Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

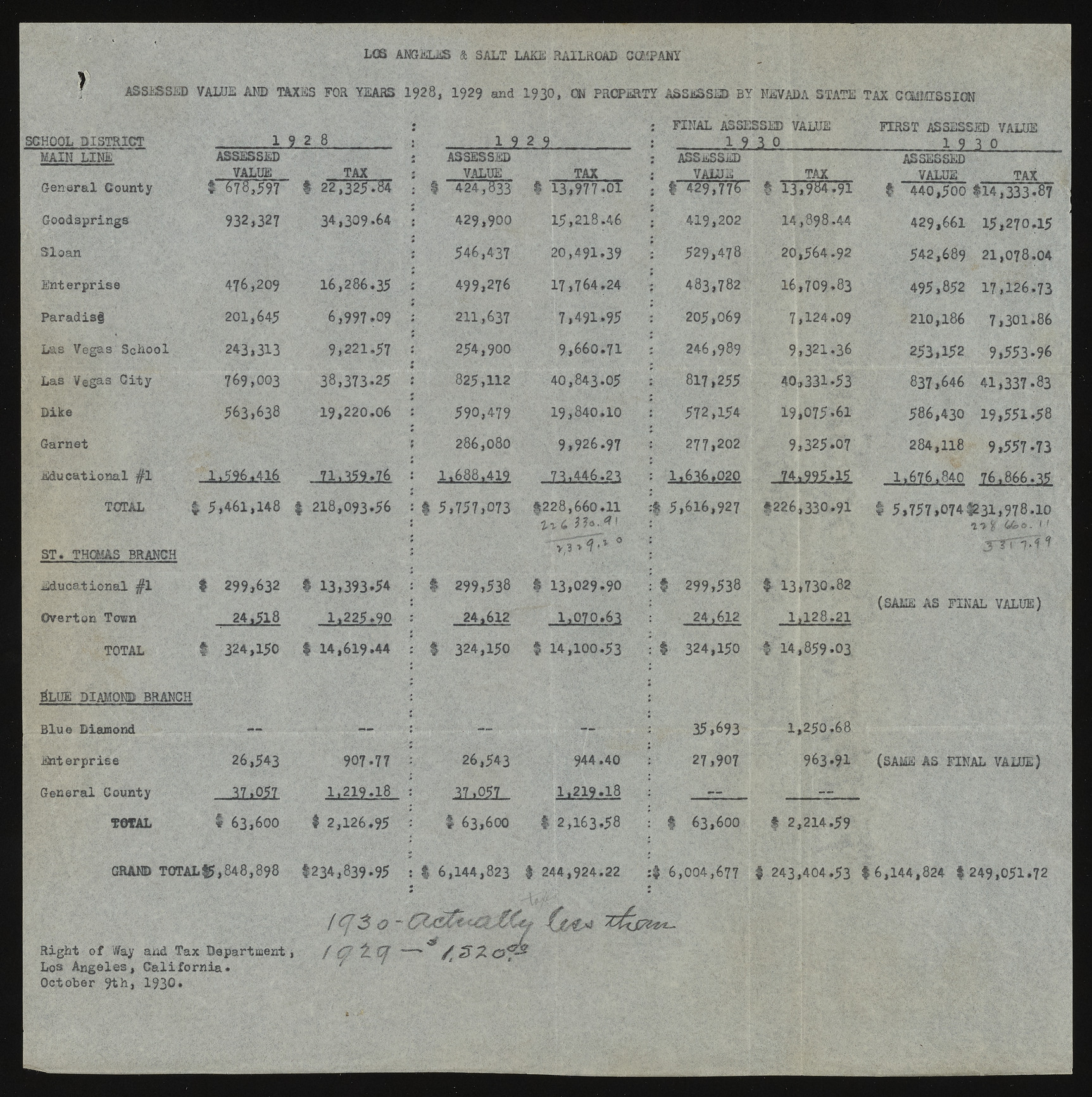

LOS ANGELES & SALT LAKE RAILROAD COMPANY ASSESSED VALUE AND TAXES FOR YEARS 1 9 2 8 , 1929 and 1 9 3 0 , ON PROPERTY ASSESSED BY NEVADA STATE SCHOOL DISTRICT MAIN LINE General County Goodsprings Sloan E nterp rise Paradis# Las Vegas School Las Vegas C ity Dike Garnet E ducational #1 TOTAL ST. THOMAS BRANCH E ducational §1 Overton Town TOTAL ; FINAL ASSESSED VALUE 1 9 2 8 - 1 . 9 2 9 : 4 _ 1 9 3 0 ASSESSED VALUE TAX ASSESSED VALUE TAX ASSESSED VALUE TAX $ ^ 78 ,59 7 # 2 2 ,3 2 5 .8 4 # 4 2 4 ,8 3 3 I 1 3 ,9 7 7 .0 1 f 4 2 9 ,7 7 6 9 1 3 ,9 8 4 .9 1 93 2,32 7 3 4 ,3 0 9 *6 4 4 2 9 ,9 0 0 1 5 ,2 1 8 .4 6 4 1 9 ,2 0 2 14, 898.44 5 4 6 ,4 3 7 20, 491.39 529*478 2 0 ,5 6 4 .9 2 476,209 1 6 ,2 8 6 .3 5 4 9 9 ,2 7 6 1 7 ,7 6 4 ,2 4 483,782 16, 709.83 2 0 1,64 5 6 ,9 9 7 .0 9 2 1 1,63 7 7 ,4 9 1 .9 5 205,069 7 ,1 2 4 .0 9 2 4 3 ,3 1 3 9 ,2 2 1 .5 7 2 5 4 ,9 0 0 9, 660.71 2 4 6 ,989 9, 321.36 7 6 9 ,0 0 3 3 8 ,3 7 3 *2 5 825,112 40, 843.05 8 1 7,25 5 40, 331.53 5 6 3 ,6 3 8 19, 220,06 5 9 0 ,4 7 9 19, 840.10 5 7 2 ,1 5 4 19, 075.61 286,080 9 ,9 2 6 .9 7 277,202 9, 325.07 1 *5 9 6 ,4 1 6 7 1 *3 5 9 ,7 6 1 .6 8 8 ,4 1 9 J Q i 4 4 6 t23 1 ,6 3 6 .0 2 0 .J4^995..i5. # 5 ,4 6 1 ,1 4 8 $ 21 8 ,0 9 3 *5 6 | 5 ,7 5 7 ,0 7 3 # 228, 660.11 ? 0 1 # 5 ,6 1 6 ,9 2 7 # 226, 330.91 # 2 9 9 ,6 3 2 # 1 3 ,3 9 3 .5 4 # 2 9 9 ,5 3 8 # 13, 029.90 # 2 9 9 ,5 3 8 # 13, 730.82 2 4 ,5 1 8 1 .2 2 5 .9 0 24*612 1 , 070.63 2 4 ,6 1 2 1 , 128.21 I 324,150 # 1 4 ,6 1 9 *4 4 # 3 2 4 ,1 5 0 # 14, 100,53 #•' 3 2 4 ,1 5 0 # 14, 859.03 #LUE DIAMOND BRANCH Blue Diamond — — ! 3 5 ,6 9 3 1 , 250.68 E nterprise 2 6 ,5 4 3 9 0 7 .7 7 26,543 944.4 0 2 7 ,9 0 7 963.91 General County 37.057 1 .2 1 9 .1 8 37,057 1 ,2 1 9 .1 8 ’ TOTAL 1 63,600 $ 2 ,1 2 6 *9 5 # 63,600 | 2 ,1 6 3 .5 8 # 63,600 # 2 ,2 1 4 .5 9 GRAND TOTAL#,8 4 8 ,898 1 2 3 4 ,8 3 9 *9 5 6 ,1 4 4 ,8 2 3 2 4 4 ,9 2 4 .2 2 #. 6 ,0 0 4 ,6 7 7 | 2 4 3 ,4 0 4 .5 3 p f p l i o || jr r>*. ^ Right o f Way and Tax Department j f / t S'A-Los A n g e le s, C a lifo r n ia * ^ ? October 9t h , 1 9 3 0 . TAX COMMISSION FIRST ASSESSED VALUE ____________ P - 3 P ASSESSED VALUE TAX_ # 4 4 0 ,5 0 0 1 1 4 ,3 3 3 .8 7 4 2 9 ,6 6 1 1 5 ,2 7 0 .1 5 542,689 2 1 ,0 7 8 .0 4 495,852 1 7 ,1 2 6 .7 3 2 1 0 ,1 8 6 7, 301.86 2 5 3 ,1 5 2 9 ,5 5 3 *9 6 8 3 7,64 6 4 1 ,3 3 7 * 8 3 5 8 6 ,4 3 0 1 9 ,5 5 1 * 5 8 2 8 4 ,1 1 8 9 ,5 5 7 * 7 3 1 ,6 7 6 .8 4 0 7 6 ,8 6 6 .3 5 $ 5 , 757,0741231, 978.10 ||§|j * 1 ?, j ~iT ir f 1 (SAME AS FINAL VALUE) (SAME AS FINAL VALUE) # 6 ,1 4 4 ,8 2 4 # 2 4 9 ,0 5 1 .7 2