Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

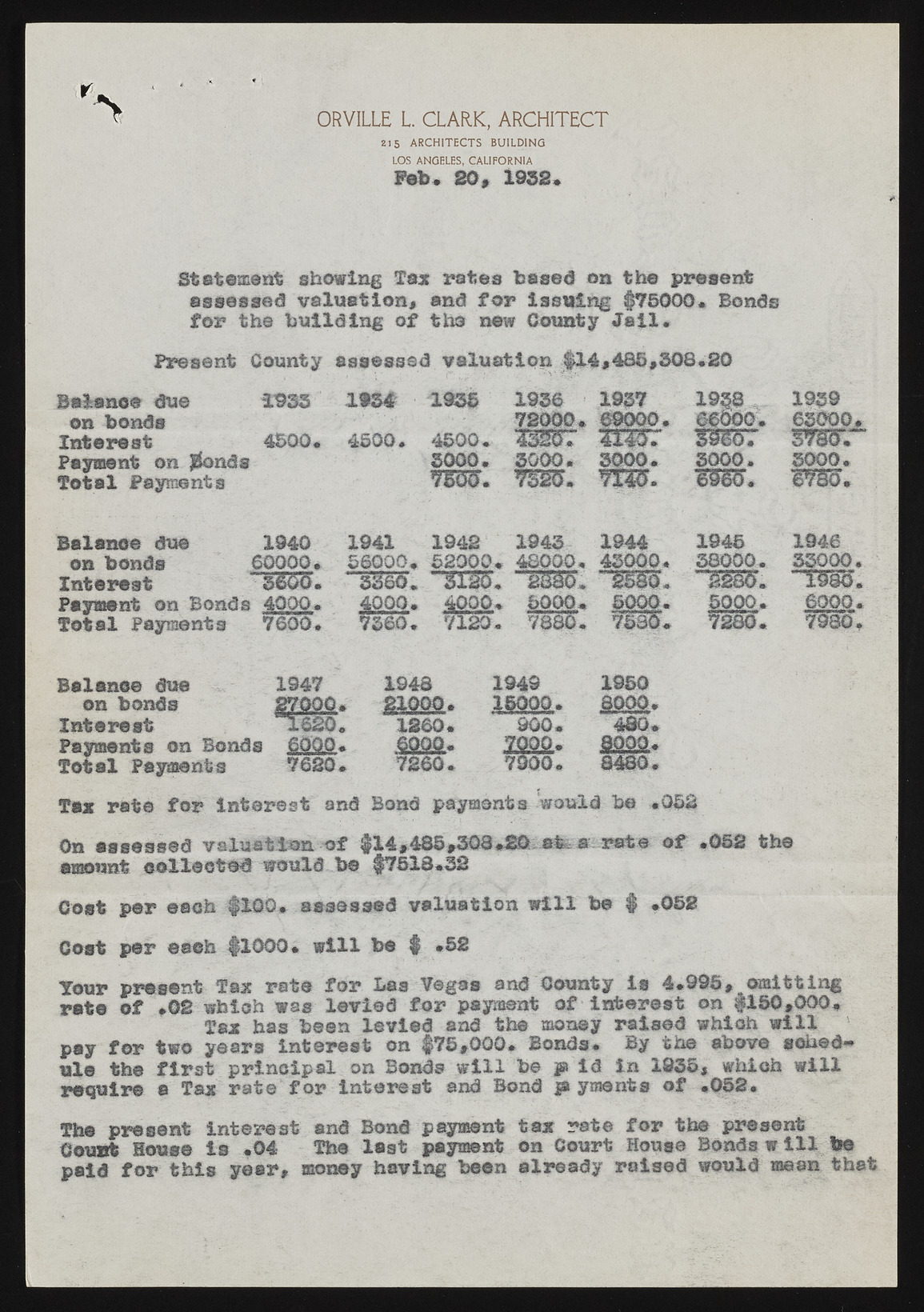

ORVILLE L. CLARK, ARCHITECT 2 1 5 A R C H IT E C T S BU ILDIN G LOS ANGELES, CALIFORNIA Feb. 20, 1952. Statement showing Tax fates based on the present assessed valuation, and for Issuing §75000* Bonds for the building of the new County Jail. assessed valuation Present County §14,465,308.20 Balance due 1035 on bonds Interest 4500. Payment on JJtands Total Payments Balance due 1940 on bonds 60000* Interest 5600. Payment on Bonds 4000* Total Payments 7600* 1934 1935 1936 72000 4500. 4500. ’2l2oT 3000* 3000. ?S25* 1941 1942 1943 56000* 52000* 48000 5360, "35135* 2860 4000. 4000* 5000 7360. 7120. 7880 1937 19^8 1939 69000* 66000. 63000* T O R T l i f e SyS5* 3000. 3000. 3000. - m m . w m * 1944 1945 1946 43000* 38000. 33000. '“' w W . ~T93l* 5000. 5000* 6000. 7580. 7280. 7980. Balanee due 1947 1948 1949 1950 on bonds 27000. 1620. 21000. 1§000. ,0000. Interest 1260. 900. 430* Payments on Bonds Total Payments 6000. 7620* j7m2o6.0.• 7000. 7900. 8000. 8480. Tax rate for Interest and Bond payments would be *052 On assessed valuation of §14,485,308*20 at, a rate or .052 the amount collected would be §7518*32 Coat per each $100* assessed valuation will be $ *052 Cost per eaeh $1000* will be f» *52 Your present Tax rate for Las Vegas and County is 4.995, omitting rate of ,02 which was levied for payment of interest on $150,000* Tax has been levied and the money raised which will pay for two years Interest on $75,000* Bonds. By the above schedule the first principal on Bonds will be f id in 1955, which will require a Tax rate for interest and Bond j# yments of *052* The present interest and Bond payment tax rat© for the present Count House is .04 The last payment on Court House Bonds w ill be paid for this year, money having been already raised would mean that