Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

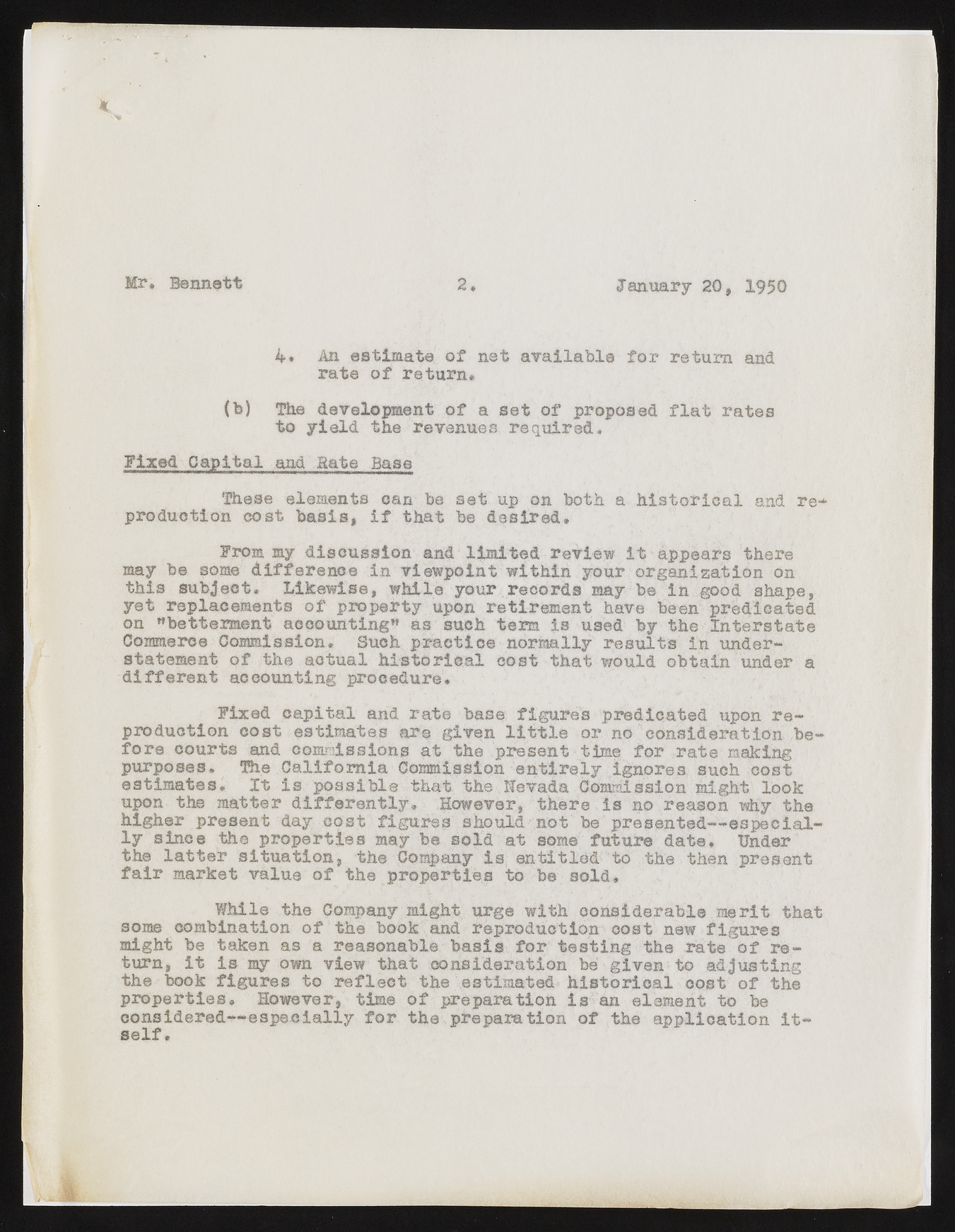

M r . B e n n e t t 2 , J a n u a r y 2 0 , 1 9 5 0 4* An estimate of net available for return and rate of return. m 1&e development of a set of proposed flat rates to yield the revenues required. Fixed Capital and Hate Base These elements can be set up on both a historical and. reproduction cost basis* if that be desired. From my discussion and limited review it appears there may be some difference in viewpoint within your organization on this subject. Likewise, while your records may be in good shape, yet replacements of property upon retirement have been predicated on "betterment accounting" as such term is used by the Interstate Commerce Commission. Such practice normally results in understatement of the actual historical cost that would obtain under a different accounting procedure. Fixed capital and rate base figures predicated upon reproduction cost estimates are given little or no consideration before courts and commissions at the present time for rate making purposes* The California Commission entirely ignores such cost estimates. It is possible that the Nevada Commission might look upon the matter differently, However, there Is no reason why the higher present day cost figures ly since the properties may be soslhdo uladt nsootme bef utpurrees endatteed,— eUsnpdeecrialthe latter situation, the Company is entitled to the then present fair market value of the properties to be sold. While the Company might urge with considerable merit that some combination of'the book and reproduction cost new figures might be taken as a reasonable basis for testing the rate of return, it is my own view that consideration be given to adjusting the book figures to reflect the estimated historical cost of the properties. However, time of preparation is an element to be cseolnfs.idered— especially for the preparation of the application it