Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

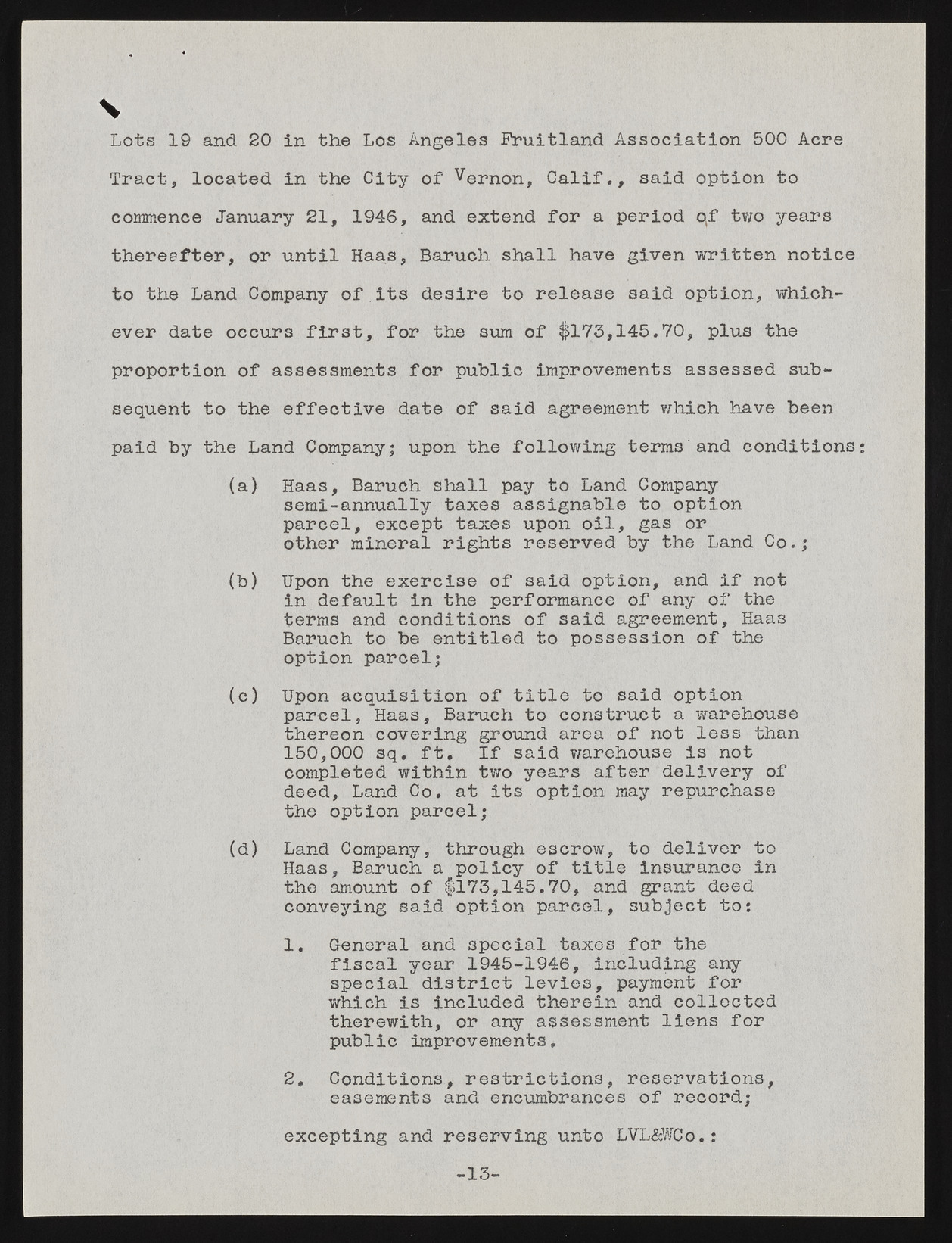

Lots 19 and 20 in the Los Angeles Fruitland Association 500 Acre Tract, located in the City of Vernon, Calif., said option to commence January 21, 1946, and extend for a period qf two years thereafter, or until Haas, Baruch shall have given written notice to the Land Company of its desire to release said option, whichever date occurs first, for the sum of $173,145.70, plus the proportion of assessments for public improvements assessed subsequent to the effective date of said agreement which have been paid by the Land Company; upon the following terms'and conditions: (a) Haas, Baruch shall pay to Land Company semi-annually taxes assignable to option parcel, except taxes upon oil, gas or other mineral rights reserved by the Land Co.; (b) Upon the exercise of said option, and if not in default in the performance of any of the terms and conditions of said agreement, Haas Baruch to be entitled to possession of the option parcel; (c) Upon acquisition of title to said option parcel, Haas, Baruch to construct a warehouse thereon covering ground area of not less than 150,000 sq. ft. If said warehouse is not completed within two years after delivery of deed, Land Co. at its option may repurchase the option parcel; (d) Land Company, through escrow, to deliver to Haas, Baruch a policy of title insurance in the amount of $173,145.70, and grant deed conveying said option parcel, subject to: 1. General and special taxes for the fiscal year 1945-1946, including any special district levies, payment for which is included therein and collected therewith, or any assessment liens for public improvements. 2. Conditions, restrictions, reservations, easements and encumbrances of record; excepting and reserving unto LVL&WCo.: \ -13-