Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

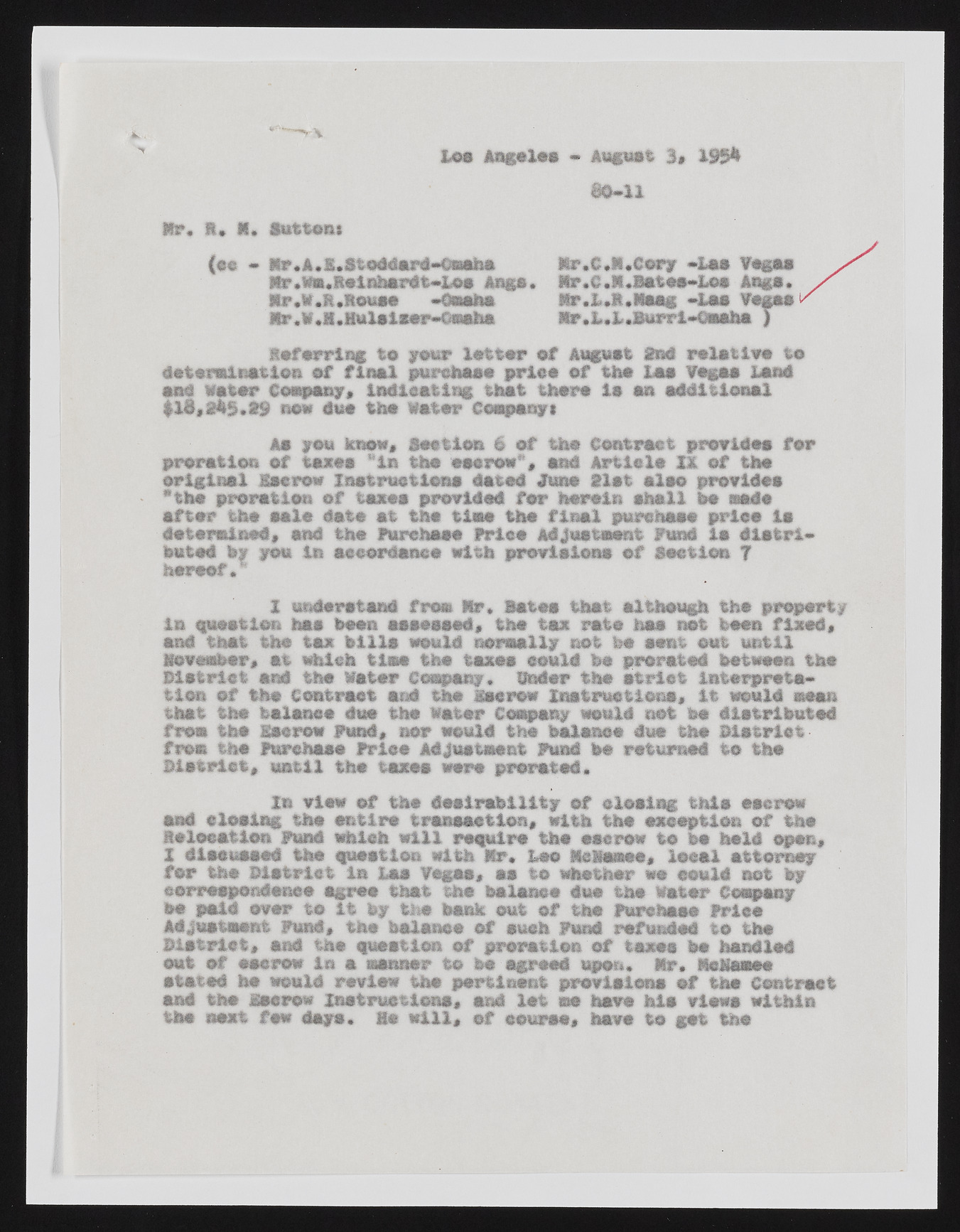

le a i w g e l s s - A u g u s t 3» 1994 e o - n Nr« R» 8 . g utto nt (e« • lir.A .£.8toddard*0m aha H r,w m .R e in h a rd t* L o e A n g s . h r . w.ft.House •Omaha flr.S *H .Hulsiaer-Gojaha N r. C *11.Cory *1419 Vegas Nr.c.N.Bates~Los Angs. N r.l.!t.ll8 a g »H>$ Vegas N r.L .l.B u rri-c m s h a J d e fe rrin g to ;o u r la t t e r o f August 2nd r e la tiv e to d e te rm in a tio n o f f in a l purchase p ric e o f tho Loo Vegas load and w ater Company* in d ic a tin g th a t th e re la an a d d itio n a l $ l£ *2 4 § .f9 new duo th e H ater Company* Aa you know* Soot io n 6 o f the C ontrast provides fo r p re ra tlo o o f taxes * in tha escrow ", and A rtie la X I o f the o rig in a l Escrow fn a tru e tie n a dated June f l a t a ls o provides *th e p ro ra tio n o f tacos provided fo r h e re in s h a ll ho aside a fte r th e e ele date a t th e tim e the f in a l purchase p ric e is determ ined* and the Purchase P rice Adjustm ent fund ia d is t r i-hated by you In accordance w ith p ro v is io n s o f S ection 7 h e re o f. X understand fr o * H r* Sates th a t although th a p ro p e rty in question has been assessed* th e ta x fa te has riot toon fix e d * and th a t th e ta x h ills would norm ally not he sent o ut u n t il November* a t which tim e the taxes could he p ro ra te d between th e P ie tr io t and the H ater Company* Under th e s t r ic t in te rp re ts * tto n o f th e C ontract and the Escrow In s tru c tio n s * i t would mean th a t th e balance due the H ater Coopery would net 'he d is trib u te d from th e Escrow Fund, nor would the balance due the D is tr ic t from the Purchase P rice Adjustm ent fund be returned to th e M s tr ie t* u n t il th e taxes were p ro ra te d . In view o f th e d e s ir a b ility o f c lo s in g th is escrow and c lo s in g th e e n tire tra n s a c tio n * w ith ® jp exception o f the a c lo c a tio n Fund which w i ll re q u ire tike escrow to bo hold open* X discussed the question w ith Mr* le e Neftamae* lo c a l a tto rn e y fo r the M e tr ic t in la s Vegas* aa to whether we could not by correspondence agree th a t th e balance due the w ater Company be paid over to i t by the bank out o f the purchase P rice Adjustm ent Fund* th e balance o f such Fund refunded to the .M a tr io t* ®t® the question o f prorafelon o f taxes be handled o u t o f escrow in a manner to be agreed upon. H r. hchamee sta te d he would review the p e rtin e n t p ro v is io n s o f the C ontract and the Em row X n e tru ctio n s, and lo t me have h is views w ith in the next few days, m w ill* o f course* have to g e t the