Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

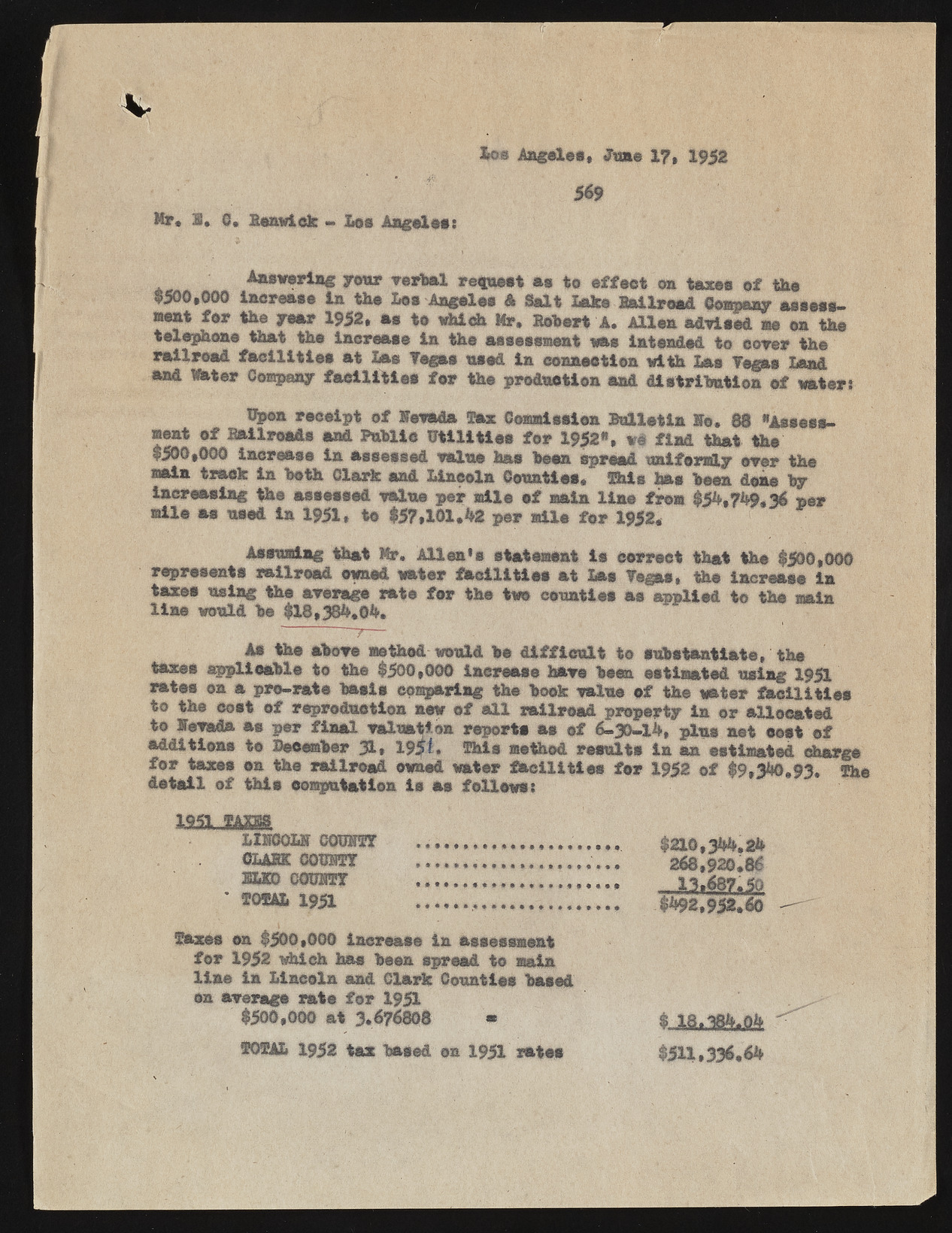

Los Angeles, June 17, 1952 569 Mr. 1 * Benwick « Los Angeles: Answering your verbal request as || offset cm taxes of the $500*000 Increase In the Los Angeles A Salt Lake Railroad Company assess— meat for the year 1952. »* to which Mr. Robert A. Allen adwised as oa the telephone that the laerease la the assessment was Intended to core? the railroad facilities at Las Togas used la eonaeotloa with Las Togas Land and Mater Company facilities for the production and distribution of water: % e a reeolpt of Kewada fax Commission Bulletin Me. 88 "Assessment of Ballrosds and Publle Utilities for 1952", ve find that the $590,009 iaoreaso In assessed mine has been spread uniformly ewer the main track In both Clark and Lincoln Counties* Shis has been done by increasing ths assssssd mine per mile sf main line from $54,749.36 per mile as used In 1951. to $57,101*42 por mile for 1952. Assuming that Mr. Allen's statement ie correct that the $500,000 repreeents railroad owned water facilities at Las Togas, ths increase la taxee using the aweruge rate for the twe counties as applitd to the main lino would be $18,584*04* As the abowe method would bo difficult to substantiate, the taxee applicable to the $500,000 increase hare been estimated using 1951 rates on a pre-rate basis comparing the book walue of the water facilities to the cost of reproduction new of all railroad property in or allocated to lewada as per final valuation reports as ef 6-30-14 , plus net oeet of additions te December 31. 19p , fhis method results in an estimated charge for taxes on the railroad owned water facilities for 1952 of $9,340,93. She detail of this computation ie as follows: 1911 TAMS ©axes on $500,000 increase in assessment for 1952 which has boon spread to main line in Lincoln and Clark Counties based on aweruge rate for 1951 $500,000 at 3.676808 • tOSAL 1952 tax based on 1951 rates L i r n o m C O W T Y GLAM COUHTT SLIP COUSTY ' TOSAL 1951 $210,344.24 268,920*86 - 13.687.50 $492,952*60 $511,336*64