Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

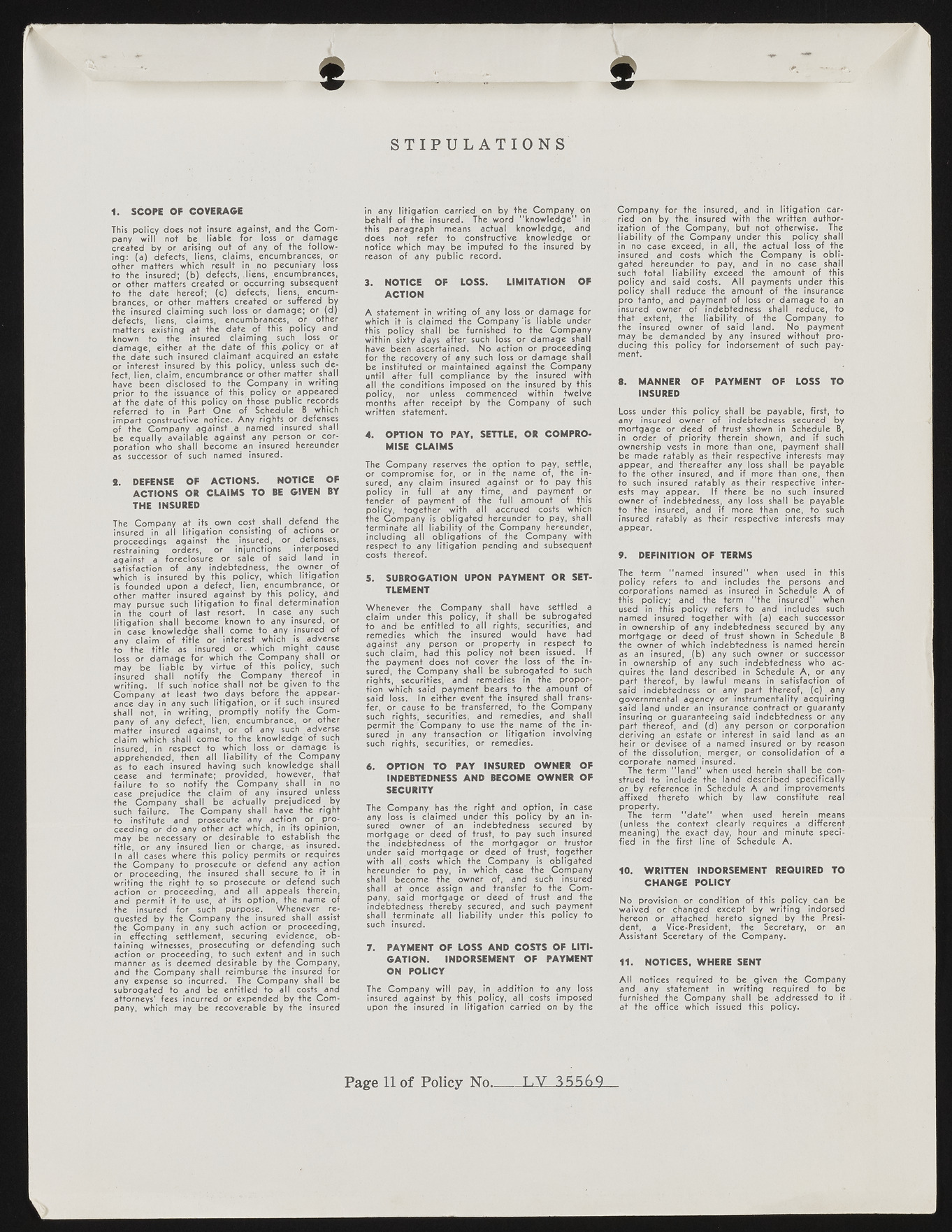

A S T I P U L A T I O N S 1. SCOPE OF COVERAGE This policy docs not insure against, and the Company will not be liable for loss or damage created by or arising out of any of the following: (a) defects, liens, claims, encumbrances, or other matters which result in no pecuniary loss to the insured; (b) defects, .liens, encumbrances, or other matters created or occurring subsequent to the date hereof; (c) defects, liens, encumbrances, or other matters created or suffered by the insured claiming such loss or damage; or (d) defects, liens, claims, encumbrances, or other matters existing at the date of this policy and known to the insured claiming _ such ^ loss or damage, either at the date of this_ policy or at the date such insured claimant acquired an estate or interest insured by this policy, unless such defect, lien, claim, encumbrance or other matter shall have been disclosed to the Company in writing prior to the issuance of this, policy or appeared at the date of this policy on those public records referred to. 'in Part One of Schedule B which impart constructive notice. Any rights or defenses of the Company against a named insured shall be equally available against any person or corporation who shall become an insured hereunder as successor of such named insured. 2. DEFENSE OF ACTIONS. NOTICE OF ACTIONS OR CLAIMS TO BE GIVEN BY THE INSURED The Company at its own cost shall defend the insured in all litigation consisting of actions or proceedings against the insured, or defenses, restraining orders, or injunctions ^ interposed against a foreclosure or sale of said land in satisfaction of any indebtedness, the owner of which is insured by this policy, which litigation is founded upon a defect, lien, encumbrance, or other matter insured against by this policy, and may pursue such litigation to final determination in the court of last resort. In case any such litigation shall become known to any insured, or in case knowledge shall come to any insured of any claim of title or interest which is adverse to the title as insured or. which might cause loss or damage for which the Company shall or may be liable by virtue of this policy, such insured shall notify the Company thereof in writing. If such'notice shall not be given to the Company at least two days before the appearance day in any such litigation, or if such insured shall not, in writing, promptly notify the Company of any defect, lien, encumbrance, or other matter insured against, or of any such adverse claim which shall come to the knowledge’ of such insured, in respect to which loss or damage is apprehended, then all liability of the Company as to each insured having such knowledge shall cease and terminate; provided, however,# that failure to so notify the Company shall in no case prejudice the claim of any insured unless the Company shall be actually prejudiced ^ by such failure. The Company shall have the right to institute and prosecute any action or_ proceeding or do any other act which, in its opinion, may be necessary or desirable to establish the title, or any insured lien or charge, as insured. In all cases where this policy permits or requires the Company to prosecute or defend any action Or proceeding, the insured shall secure to it in writing the right to so prosecute or defend such action or proceeding, and all appeals therein, and permit it to use, at its option, the name of the insured for such purpose. Whenever requested by the Company the insured shall assist the Company in any such action or proceeding, in effecting settlement, securing evidence, obtaining witnesses, prosecuting or defending such action or proceeding, to such extent and in such manner as is deemed desirable by the_ Company, and the Company shall reimburse the insured for any expense so incurred. The Company shall be subrogated to and be entitled to all costs and attorneys' fees incurred or expended by the Company, which may be recoverable by the insured in any litigation carried on by the Company on behalf of the insured. The word "knowledge" in this paragraph means actual knowledge, and does not refer to constructive knowledge or notice which may be imputed to the insured by reason of any public record. 3. NOTICE OF LOSS. LIMITATION OF ACTION A statement in writing of any loss or damage for which it is claimed the Com pany'is liable under this policy shall be furnished to the Company within sixty days after, such loss or damage shall have been ascertained. No action or proceeding for the recovery of any such loss or damage shall be instituted or maintained against the Company until after full compliance by the insured with all the conditions imposed on the insured by this policy, nor unless commenced within twelve months after receipt by the Company of such written statement. 4. OPTION TO PAY, SETTLE, OR COMPROMISE CLAIMS The Company reserves the option to pay, settle, or compromise for, or in the name of, the insured, any claim insured against or to pay this policy in full at any time, and payment or tender of payment of the full amount of this policy, together with all accrued costs which the Company is obligated hereunder to pay, shall terminate all liability of the Company hereunder, including all obligations of the Company with respect to any litigation pending and subsequent costs thereof. 5. SUBROGATION UPON PAYMENT OR SETTLEMENT Whenever the Company shall have settled a claim under this policy, it shall be subrogated to and be entitled to all rights* securities, and remedies which the insured would have had against any person or property in respect to such claim, had this policy not been issued. J f the payment does not cover the loss of the insured, the Company shall be subrogated to such rights, securities, and remedies in the proportion which said payment bears to the amount of said loss. In either event the insured shall transfer, or cause to be transferred, to the Company such rights, securities, and remedies, and shall permit the Company to use the name of the insured in any transaction or litigation involving such rights, securities, or remedies. 6. OPTION TO PAY INSURED OWNER OF INDEBTEDNESS AND BECOME OWNER OF SECURITY The Company has the right and option, in case any loss is claimed under this policy by an insured owner of an indebtedness secured by mortgage or deed of trust, to pay such insured the . indebtedness of the mortgagor or trustor under said mortgage or deed of trust, together with all costs which the Company is obligated hereunder to pay, in which case the Company shall become the owner of, and such insured shall at once assign and transfer to the Company, said mortgage or deed of trust and the indebtedness thereby secured, and such payment shall terminate all liability under this policy to such insured. 7. PAYMENT OF LOSS AND COSTS OF LITIGATION. INDORSEMENT OF PAYMENT ON POLICY The Company will pay, in addition to any loss insured against by this policy, all costs imposed upon the insured in litigation carried on by the Company for the insured, and in litigation carried on by the insured with the written authorization of the Company, but not otherwise. The liability of the Company under this policy shall in no case exceed, in all, the actual loss^ of the insured and costs which the Company is obligated hereunder to pay, and in no case shall such total liability exceed the amount of this policy and said costs. All payments under this policy shall reduce the amount of the insurance pro tanto, and payment of loss or damage to an insured owner of indebtedness shall reduce, to that extent, the liability of the Company to the insured owner of said land. No payment may be demanded by any insured without producing this policy for indorsement of such payment. 8. MANNER OF PAYMENT OF LOSS TO INSURED Loss under this policy shall be payable, first, to any insured owner of indebtedness secured by mortgage or deed of trust shown in Schedule B, in order of priority therein shown, and if such ownership vests in more than one, payment shall be made ratably as their respective interests may appear, and thereafter any loss shall be payable to the other insured, and if more than one, then to such insured ratably as their respective interests may appear. If there be no such insured owner of indebtedness, any loss shall be payable to the insured, and if more than one, to such insured ratably as their respective interests may appear. 9. DEFINITION OF TERMS The term "named insured" when used in this policy refers to and; includes The persons and corporations named as insured in Schedule A of this policy; and the term "the insured" when used in this policy refers to and includes such named insured together with (a) each successor in ownership of any indebtedness secured by any mortgage or deed of trust shown in Schedule B the owner of which indebtedness is named herein as an insured, (b) any such owner or successor in ownership of any such indebtedness who acquires the land described in Schedule A, or any part thereof, by lawful means in satisfaction of said indebtedness or any part thereof, ( c ) a n y governmental agency or instrumentality acquiring said land under an insurance contract or guaranty insuring or guaranteeing said indebtedness or any part thereof, and (d) any person or corporation deriving an estate or interest in said land as an heir or devisee of a named insured or by reason of the dissolution, merger, or consolidation of a corporate named insured. The term "la n d " when used herein shall be construed to include the land described specifically or by reference in Schedule A and improvements affixed thereto which by law constitute real property. The term "d a te " when used herein means (unless the context clearly requir.es a different meaning) the exact day, hour and minute specified in the first line of Schedule A. 10. WRITTEN INDORSEMENT REQUIRED TO CHANGE POLICY No provision or condition of this policy^ can be waived or changed except by writing indorsed hereon or attached hereto signed by the President, a Vice-President, the Secretary, or an Assistant Sceretary of the Company. 11. NOTICES, WHERE SENT All notices required to be given the Company and any statement in writing required to be furnished the Company shall be addressed to it at the office which issued this policy. Page 11 of Policy No.___ LY 35569.