Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

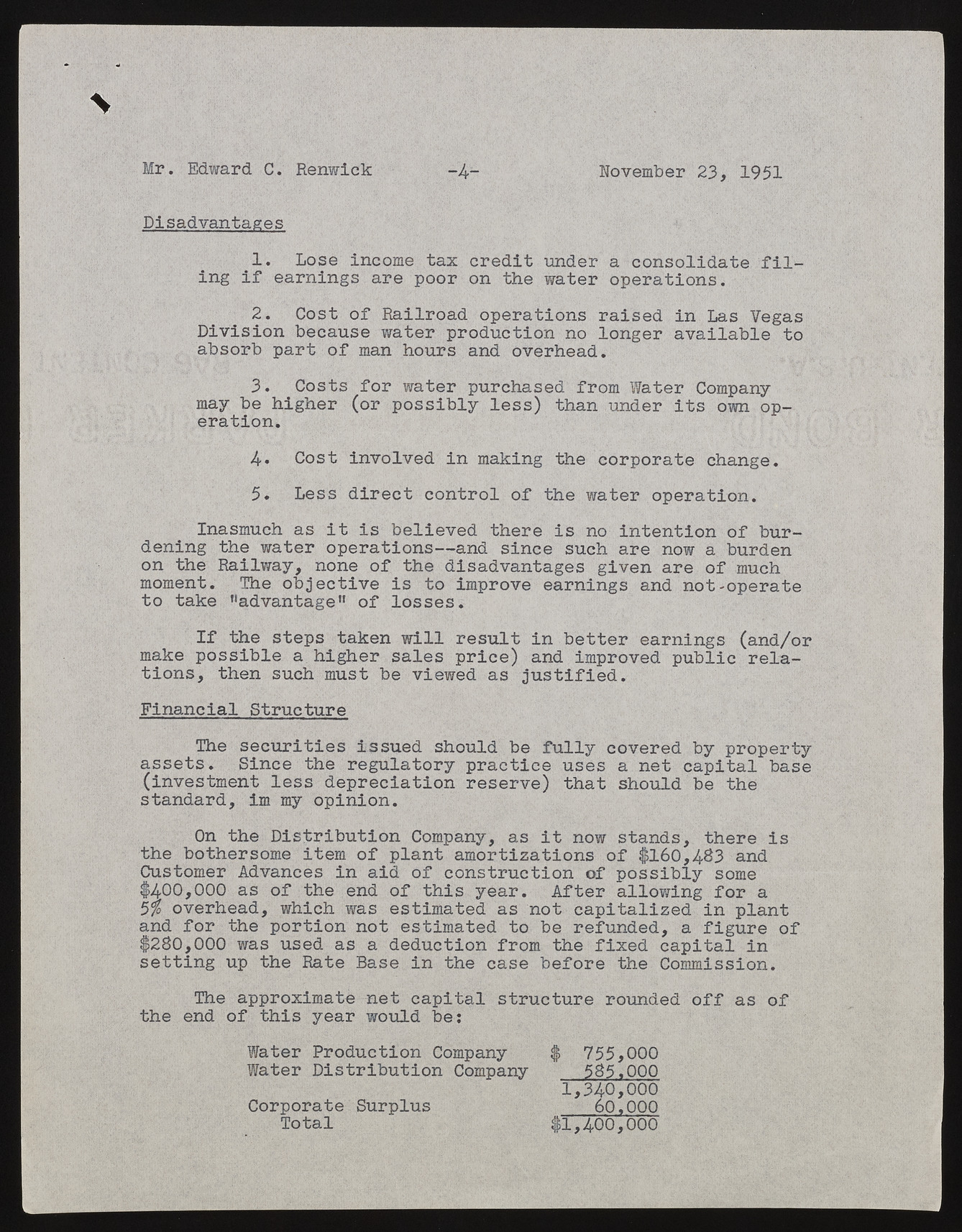

Mr. Edward C. Renwick pi November 23, 1951 Disadvantages 1. Lose income tax credit under ing if earnings are poor on the water ao pecroantsioolnisd.ate filDivis2i. o n bCeocsatu soef wRaatielrr oapdr odoupcetraitoino nnso lroanigseerd aivn aiLlasa blVee gatso absorb part of man hours and overhead* may be3. higChoesrts (foor r powastseirb lyp urlecshsa)s edt hafnr oumn dWeart eri tsC oomwpann yo peration. 4» Cost involved in making the corporate change. 5. Less direct control of the water operation. deningI natshem uwcaht ears oitp erisa tbieolnise—veadn d thseirnece iss uncoh airnet ennotwio an bouf rbdeunron the Railway, none of the disadvantages given are of much mtoom etnatk.e "Tahdev aonbtjaegcet” ivoef liso ssteos .improve earnings and not-operate make pIof sstihbe les tae phs igthaekre n swaillesl prreiscuel)t ainnd beitmtperro veeda rnpiunbglsi c (raenlda/or tions, then such must be viewed as justified. Financial Structure assetsT.h e Ssienccuer ittihee s riesgsuuleadt orsyh ouplrda ctbiec ef uulsleys coa venrete d cbayp iptarlo pebratsey (investment less depreciation reserve) that should be the standard, im my opinion. the boOtnh etrhseo mDei stitreimb utofi opnl aCnotmp aanmyo,r tiasz atiito nnso w ofs ta$n1d6s0,, 48t3h eraen dis Customer Advances in aid of construction of possibly some $400,000 as of the end of this year. After allowing for a 5 % overhead, which was estimated as not capitalized in plant a$n2d8 0,fo0r0 0 twhae s puosretdi oans noa t deedsutcitmaitoend frtoo mb et her effuinxdeedd ,c aap itfailg urien of setting up the Rate Base in the case before the Commission. the enTdh e ofa pptrhoisx imyaetaer wnoeutl dc abpei:tal structure rounded off as of WWaatteerr DPirsotdruicbtuitoino nC oCmopamnpya ny CorpToortaalte Surplus $ 755855,.000000 1,340,000 60.000 $ 1 ,4 0 0 ,0 0 0