Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

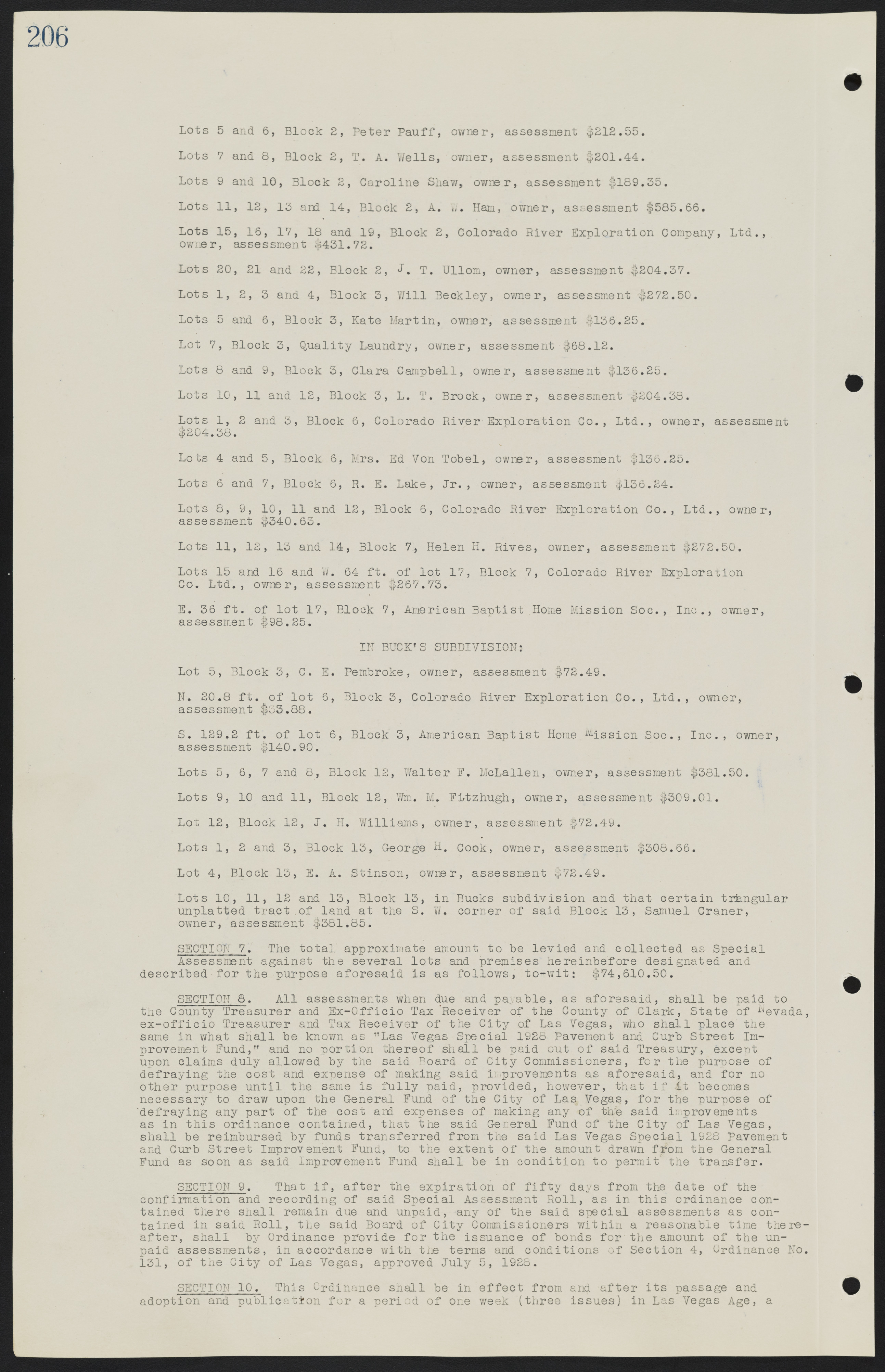

Lots 5 and 6, Block 2, Peter Pauff, owner, assessment $212.55. Lots 7 and 8, Block 2, T. A. Wells, owner, assessment $201.44. Lots 9 and 10, Block 2, Caroline Shaw, owner, assessment $189.35. Lots 11, 12, 13 and 14, Block 2, A. W. Ham, owner, assessment $585.66. Lots 15, 16, 17, 18 and 19, Block 2, Colorado River Exploration Company, Ltd., owner, assessment $431.72. Lots 20, 21 and 22, Block 2, J. T. Ullom, owner, assessment $204.37. Lots 1, 2, 3 and 4, Block 3, Will Beckley, owner, assessment $272.50. Lots 5 and 6, Block 3, Kate Martin, owner, assessment $136.25. Lot 7, Block 3, Quality Laundry, owner, assessment $68.12. Lots 8 and 9, Block 3, Clara Campbell, owner, assessment $136.25. Lots 10, 11 and 12, Block 3, L. T. Brock, owner, assessment $204.38. Lots 1, 2 and 3, Block 6, Colorado River Exploration Co., Ltd., owner, assessment $204.38. Lots 4 and 5, Block 6, Mrs. Ed Von Tobel, owner, assessment $136.25. Lots 6 and 7, Block 6, R. E. Lake, Jr. , owner, assessment $136.24. Lots 8, 9, 10, 11 and 12, Block 6, Colorado River Exploration Co., Ltd., owner, assessment $340.63. Lots 11, 12, 13 and 14, Block 7, Helen H. Rives, owner, assessment $272.50. Lots 15 and 16 and W. 64 ft. of lot 17, Block 7, Colorado River Exploration Co. Ltd., owner, assessment $267.73. E. 36 ft. of lot 17, Block 7, American Baptist Home Mission Soc., Inc., owner, assessment $98.25. IN BUCK'S SUBDIVISION: Lot 5, Block 3, C. E. Pembroke, owner, assessment $72.49. N. 20.8 ft. of lot 6, Block 3, Colorado River Exploration Co., Ltd., owner, assessment $33.88. S. 129.2 ft. of lot 6, Block 3, American Baptist Home Mission Soc., Inc., owner, assessment $140.90. Lots 5, 6, 7 and 8, Block 12, Walter F. McLallen, owner, assessment $381.50. Lots 9, 10 and 11, Block 12, Wm. M. Fitzhugh, owner, assessment $309.01. Lot 12, Block 12, J. H. Williams, owner, assessment $72.49. Lots 1, 2 and 3, Block 13, George H. Cook, owner, assessment $308.66. Lot 4, Block 13, E. A. Stinson, owner, assessment $72.49. Lots 10, 11, 12 and 13, Block 13, in Bucks subdivision and that certain triangular unplatted tract of land at the S. W. corner of said Block 13, Samuel Craner, owner, assessment $381.85. SECTION 7. The total approximate amount to be levied and collected as Special Assessment against the several lots and premises hereinbefore designated and described for the purpose aforesaid is as follows, to-wit: $74,610.50. SECTION 8. All assessments when due and payable, as aforesaid, shall be paid to the County Treasurer and Ex-Officio Tax Receiver of the County of Clark, State of Nevada, ex-officio Treasurer and Tax Receiver of the City of Las Vegas, who shall place the same in what shall be known as "Las Vegas Special 1928 Pavement and Curb Street Improvement Fund," and no portion thereof shall be paid out of said Treasury, except upon claims duly allowed by the said Board of City Commissioners, for the purpose of defraying the cost and expense of making said improvements as aforesaid, and for no other purpose until the same is fully paid, provided, however, that if it becomes necessary to draw upon the General Fund of the City of Las Vegas, for the purpose of defraying any part of the cost and expenses of making any of the said improvements as in this ordinance contained, that the said General Fund of the City of Las Vegas, shall be reimbursed by funds transferred from the said Las Vegas Special 1928 Pavement and Curb Street Improvement Fund, to the extent of the amount drawn from the General Fund as so on as said Improvement Fund shall be in condition to permit the transfer. SECTION 9. That if, after the expiration of fifty days from the date of the confirmation and recording of said Special Assessment Roll, as in this ordinance contained there shall remain due and unpaid, any of the said special assessments as contained in said Roll, the said Board of City Commissioners within a reasonable time thereafter, shall by Ordinance provide for the issuance of bonds for the amount of the unpaid assessments, in accordance with the terms and conditions of Section 4, Ordinance No. 131, of the City of Las Vegas, approved July 5, 1928. SECTION 10. This Ordinance shall be in effect from and after its passage and adoption and publication for a period of one week (three issues) in Las Vegas Age, a