Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

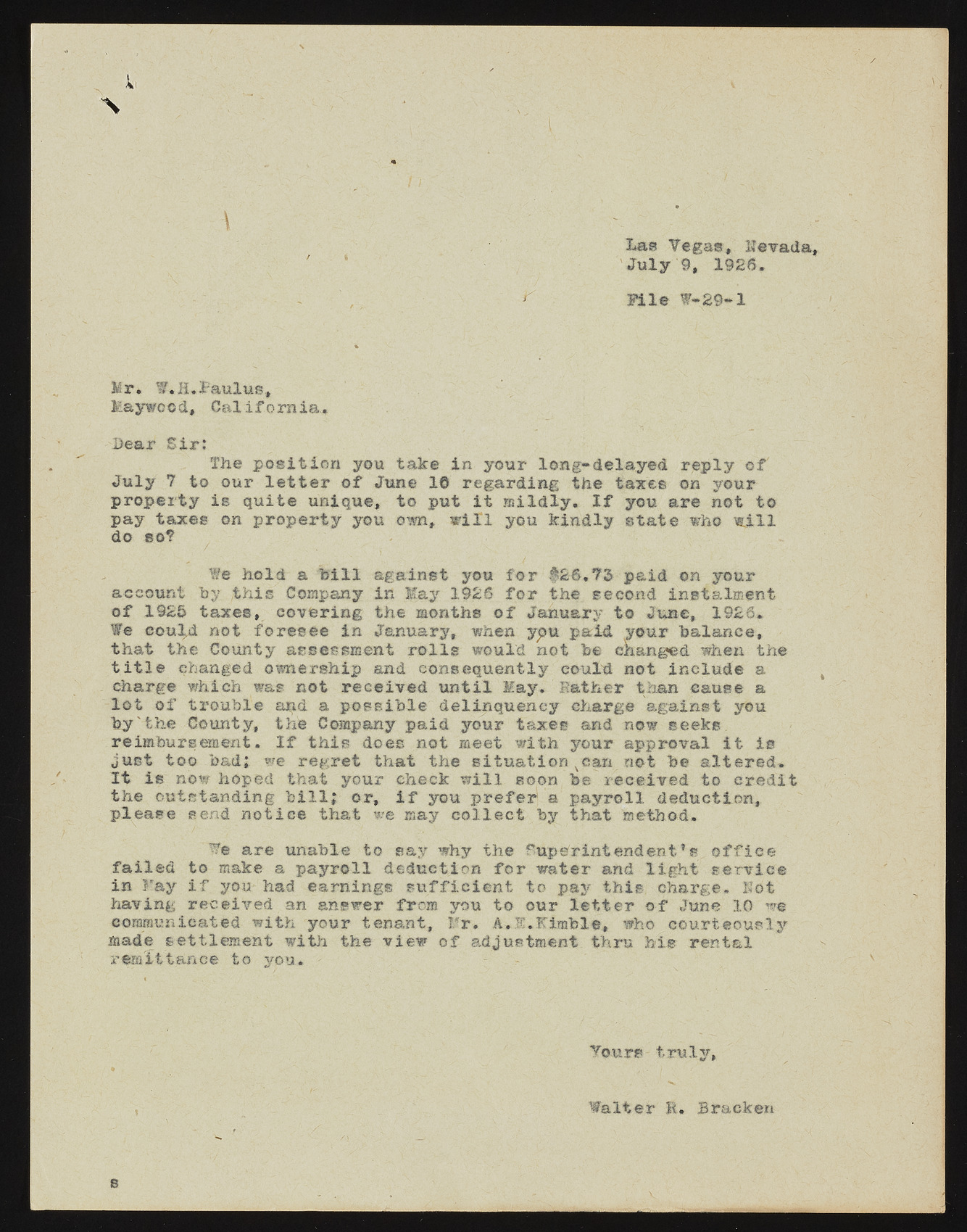

% Las Vegas, Kevada, July 9, 1926. § File W-29-1 Mr. W.H.iaulus, Maywood, California., Bear Sir: The position you take in your long-delayed reply of July 7 to our letter of June 1© regarding the taxes on your property is quite unique, to put it mildly. If you are not to pay taxes on property you own, will you kindly state who will do so? We hold a bill against you for #26,73 paid on your account by this Company in May 1926 for the second instalment of 192© taxes, covering the months of January to June, 1926. We could not foresee in January, when ypu paid your balance, that the County assessment rolls would not be ekanged when the title changed ownership and consequently could not include a charge which was not received until Hay. Bather than cause a lot of trouble and a possible delinquency charge against you by'the County, the Company paid your taxes and now seeks reimbursement. If this does not meet with your approval it is just too bad; we regret that the situationxcan not be altered. It is now hoped that your check will soon be received to eredit the outstanding bill; or, if you prefer a payroll deduction, please send notice that we may collect by that method. We are unable to say why the OupeMntendent*s office failed to make a payroll deduction for water and light service in May if yo-ir had earnings sufficient to pay this charge. Hot having received an answer from you to our letter of June 10 we communicated with your tenant, Mr. A.$.Kimble, who courteously made settlement with the view of adjustment thru M e rental remittance to you. Tours truly, Walter li. Bracken 8