Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

More Info

Rights

Digital Provenance

Publisher

Transcription

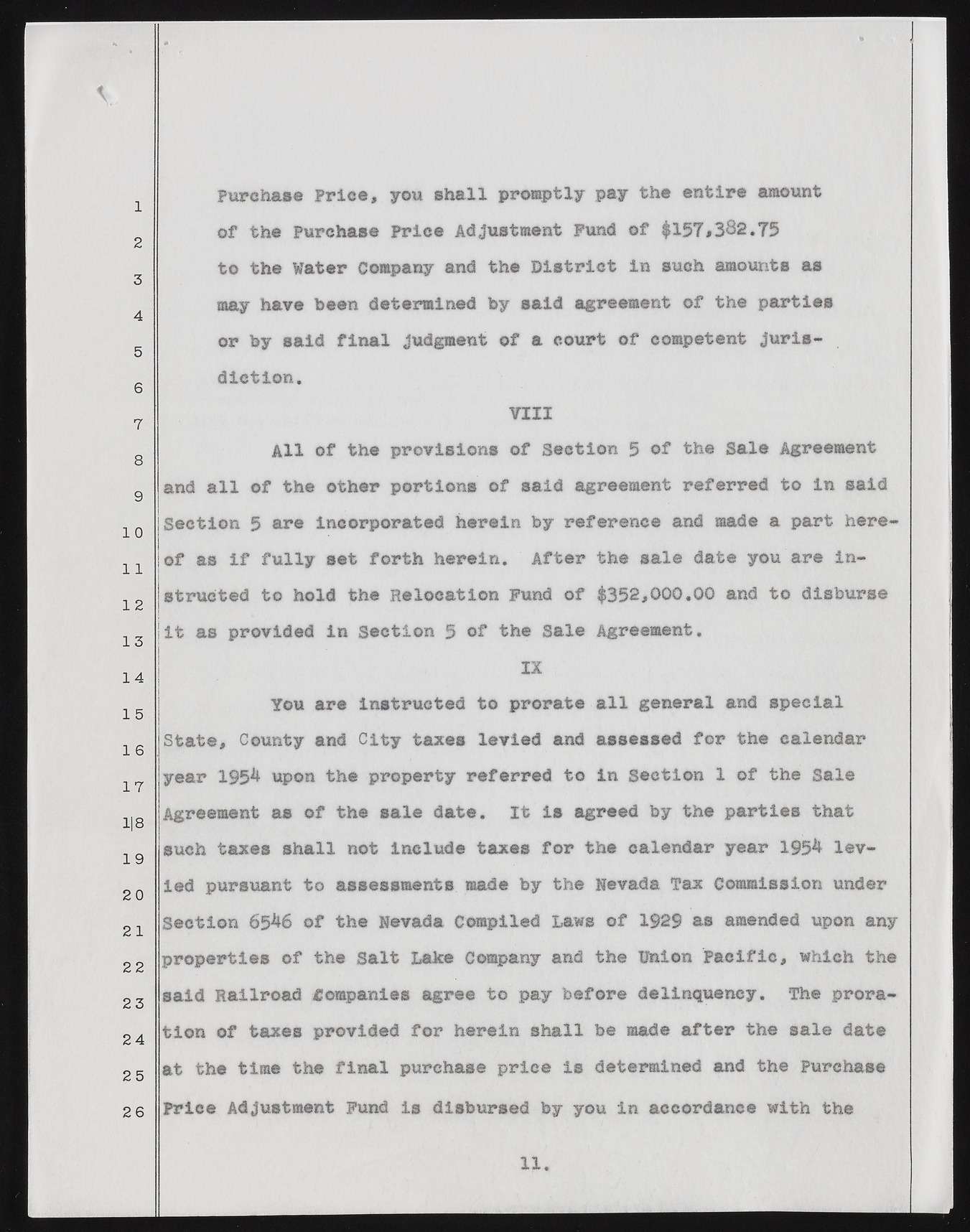

1 2 3 4 5 6 7 8 9 1 0 1 1 1 2 13 14 1 5 1 6 17 1|8 19 20 2 1 22 23 24 25 26 Purchase Price, you shall promptly pay the entire amount of the Purchase Price Adjustment Fund of $157*382.75 to the Water Company and the District in such amounts as may have been determined by said agreement of the parties or by said final judgment of a court of competent jurisdiction. VIII All of the provisions of Section 5 of the Sale Agreement and all of the other portions of said agreement referred to in said Section 5 are incorporated herein by reference and made a part hereof as if fully set forth herein. After the sale date you are instructed to hold the Relocation Fund of $352,000,00 and to disburse it as provided in section 3 of the Sale Agreement, IX You are Instructed to prorate all general and special State, County and City taxes levied and assessed for the calendar year 1954 upon the property referred to in section 1 of the Sale Agreement as of the sale date, it is agreed by the parties that such taxes shall not Include taxes for the calendar year 1954 levied pursuant to assessments made by the Nevada Tax Commission under Section 6546 of the Nevada Compiled Laws of 1929 as amended upon any properties of the Salt Lake Company and the Union Pacific, which the said Railroad Companies agree to pay before delinquency. The proration of taxes provided for herein shall be made after the sale date at the time the final purchase price is determined and the Purchase price Adjustment Fund is disbursed by you in accordance with the 11.