Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

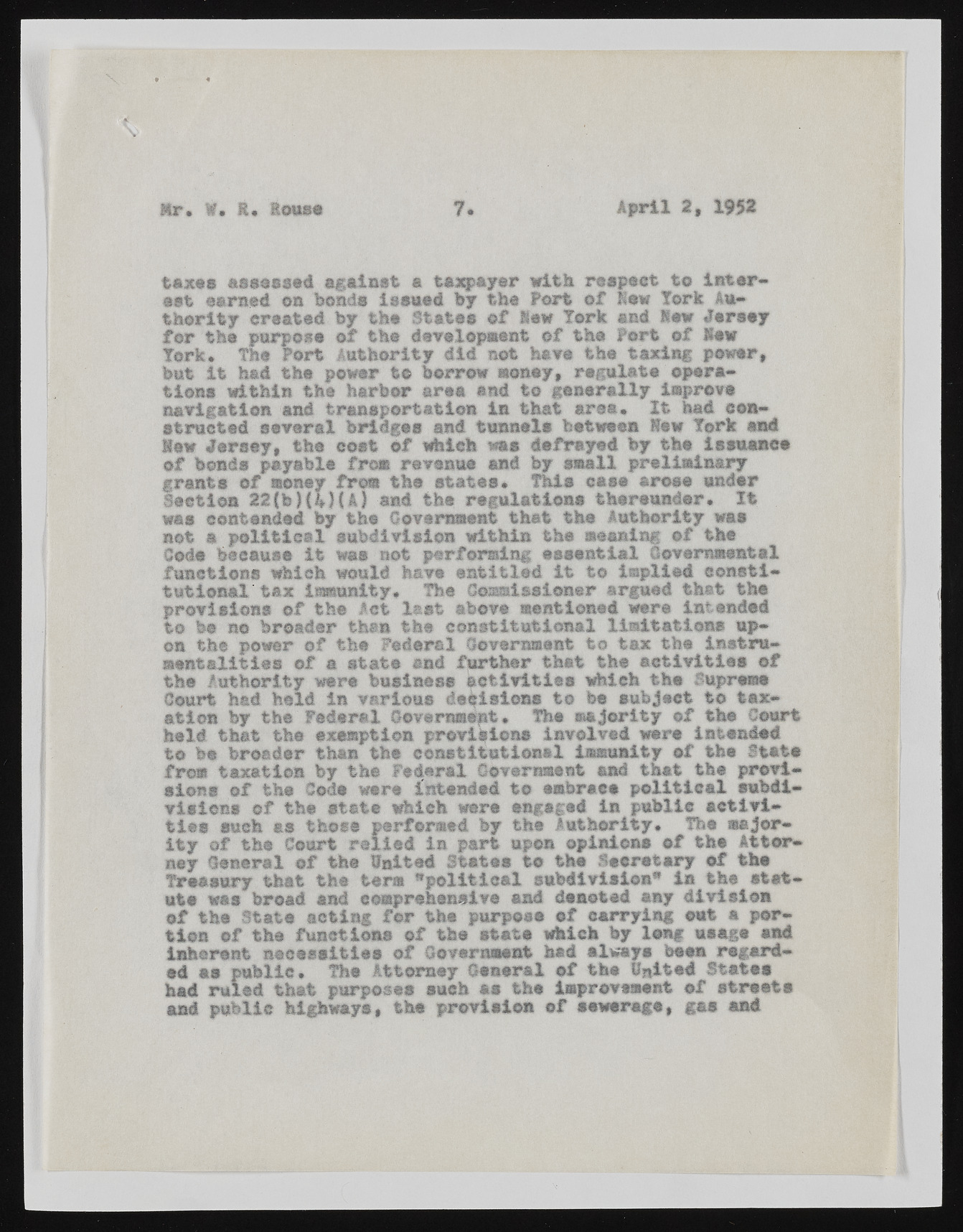

Mr* W. t* louse 7. April 2, 1952 taxes assessed against a taxpayer with respect to interest earned on bends Issued by the Fort of lew fork Authority created by the States of lew Tork and lew Jersey for the purpose of the development of the Port of New Tork* The Port Authority did not have the taxing power, but It had the power to borrow money, regulate operations within the harbor area and to generally improve navigation and transportation in that area* It had constructed several bridges and tunnels between Hew Tork and lew Jersey, the cost of which was defrayed by the issuance of bonds payable from revenue and by snail preliminary grants of money from the states• This case arose under Section 22(b)(4)(A) and the regulations thereunder* It was contended by the Government that the Authority was not a politic#1 subdivision within the meaning of the Code because It was not performing essential Governmental functions which would have entitled it to implied constitutional tax immunity. The Commissioner argued that the provisions of the let last above mentioned were intended to be no broader than the constitutional limitations upon the power of the Federal Government to tax the instrumentalities of a state and further that the activities of the Authority were business activities which the Supreme Court had held in various decisions to be subject to taxation by the Federal Government* The majority of the Court held that the exemption provisions involved were intended to be broader than the constitutional immunity of the State fro® taxation by the federal Government and that the provisions of the Code were intended to embrace political subdivisions of the state which were engaged in public activities such as those performed by the Authority* The majority of the Court relied in part upon opinions of the Attorney General of the United States to the Secretary of the Treasury that the term Apolitical subdivision* in the statute was broad and comprehensive and denoted any division of the State acting for the purpose of carrying out a portion of the functions of the state which by long usage and inherent necessities of Government had always been regarded as public, The Attorney General of the United States had ruled that purposes such as the improvement of streets and public highways, the provision of sewerage, gas and