Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

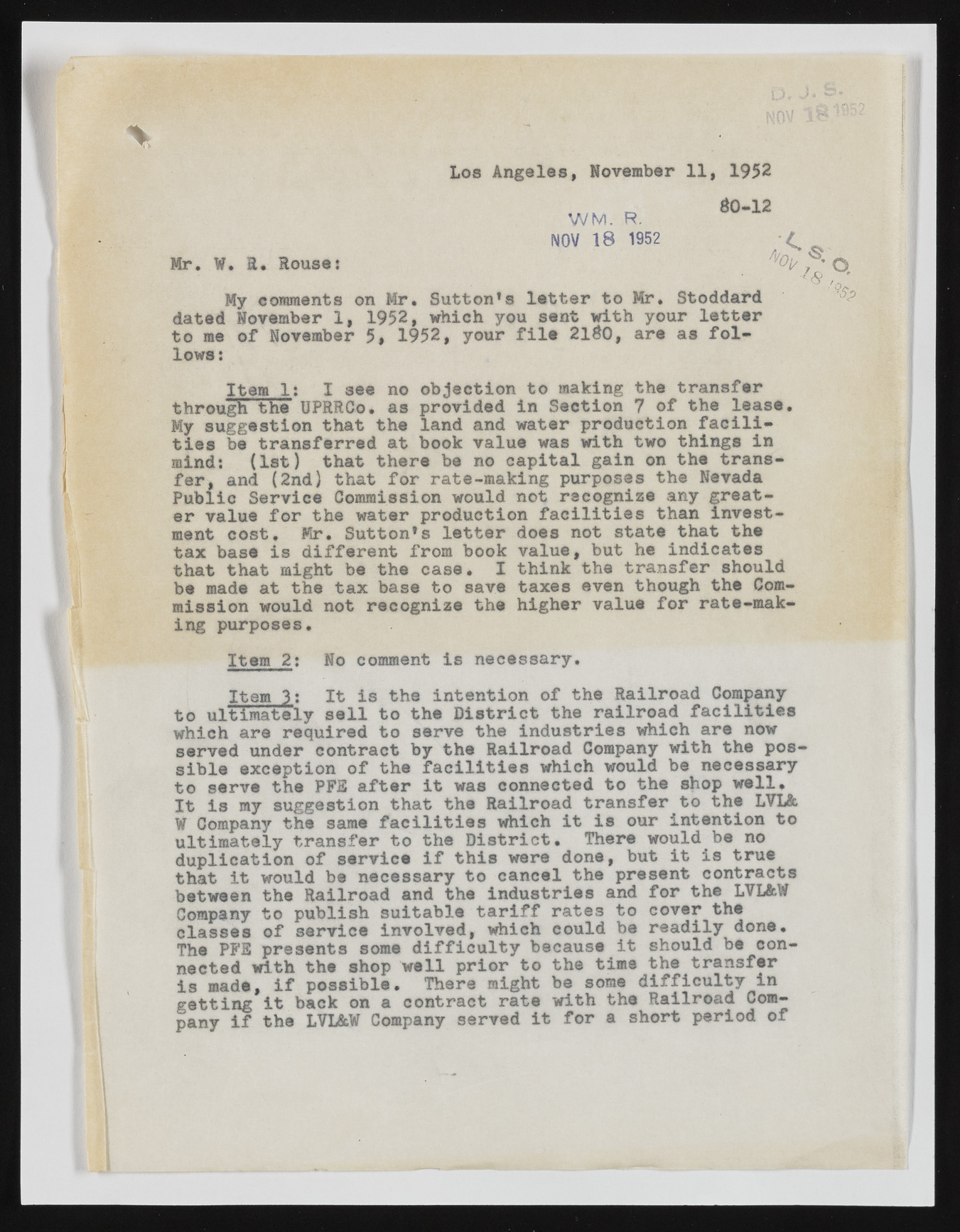

Los Angeles, November 11, 1952 NOV 1 8 1952 Mr. W. E. Rouse: My comments on Mr. Sutton*s letter to Mr. Stoddard dated November 1, 1952, which you sent with your letter to me of November 5# 1952, your file 21$0, are as fol-lows: Item 1 ; I see no objection to making the transfer through the UPRRGo. as provided in Section 7 of the lease. My suggestion that the land and water production facilities be transferred at book value was with two things in mind: (1 st) that there be no capital gain on the transfer, and (2nd) that for rate-making purposes the Nevada Public Service Commission would not recognize any greater value for the water production facilities than investment cost. Mr. Sutton’s letter does not state that the tax base is different from book value, but he indicates that that might be the case. I think the transfer should be made at the tax base to save taxes even though the Commission would not recognize the higher value for rate-making purposes. Item 2 : No comment is necessary. Item 3: It is the intention of the Railroad Company to ultimately sell to the District the railroad facilities which are required to serve the Industries which are now served under contract by the Railroad Company with the possible exception of the facilities which would be necessary to serve the PFS after it was connected to the shop well* It is my suggestion that the Railroad transfer to the LVLfc W Company the same facilities which it is our Intention to ultimately transfer to the District. There would be no duplication of service if this were done, but it is true that it would be necessary to cancel the present contracts between the Railroad and the industries and for the L7L&W Company to publish suitable tariff rates to cover the classes of service involved, which could be readily done. The PFB presents some difficulty because it should be connected with the shop well prior to the time the transfer is made, if possible. There might be some difficulty in getting it back on a contract rate with the Railroad Company if the LVL&W Company served it for a short period of