Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

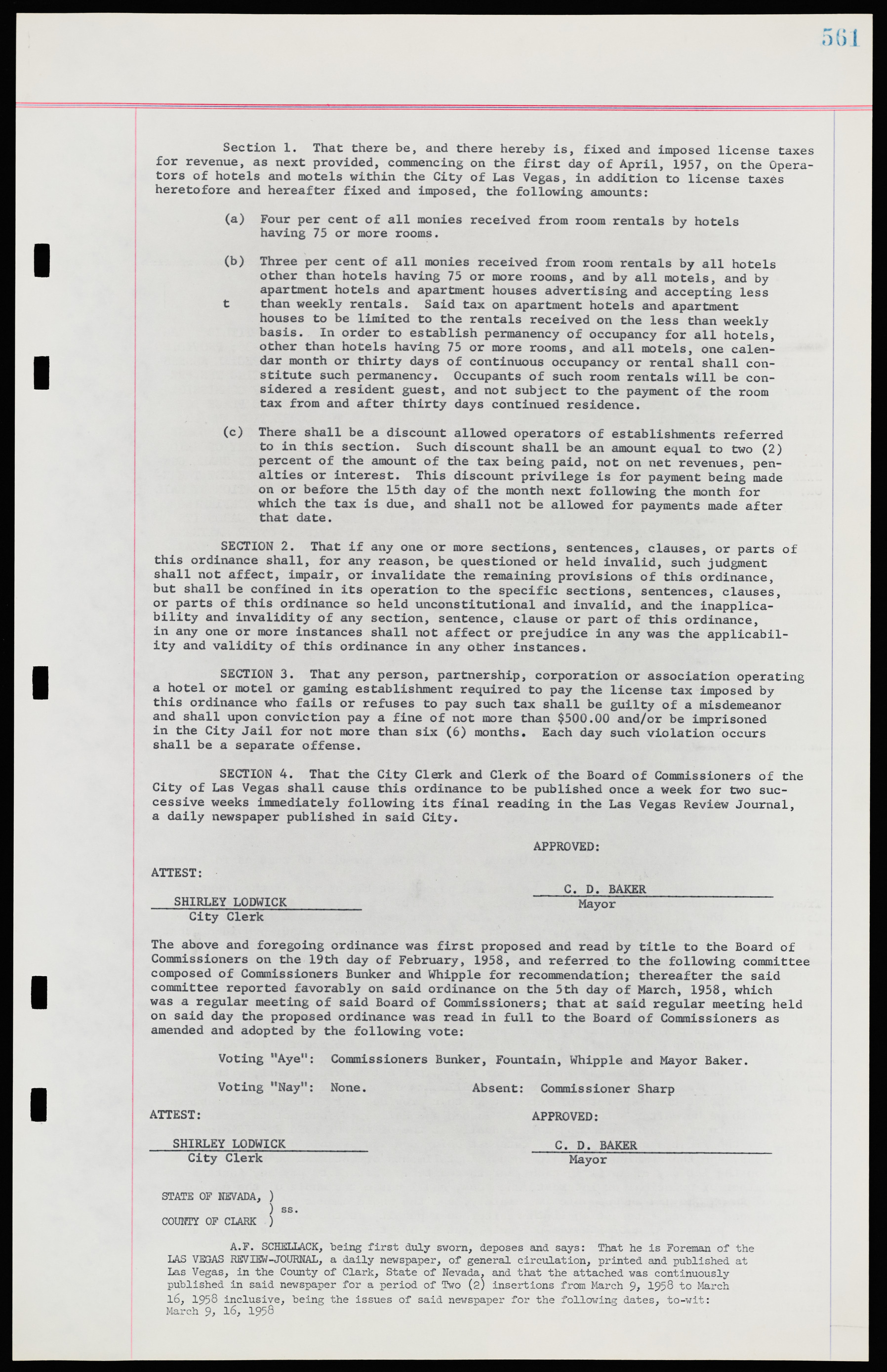

Section 1. That there be, and there hereby is, fixed and imposed license taxes for revenue, as next provided, commencing on the first day of April, 1957, on the Operators of hotels and motels within the City of Las Vegas, in addition to license taxes heretofore and hereafter fixed and imposed, the following amounts: (a) Four per cent of all monies received from room rentals by hotels having 75 or more rooms. (b) Three per cent of all monies received from room rentals by all hotels other than hotels having 75 or more rooms, and by all motels, and by apartment hotels and apartment houses advertising and accepting less than weekly rentals. Said tax on apartment hotels and apartment houses to be limited to the rentals received on the less than weekly basis. In order to establish permanency of occupancy for all hotels, other than hotels having 75 or more rooms, and all motels, one calendar month or thirty days of continuous occupancy or rental shall constitute such permanency. Occupants of such room rentals will be considered a resident guest, and not subject to the payment of the room tax from and after thirty days continued residence. (c) There shall be a discount allowed operators of establishments referred to in this section. Such discount shall be an amount equal to two (2) percent of the amount of the tax being paid, not on net revenues, penalties or interest. This discount privilege is for payment being made on or before the 15th day of the month next following the month for which the tax is due, and shall not be allowed for payments made after that date. SECTION 2. That if any one or more sections, sentences, clauses, or parts of this ordinance shall, for any reason, be questioned or held invalid, such judgment shall not affect, impair, or invalidate the remaining provisions of this ordinance, but shall be confined in its operation to the specific sections, sentences, clauses, or parts of this ordinance so held unconstitutional and invalid, and the inapplicability and invalidity of any section, sentence, clause or part of this ordinance, in any one or more instances shall not affect or prejudice in any was the applicability and validity of this ordinance in any other instances. SECTION 3. That any person, partnership, corporation or association operating a hotel or motel or gaming establishment required to pay the license tax imposed by this ordinance who fails or refuses to pay such tax shall be guilty of a misdemeanor and shall upon conviction pay a fine of not more than $500.00 and/or be imprisoned in the City Jail for not more than six (6) months. Each day such violation occurs shall be a separate offense. SECTION 4. That the City Clerk and Clerk of the Board of Commissioners of the City of Las Vegas shall cause this ordinance to be published once a week for two successive weeks immediately following its final reading in the Las Vegas Review Journal, a daily newspaper published in said City. APPROVED: ATTEST: C. D. BAKER_____________________ SHIRLEY LODWICK____________ Mayor City Clerk The above and foregoing ordinance was first proposed and read by title to the Board of Commissioners on the 19th day of February, 1958, and referred to the following committee composed of Commissioners Bunker and Whipple for recommendation; thereafter the said committee reported favorably on said ordinance on the 5th day of March, 1958, which was a regular meeting of said Board of Commissioners; that at said regular meeting held on said day the proposed ordinance was read in full to the Board of Commissioners as amended and adopted by the following vote: Voting "Aye": Commissioners Bunker, Fountain, Whipple and Mayor Baker. Voting "Nay": None. Absent: Commissioner Sharp ATTEST: APPROVED: SHIRLEY LODWICK______________ C. D. BAKER_______________________ City Clerk Mayor STATE OF NEVADA, ) ) ss. COUNTY OF CLARK ) A.F. SCHELLACK, being first duly sworn, deposes and says: That he is Foreman of the LAS VEGAS REVIEW-JOURNAL, a daily newspaper, of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of Two (2) insertions from March 9, 1958 to March 16, 1958 inclusive, being the issues of said newspaper for the following dates, to-wit: March 9, 16, 1958