Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

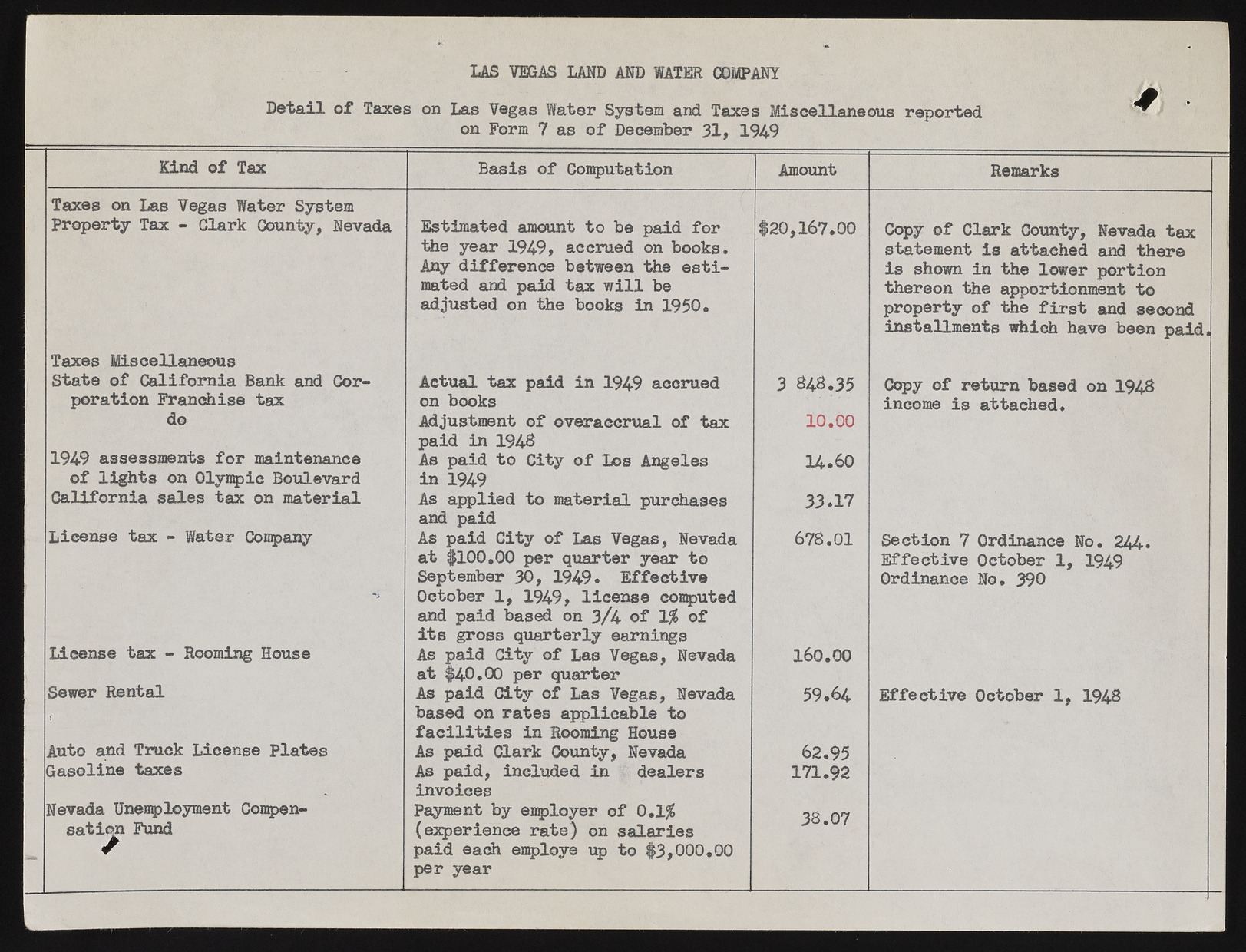

LAS VEGAS LAND AND WATER COMPANY Detail of Taxes on Las Vegas Water System and Taxes Miscellaneous reported on Form 7 as of December 31, 1949 Kind of Tax Basis of Computation Amount Remarks Taxes on Las Vegas Water System Property Tax - Clark County, Nevada Estimated amount to be paid for the year 1949, accrued on books. Any difference between the estimated and paid tax will be adjusted on the books in 1950. $20,167.00 Copy of Clark County, Nevada tax statement is attached and there is shown in the lower portion thereon the apportionment to property of the first and second installments which have been paid. Taxes Miscellaneous State of California Bank and Cor- Actual tax paid in 1949 accrued 3 848.35 Copy of return poration Franchise tax on books based on 1948 do income is attached. Adjustment of overaccrual of tax paid in 1948 1 0 .0 0 1949 assessments for maintenance of lights on Olympic Boulevard As paid to City of Los Angeles in 1949 1 4 .6 0 California sales tax on material As applied to material purchases and paid 33.17 License tax - Water Company As paid City of Las Vegas, Nevada at $100,00 per quarter year to September 30, 1949. Effective October 1, 1949, license computed and paid based on 3/4 of 1% of its gross quarterly earnings 678.01 Section 7 Ordinance No. 244. Effective October 1, 1949 Ordinance No. 390 License tax - Rooming House As paid City of Las Vegas, Nevada at $40.00 per quarter 160.00 Sewer Rental H 1 As paid City of Las Vegas, Nevada based on rates applicable to facilities in Rooming House 59.64 Effective October 1, 1948 Auto and Truck License Plates As paid Clark County, Nevada 62.95 Gasoline taxes As paid, included in dealers invoices 171.92 Nevada Unemployment Compen- Payment by employer of 0.1% 38.07 sati^n Fund (experience rate) on salaries paid each employe up to $3,000.00 per year