Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

Member of

More Info

Rights

Digital Provenance

Publisher

Transcription

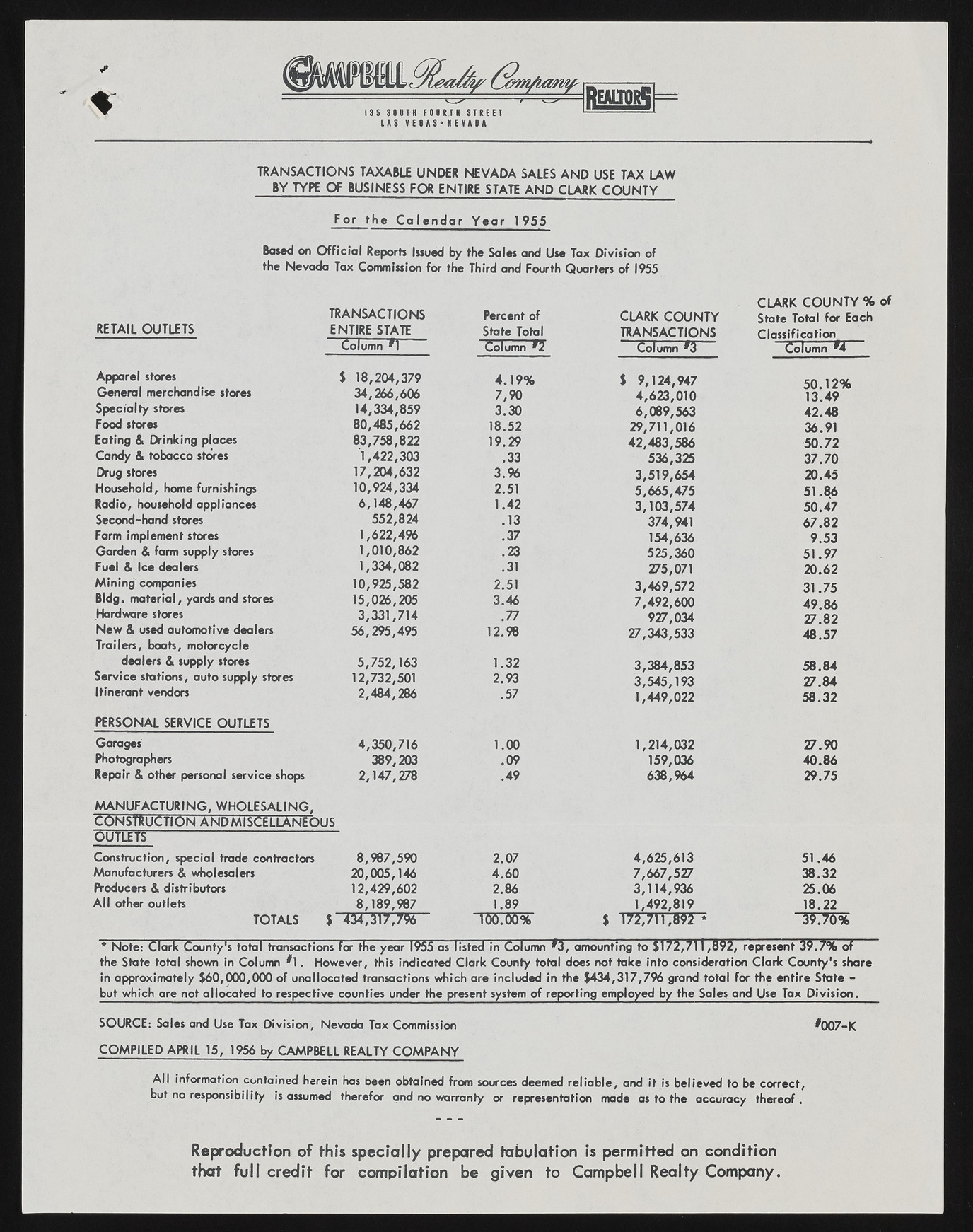

US VEGAS* NEVADA TRANSACTIONS TAXABLE UNDER NEVADA SALES AND USE TAX LAW BY TYPE OF BUSINESS FOR ENTIRE STATE AND CLARK COUNTY For t he C a le n d a r Y e a r 1955 Based on Official Reports Issued by the Sales and Use Tax Division of the Nevada Tax Commission for the Third and Fourth Quarters of 1955 CLARK COUNTY % of TRANSACTIONS Percent of CLARK COUNTY State Total for Each RETAIL OUTLETS ENTIRE STATE State Total TRANSACTIONS Classification Column *1 Column *2 Column *3 Column "4 Apparel stores $ 18,204,379 4.19% $ 9,124,947 General merchandise stores 34,266,606 50 12% 7,90 4,623,010 13.49 Specialty stores 14,334,859 3.30 6,089,563 42.48 Food stores 80,485,662 18.52 29,711,016 36.91 Eating & Drinking places 83,758,822 19.29 42,483,586 50.72 Candy & tobacco stores 1,422,303 .33 536,325 37.70 Drug stores 17,204,632 3.96 3,519,654 20.45 Household, home furnishings 10,924,334 2.51 5,665,475 51.86 Radio, household appliances 6,148,467 1.42 3,103,574 50.47 Second-hand stores 552,824 .13 374,941 67.82 Farm implement stores 1,622,496 .37 154,636 9.53 Garden & farm supply stores 1,010,862 .23 525,360 51.97 Fuel & Ice dealers 1,334,082 .31 275,071 20.62 Mining' companies 10,925,582 2.51 3,469,572 31.75 Bldg, material, yards and stores 15,026,205 3.46 7,492,600 49.86 Hardware stores 3,331,714 .77 927,034 27.82 New & used automotive dealers 56, #5,495 12.98 27,343,533 48.57 Trailers, boats, motorcycle dealers & supply stores 5,752,163 1.32 3,384,853 58.84 Service stations, auto supply stores 12,732,501 2.93 3,545,193 27.84 Itinerant vendors 2,484,286 .57 1,449,022 58.32 PERSONAL SERVICE OUTLETS Garages 4,350,716 1.00 1,214,032 27.90 Photographers 389,203 .09 159,036 40.86 Repair & other personal service shops 2,147,278 .49 638,964 29.75 MANUFACTURING, WHOLESALING, C o n s t r u c t io n a n d m is C e l l a n e o u s O u tlets Construction, special trade contractors 8,967,590 2.07 4,625,613 51.46 Manufacturers & wholesalers 20,005,146 4.60 7,667,527 38.32 Producers & distributors 12,429,602 2.86 3,114,936 25.06 All other outlets 8,189,987 1.89 1,492,819 18.22 TOTALS $ 434,317,796 100 tt)% $ 172,711,092 * # .? 0 % * Note: Clark County's total transactions for the year 1955 as listed in Column *3, amounting to $172,711,892, represent 39.7% of the State total shown in Column '1. However, this indicated Clark County total does not take into consideration Clark County's share in approximately $60,000,000 of unallocated transactions which are included in the $434,317,796 grand total for the entire State - but which are not allocated to respective counties under the present system of reporting employed by the Sales and Use Tax Division. SOURCE: Sales and Use Tax Division, Nevada Tax Commission ^007-K COMPILED APRIL 15, 1956 by CAMPBELL REALTY COMPANY All information contained herein has been obtained from sources deemed reliable, and it is believed to be correct, but no responsibility is assumed therefor and no warranty or representation made as to the accuracy thereof. Reproduction of this special 1/ prepared tabulation is permitted on condition that full credit for compilation be given to Campbell Realty Company.