Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

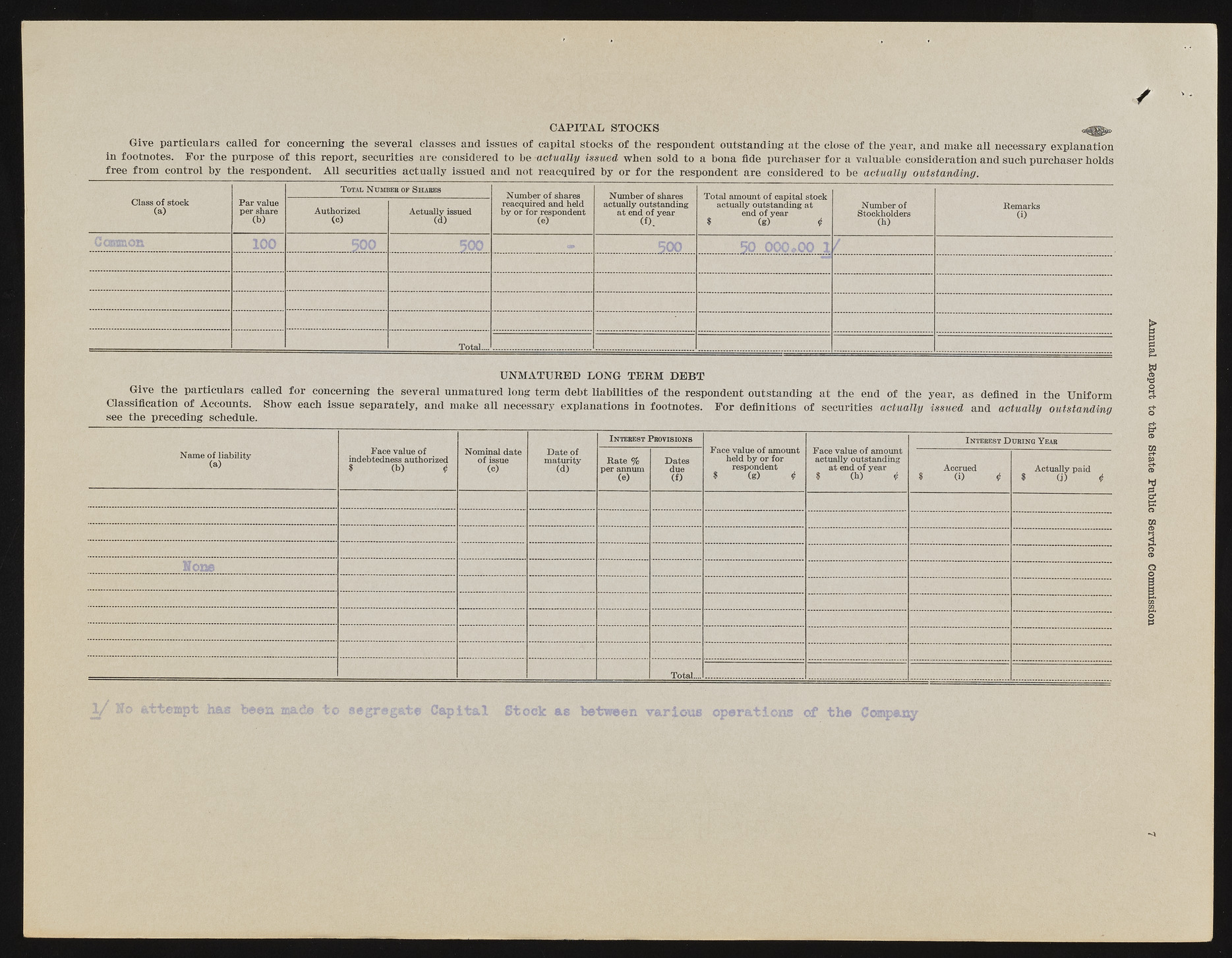

/ CAPITAL STOCKS Give particulars called for concerning the several classes and issues of capital stocks of the respondent outstanding at the close of the year, and make all necessary explanation in footnotes. For the purpose of this report, securities are considered to be actually issued when sold to a bona fide purchaser for a valuable consideration and such purchaser holds free from control by the respondent. All securities actually issued and not reacquired by or for the respondent are considered to be actually outstanding. Class of stock (a) Par value per share (b) T otal Number of Shares Number of shares reacquired and held by or for respondent (e) Number of shares actually outstanding at end of year (f). Total amount of capital stock actually outstanding at end of year $ (g) 4 Number of Stockholders (h) Remarks Authorized (i) (c) Actually issued (d) Total— UNMATURED LONG TERM DEBT Give the particulars called for concerning the several unmatured long term debt liabilities of the respondent outstanding at the end of the year, as defined in the Uniform Classification of Accounts. Show each issue separately, and make all necessary explanations in footnotes. For definitions of securities actually issued and actually outstanding see the preceding schedule. Name of liability (a) Face value of indebtedness authorized % (b) 4 Nominal date of issue (c) Date of maturity (d) I nterest P rovisions Face value of amount held by or for respondent $ (g) 4 Face value of amount actually outstanding at end of year $ (h) 4 I nterest D uring Year Rate % per annum (e) Dates due (f) Accrued % (i) 4 Actually paid 1 (j) 4 Total.... Annual Report to the State Public Service Commission