Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

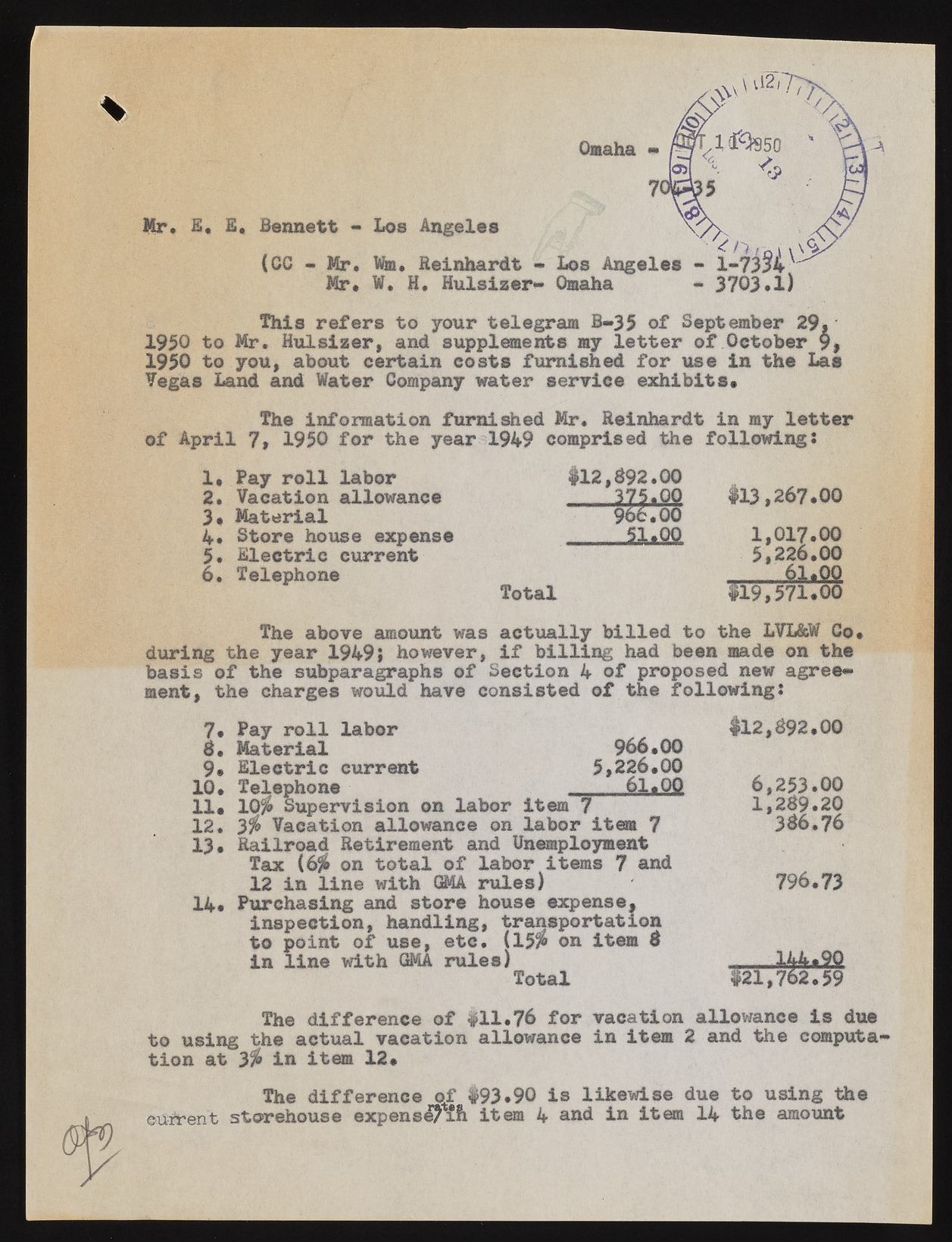

This refers to your telegram B-35 of September 29 > 1950 to Mr. Hulsizer, and supplements my letter of October 9* 1950 to you, about certain costs furnished for use in the Las Vegas Land and Water Company water service exhibits* The information furnished Mr. Reinhardt in my letter of April 7> 1950 for the year 1949 comprised the followings 1* Fay roll labor 2. Vacation allowance 3* Material 4* Store house expense 5. Electric current 6. Telephone #12,#92.00 375.00 966.00 51*00 Total #13, 267.00 1 , 017.00 5 , 226.00 ? 61.00 $19,571.00 The above amount was actually billed to the LVL&W Co* during the year 1949# however, if billing had been made on the basis of the subparagraphs of Section 4 of proposed new agreement, the charges would have consisted of the following: 7* Fay roll labor 6. Material 966*00 9* Electric current 5,226*00 10* Telephone 6l«QQ 11# 10$ Supervision on labor item 7 12. 3$ Vacation allowance on labor item 7 13* Railroad Retirement and Unemployment Tax (6$ on total of labor items 7 and 12 in line with GMA rules) 14* Purchasing and store house expense, inspection, handling, transportation to point of use, etc. (15$ on item 6 in line with GMA rules) Total #12, 692.00 6 , 253.00 1, 269.20 366.76 796.73 The difference of #11.76 for vacation allowance is due to using the actual vacation allowance in item 2 and the computation at 3$ in item 12* The difference of #93.90 is likewise due to using the current storehouse expense^i!*! item 4 and in item 14 the amount