Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

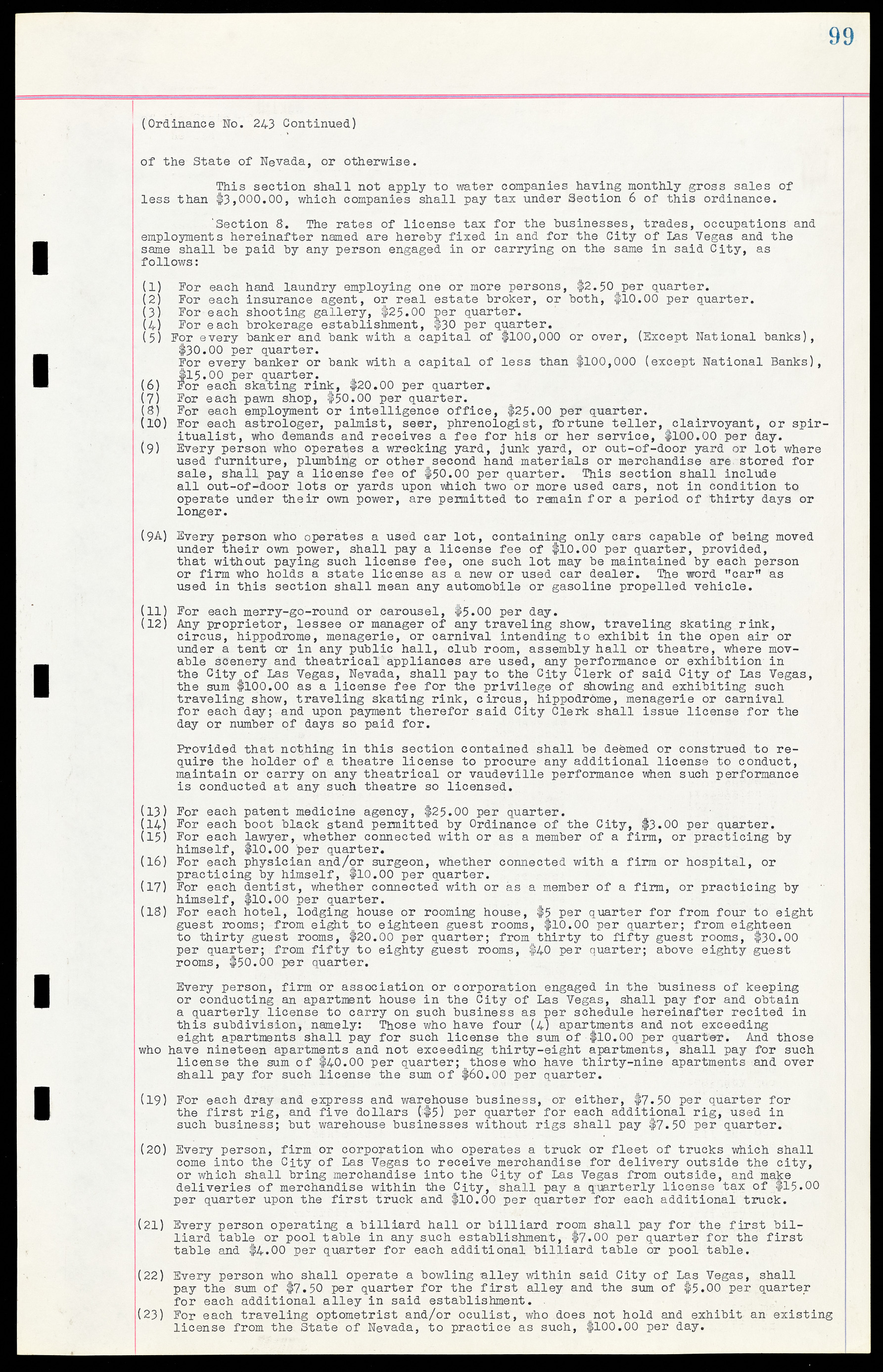

(Ordinance No. 243 Continued) of the State of Nevada, or otherwise. This section shall not apply to water companies having monthly gross sales of less than $3,000.00, which companies shall pay tax under Section 6 of this ordinance. Section 8. The rates of license tax for the businesses, trades, occupations and employments hereinafter named are hereby fixed in and for the City of Las Vegas and the same shall be paid by any person engaged in or carrying on the same in said City, as follows: (1) For each hand laundry employing one or more persons, $2.50 per quarter. (2) For each insurance agent, or real estate broker, or both, $10.00 per quarter. (3) For each shooting gallery, $25.00 per quarter. (4) For each brokerage establishment, $30 per quarter. (5) For every banker and bank with a capital of $100,000 or over, (Except National banks), $30.00 per quarter. For every banker or bank with a capital of less than $100,000 (except National Banks), $15.00 per quarter. (6) For each skating rink, $20.00 per quarter. (7) For each pawn shop, $50.00 per quarter. (8) For each employment or intelligence office, $25.00 per quarter. (10) For each astrologer, palmist, seer, phrenologist, fortune teller, clairvoyant, or spiritualist, who demands and receives a fee for his or her service, $100.00 per day. (9) Every person who operates a wrecking yard, junk yard, or out-of-door yard or lot where used furniture, plumbing or other second hand materials or merchandise are stored for sale, shall pay a license fee of $50.00 per quarter. This section shall include all out-of-door lots or yards upon which two or more used cars, not in condition to operate under their own power, are permitted to remain for a period of thirty days or longer. (9A) Every person who operates a used car lot, containing only cars capable of being moved under their own power, shall pay a license fee of $10.00 per quarter, provided, that without paying such license fee, one such lot may be maintained by each person or firm who holds a state license as a new or used car dealer. The word "car" as used in this section shall mean any automobile or gasoline propelled vehicle. (11) For each merry-go-round or carousel, $5.00 per day. (12) Any proprietor, lessee or manager of any traveling show, traveling skating rink, circus, hippodrome, menagerie, or carnival intending to exhibit in the open air or under a tent or in any public hall, club room, assembly hall or theatre, where movable scenery and theatrical appliances are used, any performance or exhibition in the City of Las Vegas, Nevada, shall pay to the City Clerk of said City of Las Vegas, the sum $100.00 as a license fee for the privilege of showing and exhibiting such traveling show, traveling skating rink, circus, hippodrome, menagerie or carnival for each day; and upon payment therefor said City Clerk shall issue license for the day or number of days so paid for. Provided that nothing in this section contained shall be deemed or construed to require the holder of a theatre license to procure any additional license to conduct, maintain or carry on any theatrical or vaudeville performance when such performance is conducted at any such theatre so licensed. (13) For each patent medicine agency, $25.00 per quarter. (14) For each boot black stand permitted by Ordinance of the City, $3.00 per quarter. (15) For each lawyer, whether connected with or as a member of a firm, or practicing by himself, $10.00 per quarter. (16) For each physician and/or surgeon, whether connected with a firm or hospital, or practicing by himself, $10.00 per quarter. (17) For each dentist, whether connected with or as a member of a firm, or practicing by himself, $10.00 per quarter. (18) For each hotel, lodging house or rooming house, $5 per quarter for from four to eight guest rooms; from eight to eighteen guest rooms, $10.00 per quarter; from eighteen to thirty guest rooms, $20.00 per quarter; from thirty to fifty guest rooms, $30.00 per quarter; from fifty to eighty guest rooms, $40 per quarter; above eighty guest rooms, $50.00 per quarter. Every person, firm or association or corporation engaged in the business of keeping or conducting an apartment house in the City of Las Vegas, shall pay for and obtain a quarterly license to carry on such business as per schedule hereinafter recited in this subdivision, namely: Those who have four (4) apartments and not exceeding eight apartments shall pay for such license the sum of $10.00 per quarter. And those who have nineteen apartments and not exceeding thirty-eight apartments, shall pay for such license the sum of $40.00 per quarter; those who have thirty-nine apartments and over shall pay for such license the sum of $60.00 per quarter. (19) For each dray and express and warehouse business, or either, $7.50 per quarter for the first rig, and five dollars ($5) per quarter for each additional rig, used in such business; but warehouse businesses without rigs shall pay $7.50 per quarter. (20) Every person, firm or corporation who operates a truck or fleet of trucks which shall come into the City of Las Vegas to receive merchandise for delivery outside the city, or which shall bring merchandise into the City of Las Vegas from outside, and make deliveries of merchandise within the City, shall pay a quarterly license tax of $15.00 per quarter upon the first truck and $10.00 per quarter for each additional truck. (21) Every person operating a billiard hall or billiard room shall pay for the first billiard table or pool table in any such establishment, $7.00 per quarter for the first table and $4.00 per quarter for each additional billiard table or pool table. (22) Every person who shall operate a bowling alley within said City of Las Vegas, shall pay the sum of $7.50 per quarter for the first alley and the sum of $5.00 per quarter for each additional alley in said establishment. (23) For each traveling optometrist and/or oculist, who does not hold and exhibit an existing license from the State of Nevada, to practice as such, $100.00 per day.