Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

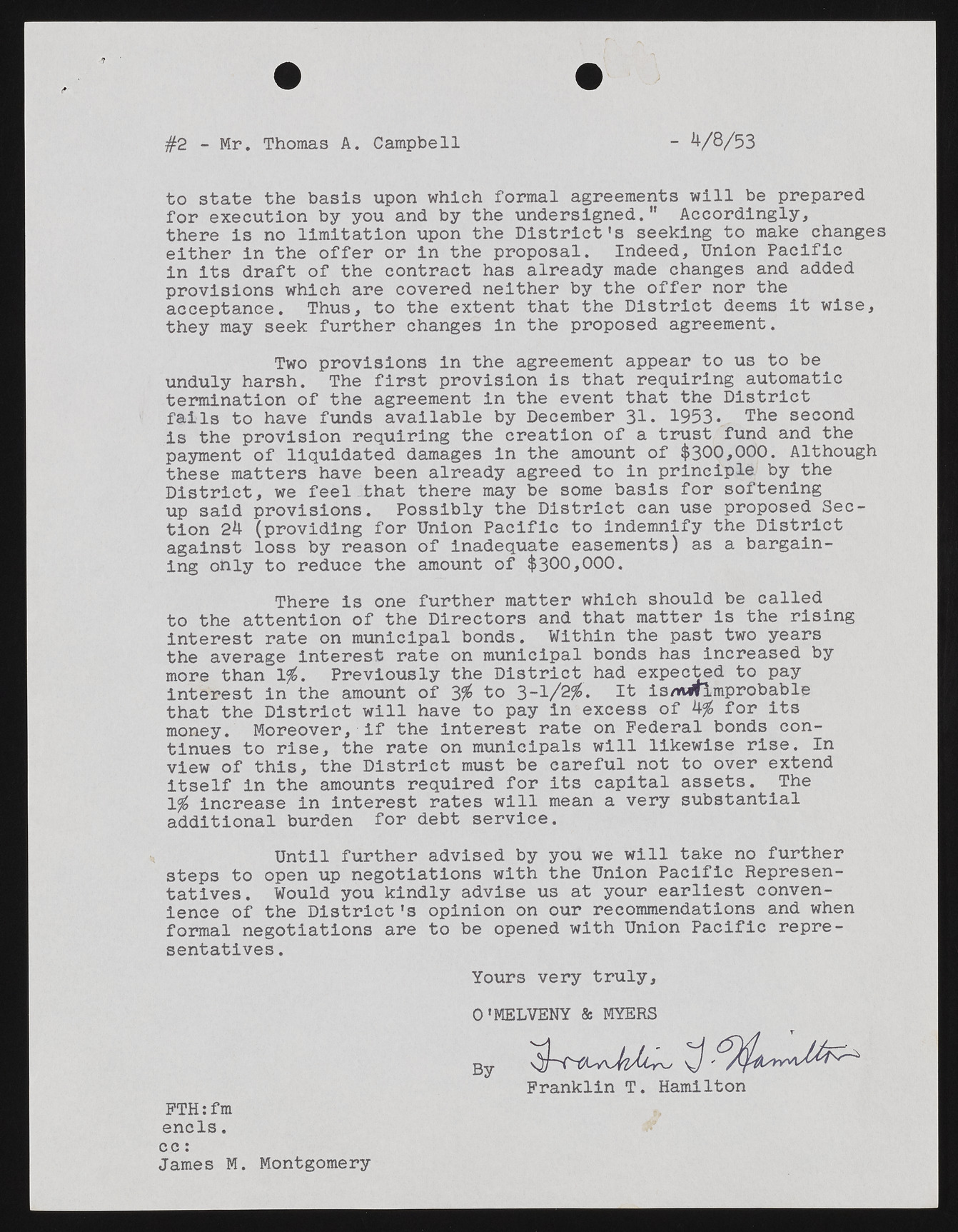

#2 - Mr. Thomas A. Campbell - 4/8/53 to state the basis upon which formal agreements will be prepared for execution by you and by the undersigned.” Accordingly, there is no limitation upon the District's seeking to make change either in the offer or in the proposal. Indeed, Union Pacific in its draft of the contract has already made changes and added provisions which are covered neither by the offer nor the acceptance. Thus, to the extent that the District deems it wise, they may seek further changes in the proposed agreement. Two provisions in the agreement appear to us to be unduly harsh. The first provision is that requiring automatic termination of the agreement in the event that the District fails to have funds available by December 31. 1953. The second is the provision requiring the creation of a trust fund and the payment of liquidated damages in the amount of $300,000. Although these matters have been already agreed to in principle by the District, we feel that there may be some basis for softening up said provisions. Possibly the District can use proposed Section 24 (providing for Union Pacific to indemnify the District against loss by reason of inadequate easements) as a bargaining only to reduce the amount of $300,000. There is one further matter which should be called to the attention of the Directors and that matter is the rising interest rate on municipal bonds. Within the past two years the average interest rate on municipal bonds has increased by more than 1$. Previously the District had expected to pay interest in the amount of 3$ to 3-1/2$. It ismrtlmprobable that the District will have to pay in excess of 4$ for its money. Moreover, if the interest rate on Federal bonds continues to rise, the rate on municipals will likewise rise. In view of this, the District must be careful not to over extend itself in the amounts required for its capital assets. The 1$ increase in interest rates will mean a very substantial additional burden for debt service. Until further advised by you we will take no further steps to open up negotiations with the Union Pacific Representatives. Would you kindly advise us at your earliest convenience of the District's opinion on our recommendations and when formal negotiations are to be opened with Union Pacific representatives . Yours very truly, 0'MELVENY & MYERS Franklin T. Hamilton FTH:fm e n d s . cc: James M. Montgomery