Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

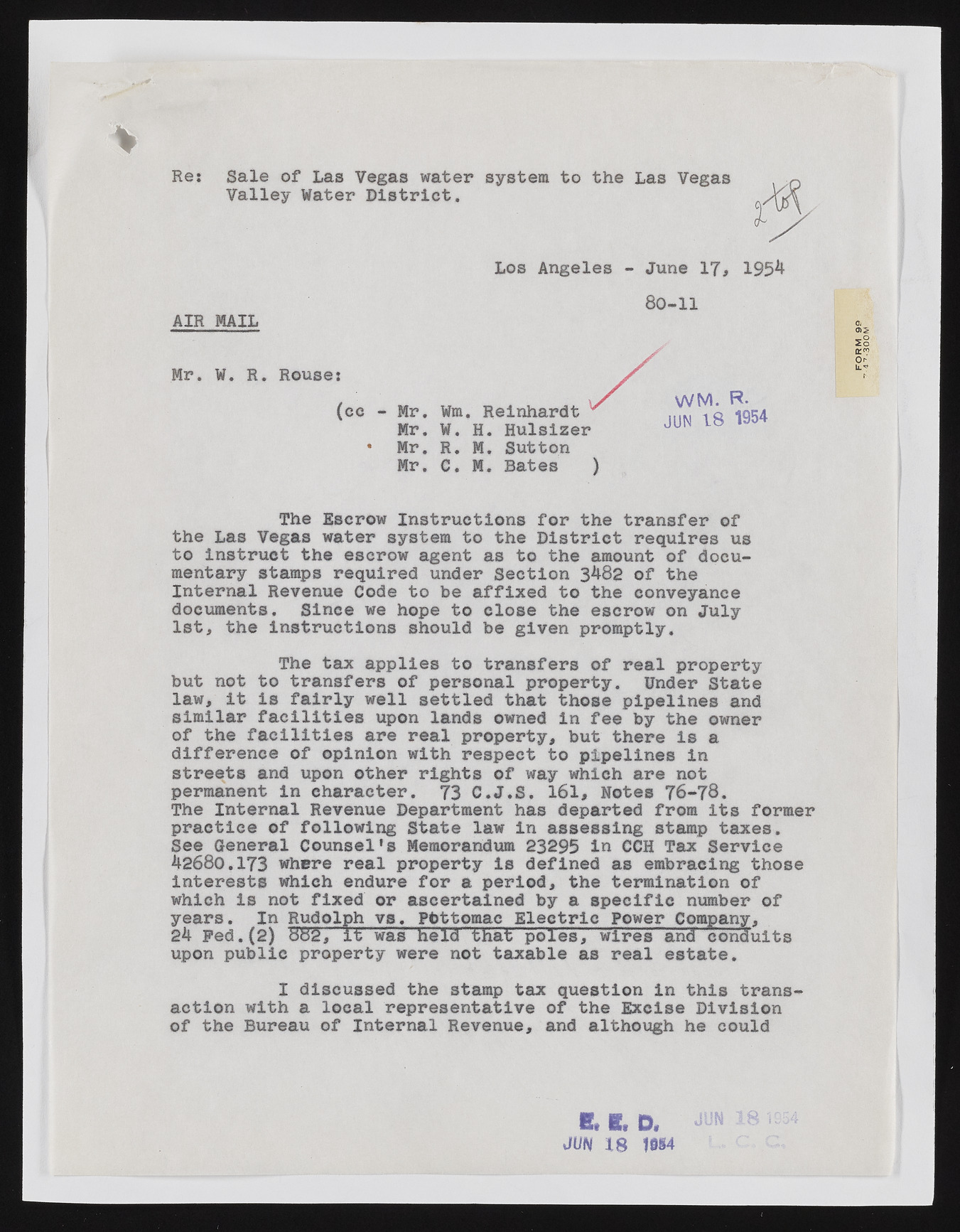

Re: Sale of Las Vegas water system to the Las Vegas Valley Water District. Los Angeles - June 17* 1954 AIR MAIL 80-11 Mr. W. R. Rouse: (ce - Mr. Mr. * Mr. Mr. Wm. Reinhardt W. H. Hulslzer R. M. Sutton C. M. Bates ) W M . R» JUN 18 1954 Cl 02>£ xOLl The Escrow Instructions for the transfer of the Las Vegas water system to the District requires us to instruct the escrow agent as to the amount of documentary stamps required under Section 3482 of the Internal Revenue Code to be affixed to the conveyance documents. Since we hope to close the escrow on July 1st, the instructions should be given promptly. The tax applies to transfers of real property but not to transfers of personal property. Under State law, it is fairly well settled that those pipelines and similar facilities upon lands owned in fee by the owner of the facilities are real property, but there is a difference of opinion with respect to pipelines in streets and upon other rights of way which are not permanent In character. 73 C.J.S. 161, Notes 76-78. The Internal Revenue Department has departed from its former practice of following State law in assessing stamp taxes. See General Counsel's Memorandum 23295 in CCH Tax Service 42680.173 where real property Is defined as embracing those Interests which endure for a period, the termination of which is not fixed or ascertained by a specific number of years. In Rudolph vs. Pfettomac Electric Power Company, 24 Fed. (2) 882, it was held that poles, wires aridf conduits upon public property were not taxable as real estate. I discussed the stamp tax question in this transaction with a local representative of the Excise Division of the Bureau of Internal Revenue, and although he could B. R, D, JUN 18 1884 4 ?’’-3 0 0 I