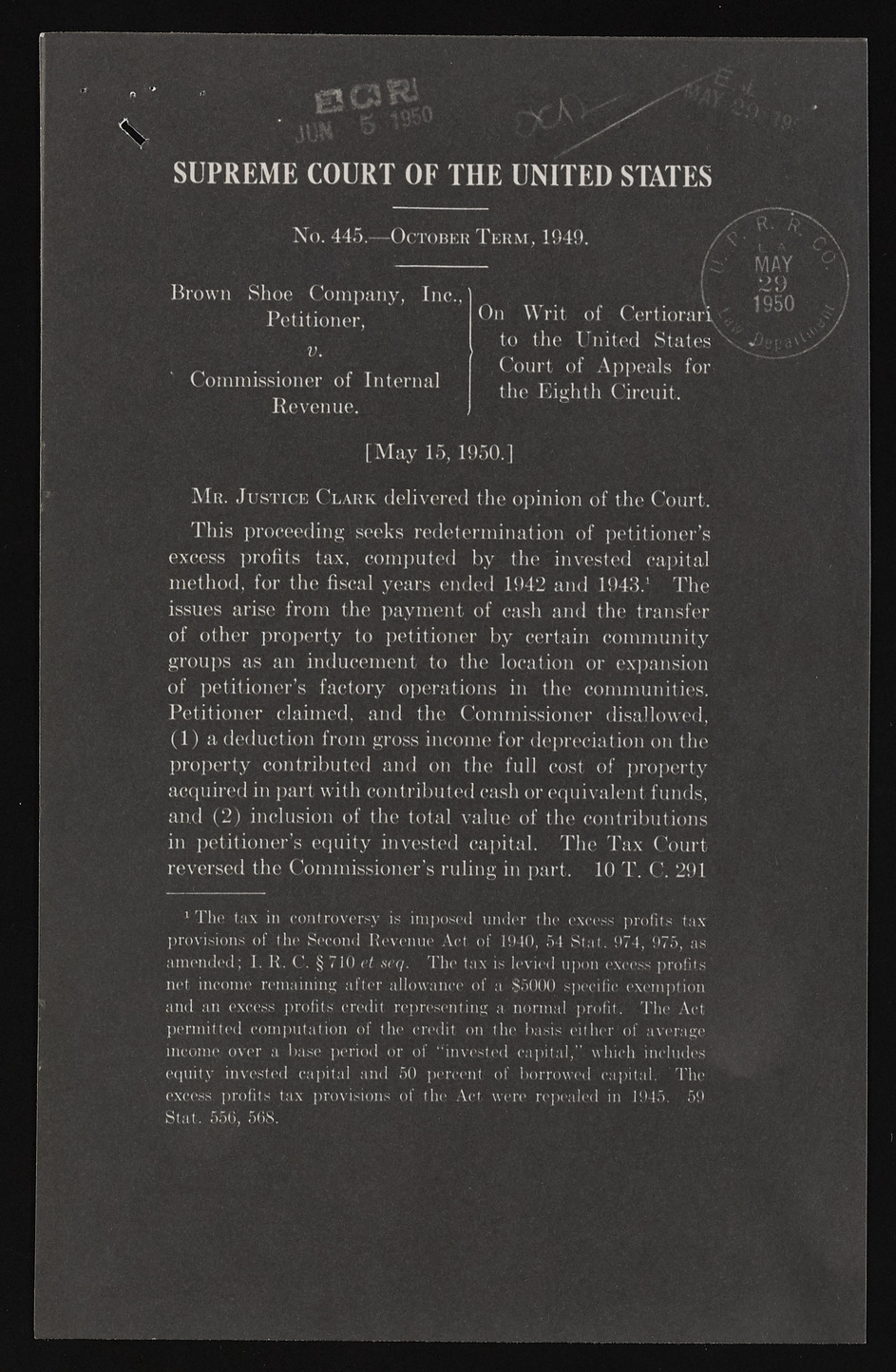

tffl e 11 f-C SUPREME COURT OF THE UNITED STATES No. 445.—October T erm, 1949. Brown Shoe Company, Inc.,) Petitioner, v . Commissioner of Internal Revenue. V On Writ of Certiorari : to the United States ^ Court of Appeals for the Eighth Circuit. MAY 25) 1950 [May 15, 1950.] M r. Justice Clark delivered the opinion of the Court. This proceeding seeks redetermination of petitioner’s excess profits tax, computed by the invested capital method, for the fiscal years ended 15)42 and 1943.1 The issues arise from the payment of cash and the transfer of other property to petitioner by certain community groups as an inducement to the location or expansion of petitioner’s factory operations in the communities. Petitioner claimed, and the Commissioner disallowed, (1) a deduction from gross income for depreciation on the property contributed and on the full cost of property acquired in part with contributed cash or equivalent funds, and (2) inclusion of the total value of the contributions in petitioner’s equity invested capital. The Tax Court reversed the Commissioner’s ruling in part. 10 T. C. 291 1 The tax in controversy is imposed under the excess profits tax provisions of the Second Revenue Act of 1940, 54 8tat. 974, 975, as amended; I. R. C. § 710 c t The tax is levied upon net income remaining after allowance of a $5000 specif iecx ceexsse mpprtofiiotns apnerdm iatnt eedx ccesosm ppurtoaftitiso nc reodfi tt hree pcrreesdietn tionng tah en obrasmiasl epirtohfeirt . of Taivme rAacgte eiqnuciotmye ionvveers tae d bacsaepi tpaelr iaond do r5 0o fp e“ricnevnets teodf cbaopritraolw,e"d whcaipciht ali.n cl'uTdhees Setxacte.s s5 5p0r,o f5i6t8s .tax provisions of the Act were repealed in 1945. 59