Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

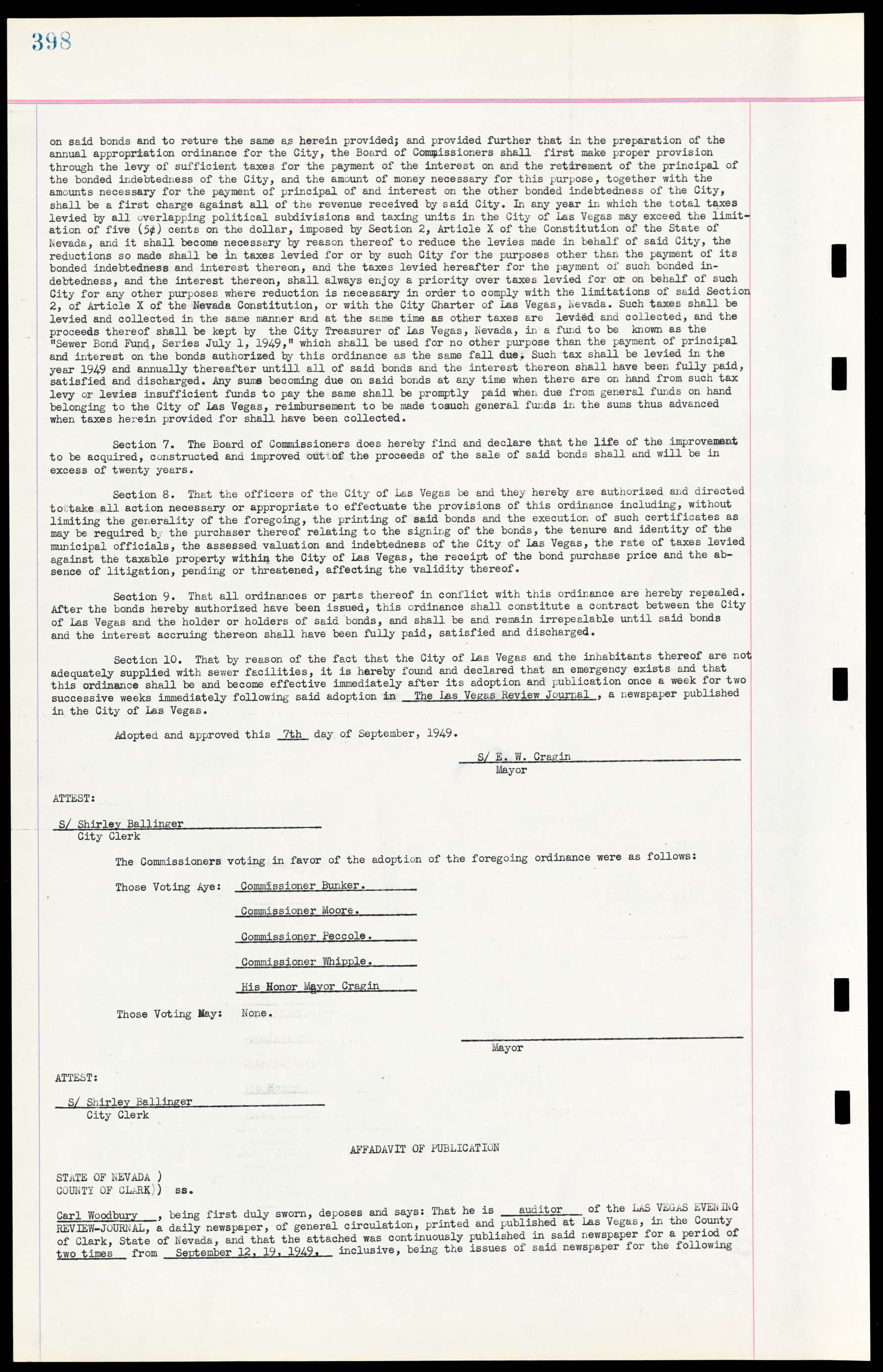

on said bonds and to reture the same as herein provided; and provided further that in the preparation of the annual appropriation ordinance for the City, the Board of Commissioners shall first make proper provision through the levy of sufficient taxes for the payment of the interest on and the retirement of the principal of the bonded indebtedness of the City, and the amount of money necessary for this purpose, together with the amounts necessary for the payment of principal of and interest on the other bonded indebtedness of the City, shall be a first charge against all of the revenue received by said City. In any year in which the total taxes levied by all overlapping political subdivisions and taxing units in the City of Las Vegas may exceed the limit- ation of five (5¢) cents on the dollar, imposed by Section 2, Article X of the Constitution of the State of Nevada, and it shall become necessary by reason thereof to reduce the levies made in behalf of said City, the reductions so made shall be in taxes levied for or by such City for the purposes other than the payment of its bonded indebtedness and interest thereon, and the taxes levied hereafter for the payment of such bonded indebtedness, and the interest thereon, shall always enjoy a priority over taxes levied for or on behalf of such City for any other purposes where reduction is necessary in order to comply with the limitations of said Section 2, of Article X of the Nevada Constitution, or with the City Charter of Las Vegas, Nevada. Such taxes shall be levied and collected in the same manner and at the same time as other taxes are levied and collected, and the proceeds thereof shall be kept by the City Treasurer of Las Vegas, Nevada, in a fund to be known as the "Sewer Bond Fund, Series July 1, 1949," which shall be used for no other purpose than the payment of principal and interest on the bonds authorized by this ordinance as the same fall due. Such tax shall be levied in the year 1949 and annually thereafter untill all of said bonds and the interest thereon shall have been fully paid, satisfied and discharged. Any sums becoming due on said bonds at any time when there are on hand from such tax levy or levies insufficient funds to pay the same shall be promptly paid when due from general funds on hand belonging to the City of Las Vegas, reimbursement to be made to such general funds in the sums thus advanced when taxes herein provided for shall have been collected. Section 7. The Board of Commissioners does hereby find and declare that the life of the improvement to be acquired, constructed and improved out of the proceeds of the sale of said bonds shall and will be in excess of twenty years. Section 8. That the officers of the City of Las Vegas be and they hereby are authorized and directed to take all action necessary or appropriate to effectuate the provisions of this ordinance including, without limiting the generality of the foregoing, the printing of said bonds and the execution of such certificates as may be required by the purchaser thereof relating to the signing of the bonds, the tenure and identity of the municipal officials, the assessed valuation and indebtedness of the City of Las Vegas, the rate of taxes levied against the taxable property within the City of Las Vegas, the receipt of the bond purchase price and the absence of litigation, pending or threatened, affecting the validity thereof. Section 9. That all ordinances or parts thereof in conflict with this ordinance are hereby repealed. After the bonds hereby authorized have been issued, this ordinance shall constitute a contract between the City of Las Vegas and the holder or holders of said bonds, and shall be and remain irrepealable until said bonds and the interest accruing thereon shall have been fully paid, satisfied and discharged. Section 10. That by reason of the fact that the City of Las Vegas and the inhabitants thereof are not adequately supplied with sewer facilities, it is hereby found and declared that an emergency exists and that this ordinance shall be and become effective immediately after its adoption and publication once a week for two successive weeks immediately following said adoption in The Las Vegas Review Journal , a newspaper published in the City of Las Vegas. Adopted and approved this 7th day of September, 1949. S/ E. W. Cragin Mayor ATTEST: S/ Shirley Ballinger__________________ City Clerk The Commissioners voting in favor of the adoption of the foregoing ordinance were as follows: Those Voting Aye: Commissioner Bunker. Commissioner Moore. Commissioner Peccole. Commissioner Whipple. His Honor Mayor Cragin Those Voting May: None. Mayor ATTEST: S/ Shirley Ballinger_________________ City Clerk AFFIDAVIT OF PUBLICATION STATE OF NEVADA ) COUNTY OF CLARK) ss. Carl Woodbury , being first duly sworn, deposes and says: That he is auditor of the LAS VEGAS EVENING REVIEW-JOURNAL, a daily newspaper, of general circulation, printed and published at Las Vegas, in the County of Clark, State of Nevada, and that the attached was continuously published in said newspaper for a period of two times from September 12. 19, 1949. inclusive, being the issues of said newspaper for the following