Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

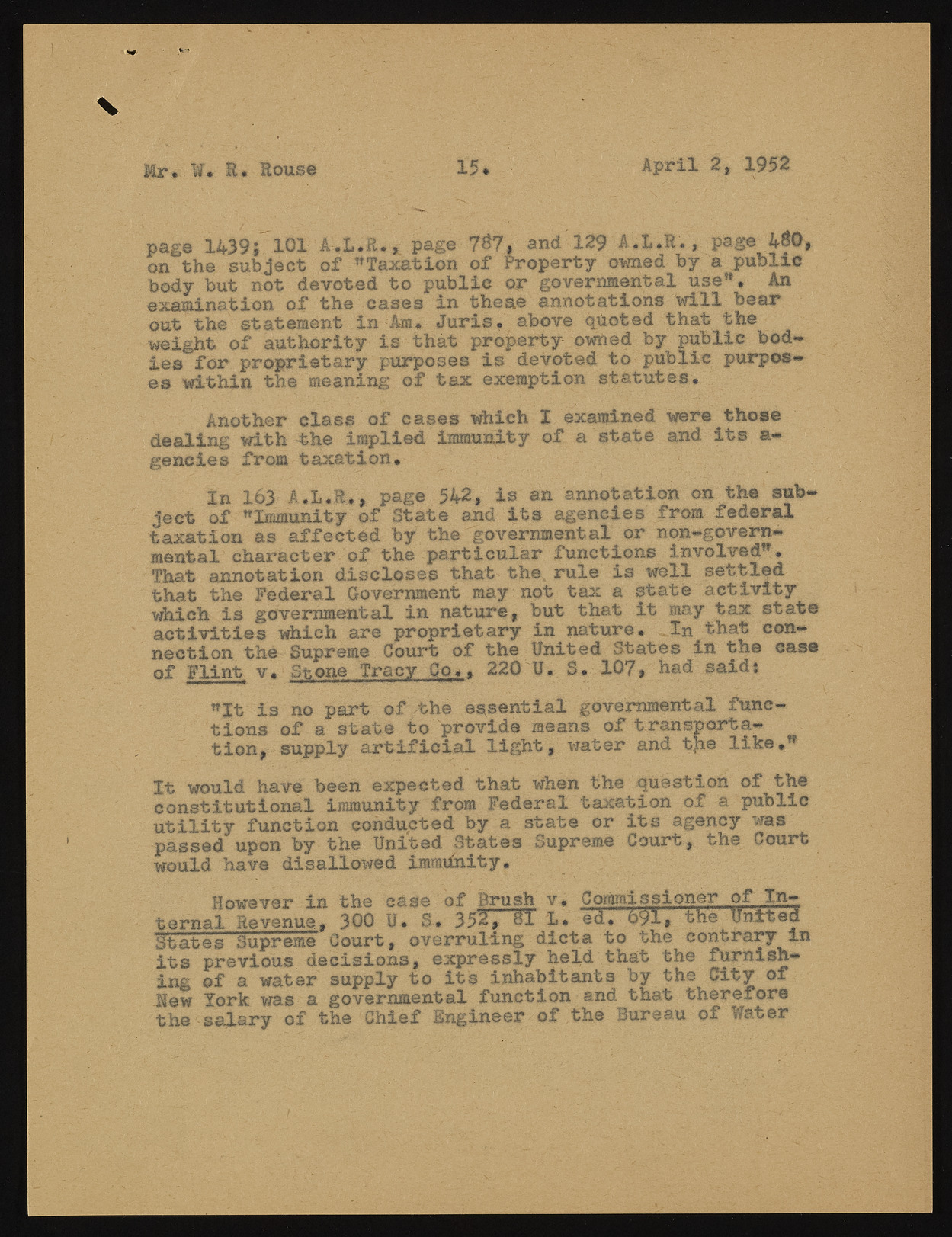

Mr, ¥• R. Rouse 15. April 2, 1952 page 1439# 101 A.L.R., page 7$7» and 129 A.L»R*, page 4$0, on the subject of "Taxation of Property owned by a public body but not devoted to public or governmental use*. An examination of the cases in these annotations will bear out the statement in Am. Juris, above quoted that the weight of authority is that property- owned by public bodies for proprietary purposes is devoted to public purposes within the meaning of tax exemption statutes. Another class of cases which I examined were those dealing with the implied immunity of a state and its a-gencies from taxation* In 163 A.L.R,, page 542, is an annotation on the subject of "Immunity of State and its agencies from federal taxation as affected by the governmental or non-governmental character of the particular functions involved". That annotation discloses that the rule is well settled that the Federal Government may not tax a state activity which is governmental in nature, but that it may tax state activities which are proprietary in nature. ,In that connection the Supreme Court of the United States in the case of Flint v. Stone Tracy Co,. 220 U. S. 107, had saidt "It is no part of -the essential governmental functions of a state to provide means of transportation, supply artificial light, water and tjie like." It would have been expected that when the question of the constitutional immunity from Federal taxation of a public utility function conducted by a state or its agency was passed upon by the United States Supreme Court, the Court would have disallowed immunity• However in the case of Brush v* Commissioner of Internal Revenue. 300 U. S. 352, 31 L. ed. 691, the United S t a t es Supreme Court, overruling dicta to the contrary in its previous decisions, expressly held that the furnishing of a water supply to its inhabitants by the City of Hew Xork was a governmental function and that therefore the salary of the Chief Engineer of the Bureau of Water