Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

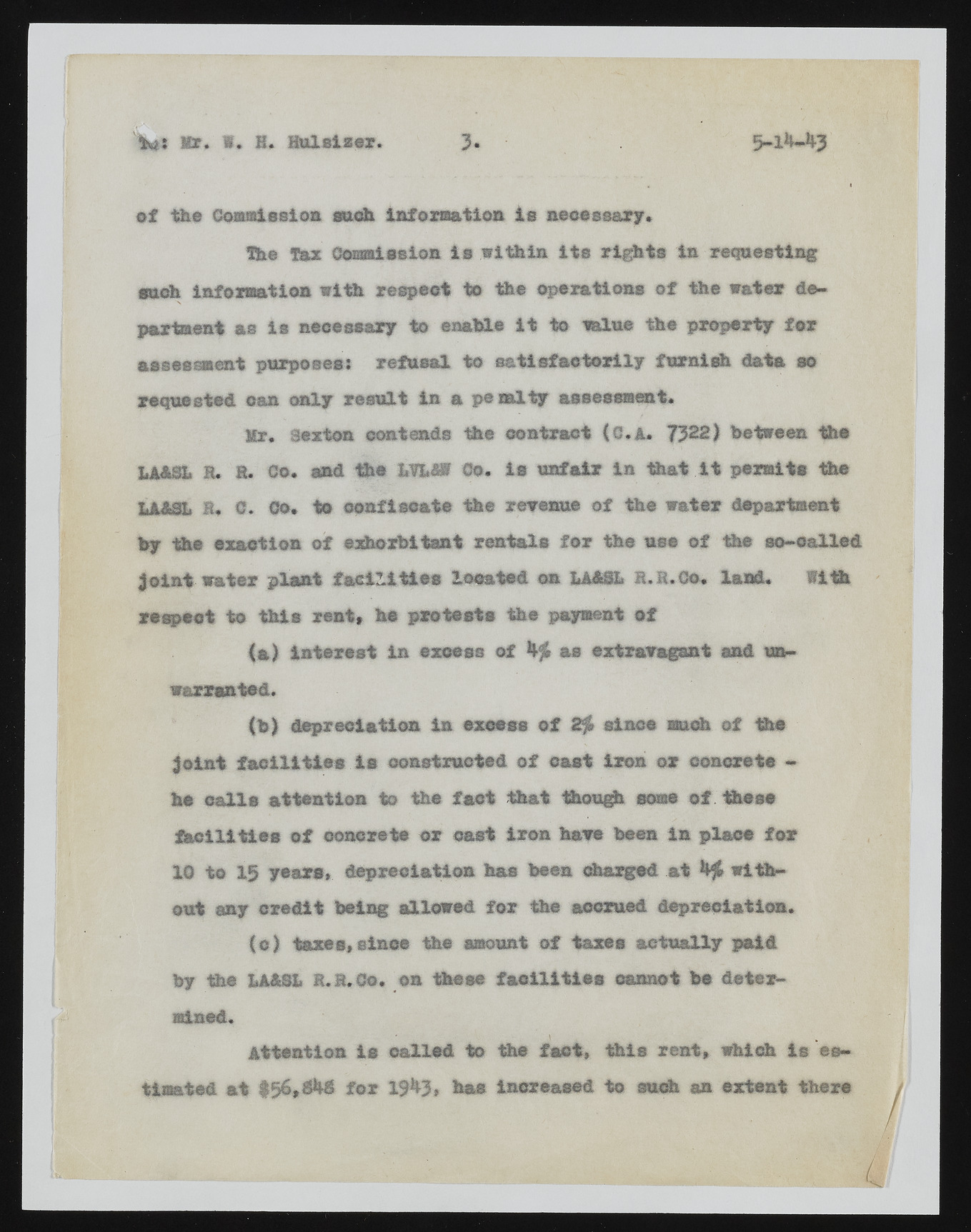

W : Mr. $. H. Hulsizer. 3. 5-14-43 of the Commission such Information is necessary. ihe Tax Commission is within its rights in requesting snob information with respect to the aerations of Hie water department as is necessary to enable it to walue the properly1 for assessment purposes: refusal to satisfactorily furnish data so requested oaa only result in a pe nalty assessment* Mr. Sexton contends the contract (C. a. 7322) between Hie W&m. h. a. Co. and the %lhSS Co. is unfair In that I t permits the Xt&dSL ft. 0. Co. to confiscate Hie revenue of the water department by the exaction of exorbitant r a t a ls for the use of the so-called Joint water plant fa c ilitie s located on LA&SL B .li.Q o. land* With r e je c t to this rent, he protests the payment of (a) interest in excess of 4$ as extravagant and unwarranted. (b) depreciation In excess of 2$ since much of the Joint facilities is constructed of cast iron or concrete - he calls attention to the fact that though some of these facilities of concrete or cast iron have been in place for 10 to 15 years, depreciation has been charged at 4$ without any credit being allowed for the accrued depreciation. le) taxes,oince the amount of taxes actually paid by the lA&Sii ft. ft. Co. on these facilities cannot be determined. Attention is called to the fact, this rent, which is estimated at $56,34$ for 1943, has increased to such an extent there