Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

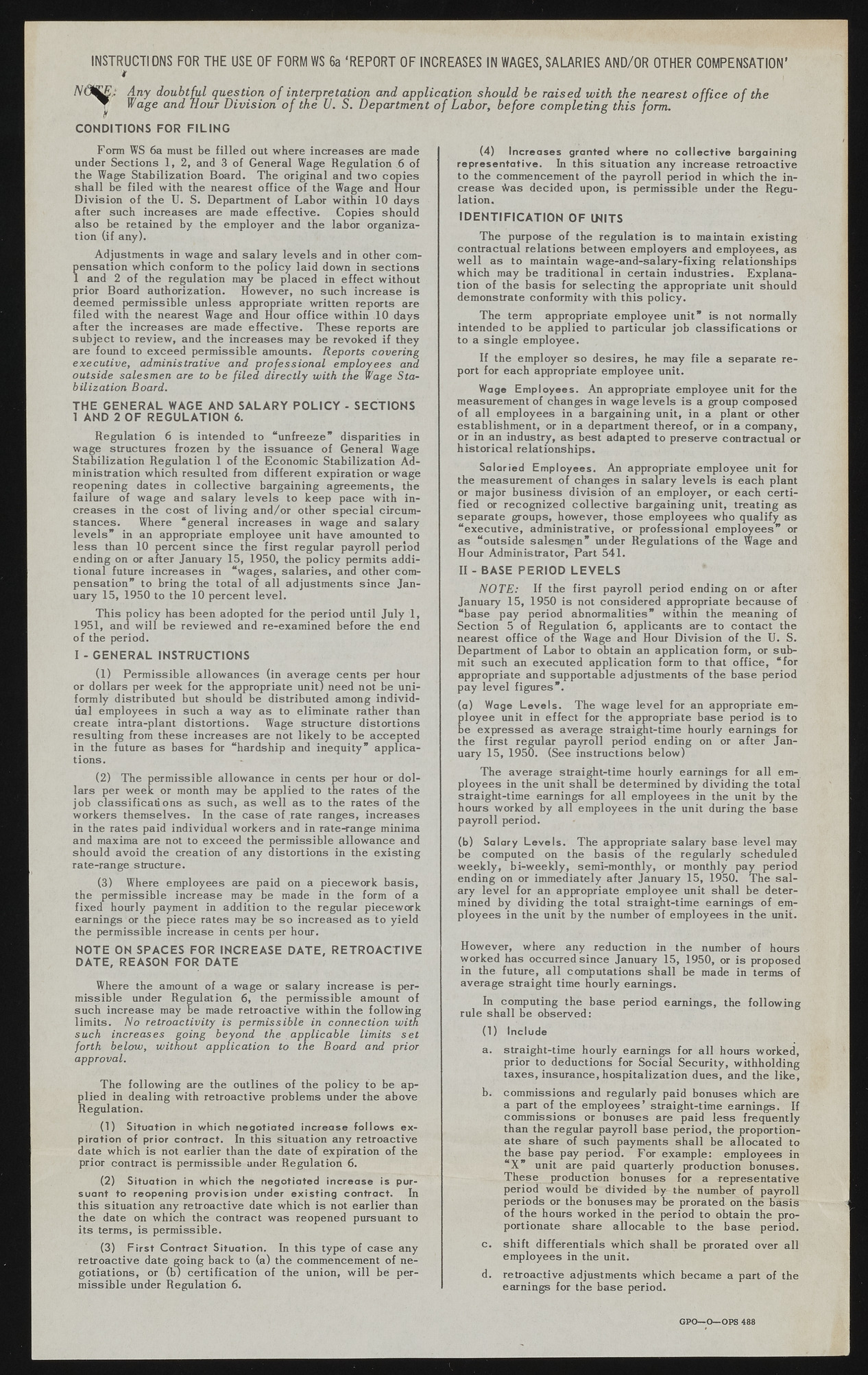

INSTRUCTIONS FOR THE USE OF FORM WS 6a ‘REPORT OF INCREASES IN WAGES, SALARIES AND/OR OTHER COMPENSATION’ * N O ^ , : Any doubtful question of interpretation and application should be raised with the nearest office of the T Wage and Hour Division of the U. S. Department of Labor, before completing this form. CONDITIONS FOR FILING Form WS 6a must be filled out where increases are made under Sections 1, 2, and 3 of General Wage Regulation .6 of the Wage Stabilization Board. The original and two copies shall be filed with the nearest office of the Wage and Hour Division of the U. S. Department of Labor within 10 days after such increases are made effective. Copies should also be retained by the employer and the labor organization (if any). Adjustments in wage and salary levels and in other compensation which conform to the policy laid down in sections 1 and 2 of the regulation may be placed in effect without prior Board authorization. However, no such increase is deemed permissible unless appropriate written reports are filed with the nearest Wage and Hour office within 10 days after the increases are made effective. These reports are subject to review, and the increases may be revoked if they are found to exceed permissible amounts. Reports covering executive, administrative and professional employees and outside salesmen are to be filed directly with the Wage Stabilization Board. THE GENERAL WAGE AND SALARY POLICY - SECTIONS 1 AND 2 OF REGULATION 6. Regulation 6 is intended to “unfreeze” disparities in wage structures frozen by the issuance of General Wage Stabilization Regulation 1 of the Economic Stabilization Administration which resulted from different expiration or wage reopening dates in collective bargaining agreements, the failure of wage and salary levels to keep pace with increases in the cost of living and/or other special circumstances. Where “ general increases in wage and salary levels” in an appropriate employee unit have amounted to less than 10 percent since the first regular payroll period ending on or after January 15, 1950, the policy permits additional future increases in “wages, salaries, and other compensation” to bring the total of all adjustments since January 15, 1950 to the 10 percent level. This policy has been adopted for the period until July T, 1951, and will be reviewed and re-examined before the end o f the period. I - GENERAL INSTRUCTIONS (1) Permissible allowances (in average cents per hour or dollars per week for the appropriate unit) need not be uniformly distributed but should be distributed among individual employees in such a way as to eliminate rather than create intra-plant distortions. Wage structure distortions resulting from these increases are not likely to be accepted in the future as bases for “hardship and inequity” applications. (2) The permissible allowance in cents per hour or dollars per week or month may be applied to the rates of the job classifications as such, as well as to the rates of the workers themselves. In the case of rate ranges, increases in the rates paid individual workers and in rate-range minima and maxima are not to exceed the permissible allowance and should avoid the creation of any distortions in the existing rate-range structure. (3) Where employees are paid on a piecework basis, the permissible increase may be made in the form of a fixed hourly payment in addition to the regular piecework earnings or the piece rates may be so increased as to yield the permissible increase in cents per hour. NOTE ON SPACES FOR INCREASE DATE, RETROACTIVE DATE, REASON FOR DATE Where the amount of a wage or salary increase is permissible under Regulation 6, the permissible amount of such increase may be made retroactive within the following limits. No retroactivity is permissible in connection with such increases going beyond the applicable limits set forth below, without application to the Board and prior approval. The following are the outlines of the policy to be applied in dealing with retroactive problems under the above Regulation. (1) Situation in which negotiated increase follows expiration of prior contract. In this situation any retroactive date which is not earlier than the date of expiration of the prior contract is permissible under Regulation 6. (2) Situation in which the negotiated increase is pursuant to reopening provision under existing contract. In this situation any retroactive date which is not earlier than the date on which the contract was reopened pursuant to its terms, is permissible. (3) First Contract Situation. In this type of case any retroactive date going back to (a) the commencement of negotiations, or (b) certification of the union, will be permissible under Regulation 6. (4) Increases granted where no collective bargaining representative. In this situation any increase retroactive to the commencement of the payroll period in which the increase Was decided upon, is permissible under the Regulation. IDENTIFICATION OF INITS The purpose of the regulation is to maintain existing contractual relations between employers and employees, as well as to maintain wage-and-salary-fixing relationships which may be traditional in certain industries. Explanation of the basis for selecting the appropriate unit should demonstrate conformity with this policy. The term appropriate employee unit” is not normally intended to be applied to particular job classifications or to a single employee. If the employer so desires, he may file a separate report for each appropriate employee unit. Wage Employees. An appropriate employee unit for the measurement of changes in wage levels is a group composed of all employees in a bargaining unit, in a plant or other establishment, or in a department thereof, or in a company, or in an industry, as best adapted to preserve contractual or historical relationships. Salaried Employees. An appropriate employee unit for the measurement of changes in salary levels is each plant or major business division of an employer, or each certified or recognized collective bargaining unit, treating as separate groups, however, those employees who qualify as “ executive, administrative, or professional employees” or as “ outside salesman’ under Regulations of the Wage and Hour Administrator, Part 541. II - BASE PERIOD LEVELS NOTE: If the first payroll period ending on or after January 15, 1950 is not considered appropriate because of “base pay period abnormalities” within the meaning of Section 5 of Regulation 6, applicants are to contact the nearest office of the Wage and Hour Division of the U. S. Department of Labor to obtain an application form, or submit such an executed application form to that office, “ for appropriate and supportable adjustments of the base period pay level figures” . (a) Wage Levels. The wage level for an appropriate employee unit in effect for the appropriate base period is to be expressed as average straight-time hourly earnings for the first regular payroll period ending on or after January 15, 1950. (See instructions below) The average straight-time hourly earnings for all employees in the unit shall be determined by dividing the total straight-time earnings for all employees in the unit by the hours worked by all employees in the unit during the base payroll period. (b) Salary Levels. The appropriate salary base level may be computed on the basis of the regularly scheduled weekly, bi-weekly, semi-monthly, or monthly pay period ending on or immediately after January 15, 1950. The salary level for an appropriate employee unit shall be determined by dividing the total straight-time earnings of employees in the unit by the number of employees in the unit. However, where any reduction in the number of hours worked has occurred since January 15, 1950, or is proposed in the future, all computations shall be made in terms of average straight time hourly earnings. In computing the base period earnings, the following rule shall be observed: (1) Include a. straight-time hourly earnings for all hours worked, prior to deductions for Social Security, withholding taxes, insurance, hospitalization dues, and the like, b. commissions and regularly paid bonuses which are a part of the employees’ straight-time earnings. If commissions or bonuses are paid less frequently than the regular payroll base period, the proportionate share of such payments shall be allocated to the base pay period. For example: employees in X unit are paid quarterly production bonuses. These production bonuses for a representative period would be divided by the number of payroll periods or the bonuses may be prorated on the basis of the hours worked in the period to obtain the proportionate share allocable to the base period. c. shift differentials which shall be prorated over all employees in the unit. d. retroactive adjustments which became a part of the earnings for the base period.