Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

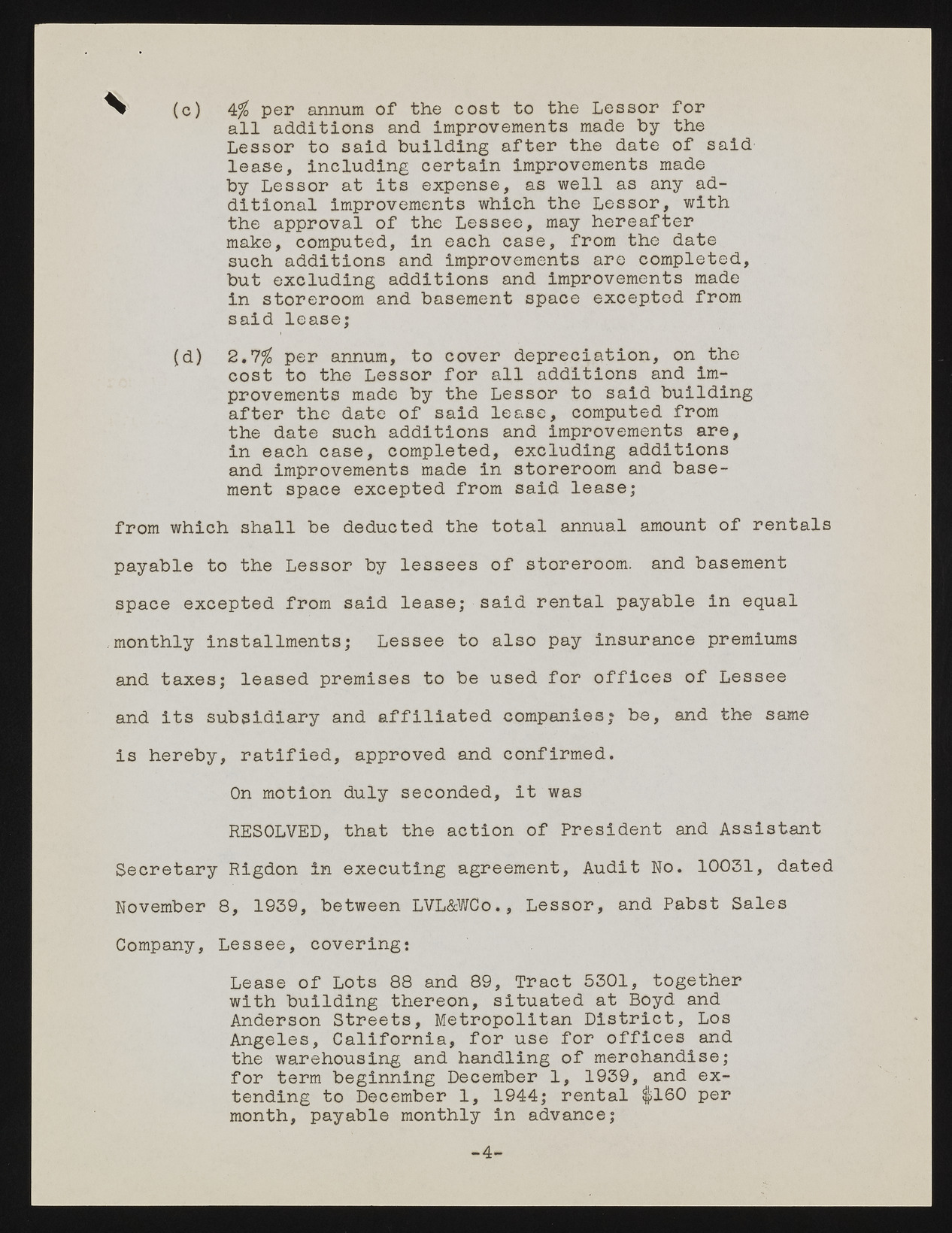

^ (c) 4% per annum of the cost to the Lessor for all additions and Improvements made by the Lessor to said building after the date of said lease, including certain improvements made by Lessor at its expense, as well as any additional improvements which the Lessor, with the approval of the Lessee, may hereafter make, computed, in each case, from the date such additions and improvements are completed, but excluding additions and improvements made in storeroom and basement space excepted from said lease; (d) 2.7% per annum, to cover depreciation, on the cost to the Lessor for all additions and improvements made by the Lessor to said building after the date of said lease, computed from the date such additions and improvements are, in each case, completed, excluding additions and improvements made in storeroom and basement space excepted from said lease; from which shall be deducted the total annual amount of rentals payable to the Lessor by lessees of storeroom, and basement space excepted from said lease; said rental payable in equal monthly installments; Lessee to also pay insurance premiums and taxes; leased premises to be used for offices of Lessee and its subsidiary and affiliated companies; be, and the same is hereby, ratified, approved and confirmed. On motion duly seconded, it was RESOLVED, that the action of President and Assistant Secretary Rigdon in executing agreement, Audit No. 10031, dated November 8, 1939, between LVL&WCo., Lessor, and Pabst Sales Company, Lessee, covering: Lease of Lots 88 and 89, Tract 5301, together with building thereon, situated at Boyd and Anderson Streets, Metropolitan District, Los Angeles, California, for use for offices and the warehousing and handling of merchandise; for term beginning December 1, 1939, and extending to December 1, 1944; rental $160 per month, payable monthly in advance; -4-