Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

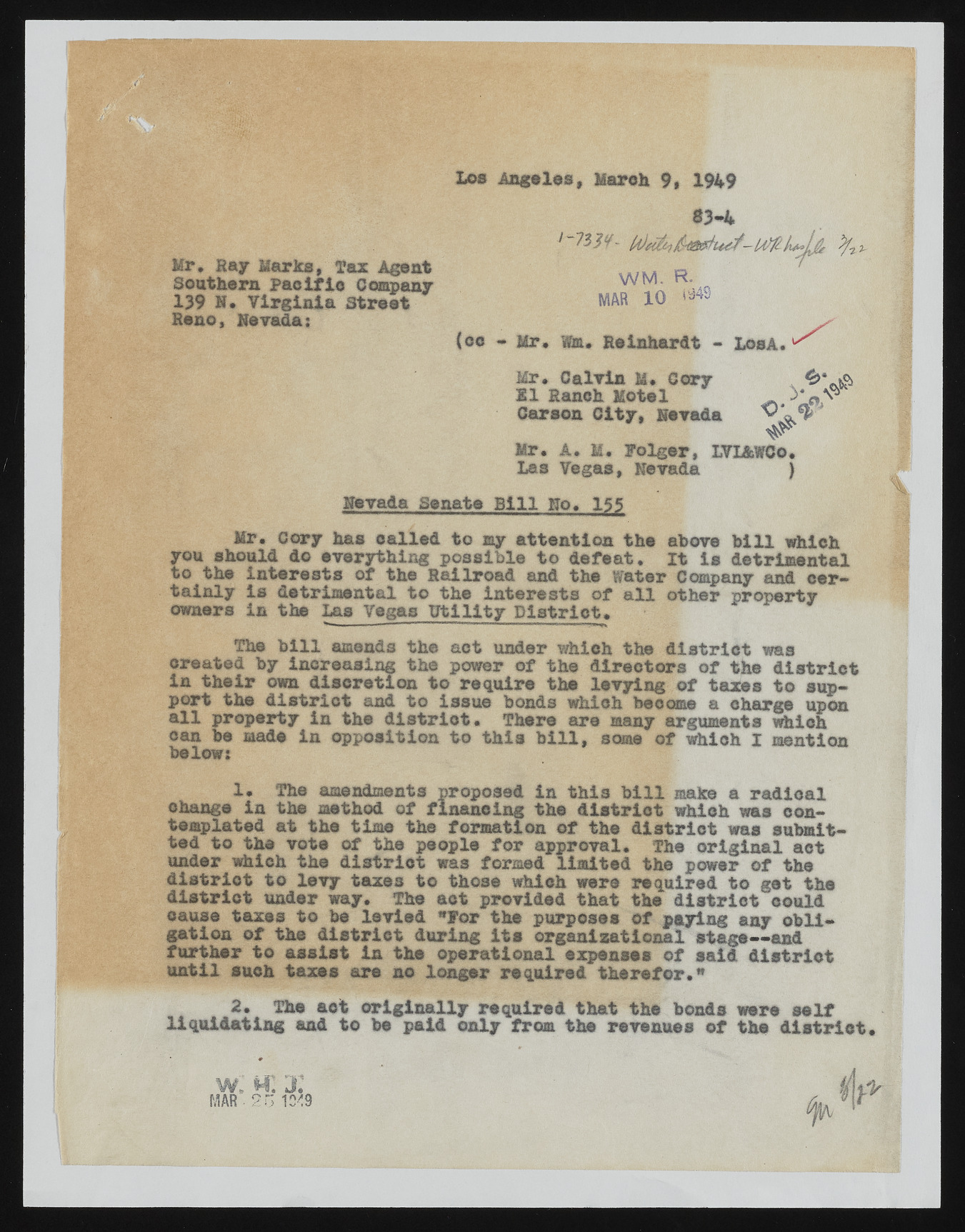

Mr, Hay Marks, Tax Agent Southern Pacific Company 139 Reno ,I * NVeviardgai;nia street $3*4 f 73 (/Otiiiff 14% - f a W M . R. MAR 10 ^ (ce - Mr, Wm. Heinhardt - LosA. § i Los Angeles, Marsh 9, 1949 Mr, Calvin M* Cory SI Ranch Motel > a \* Carson City, Nevada Y*o ^ Mr. A. M. Folder, LVL&WCo. Las Vegas, Nevada ) Nevada Senate Bill No. 1 ^ Mr. Cory has called to ay attention the above bill which you should do everything possible to defeat. It is detrimental to the interests of the Railroad and the Water Company and certainly is detrimental to the interests of all other property owners in the Las Vegas Utility District* The bill amends the act under which the district was created by Increasing the power of the directors of the district In their own discretion to require the levying of taxes to support the district and to issue bonds which become a charge upon all property in the district. There are many arguments which bcealno wb:e made in opposition to this bill, same of which I mention 1, The amendments proposed in this bill make a radical change in the method of financing the district which was contteedm ptlaot etdh e atv otteh e otf imteh e tphee opfloer mfaotri oanp porfo vtahle. disThter icotr iwgaisn als uabcmtitunder which the district was formed limited the power of the district to levy taxes to those which were required to get the district under way. The act provided that the district could cause taxes to be levied "For the purposes of paying any obligation of the district during Its organizational stage— and further to assist in the operational expenses of said district until such taxes are no longer required therefor." 2. The act originally required that the bonds were self liquidating and to be paid only from the revenues of the district. w . n : x MAR 25 1149