Copyright & Fair-use Agreement

UNLV Special Collections provides copies of materials to facilitate private study, scholarship, or research. Material not in the public domain may be used according to fair use of copyrighted materials as defined by copyright law. Please cite us.

Please note that UNLV may not own the copyright to these materials and cannot provide permission to publish or distribute materials when UNLV is not the copyright holder. The user is solely responsible for determining the copyright status of materials and obtaining permission to use material from the copyright holder and for determining whether any permissions relating to any other rights are necessary for the intended use, and for obtaining all required permissions beyond that allowed by fair use.

Read more about our reproduction and use policy.

I agree.Information

Digital ID

Permalink

Details

More Info

Rights

Digital Provenance

Publisher

Transcription

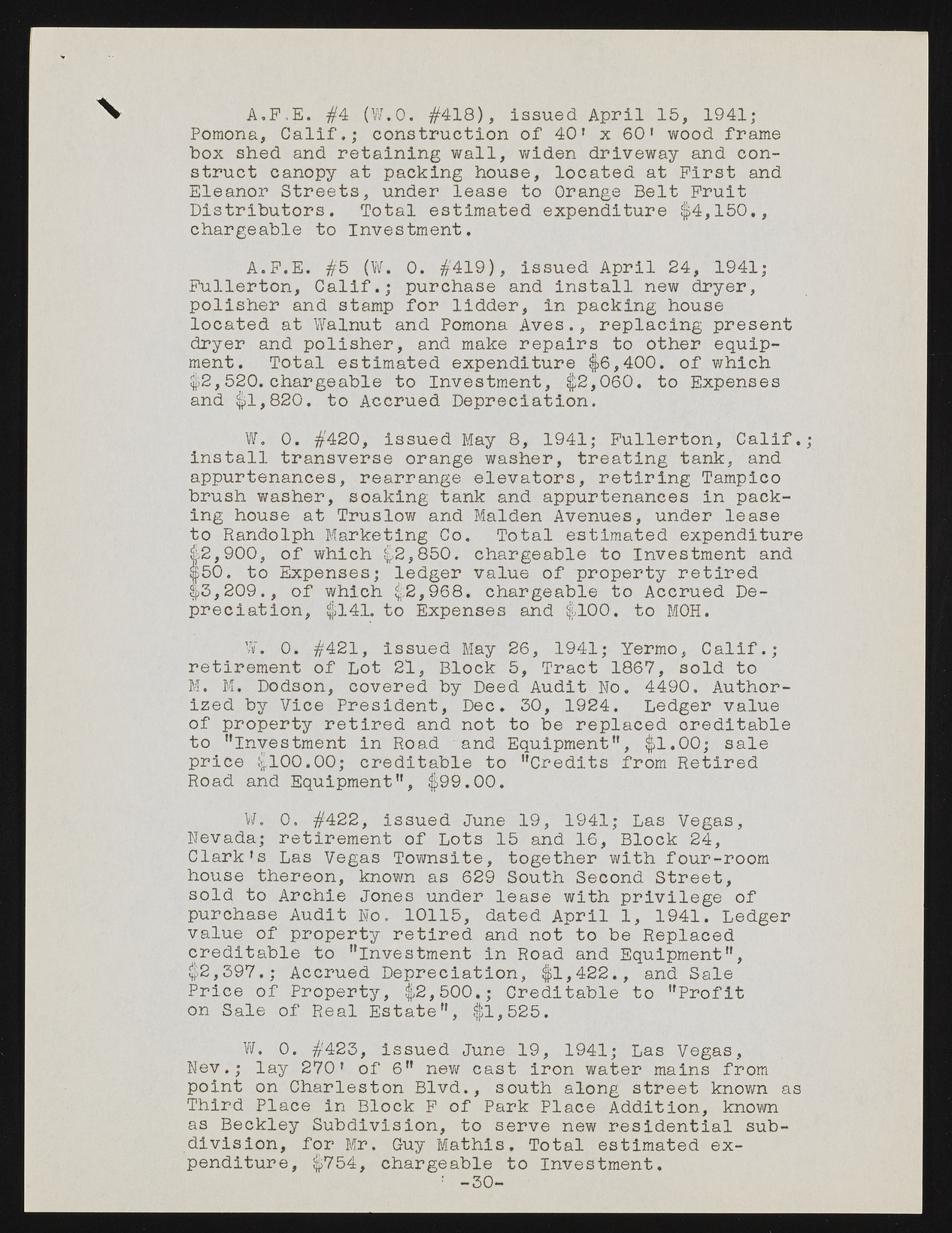

A.F.E. #4 (W.O. #418), issued April 15, 1941; Pomona, Calif.; construction of 40' x 60' wood frame box shed and retaining wall, widen driveway and construct canopy at packing house, located at First and Eleanor Streets, under lease to Orange Belt Fruit Distributors. Total estimated expenditure $4,150., chargeable to Investment, A.F.E. #5 (W. 0. #419), issued April 24, 1941; Fullerton, Calif.; purchase and install new dryer, polisher and stamp for lidder, in packing house located at Walnut and Pomona Aves., replacing present dryer and polisher, and make repairs to other equipment. Total estimated expenditure $6,400. of which $2,520.chargeable to Investment, $2,060. to Expenses and $1,820. to Accrued Depreciation. W. 0. #420, issued May 8, 1941; Fullerton, Calif, install transverse orange washer, treating tank, and appurtenances, rearrange elevators, retiring Tampico brush washer, soaking tank and appurtenances in packing house at Truslow and Malden Avenues, under lease to Randolph Marketing Co. Total estimated expenditure $2,900, of which $2,850. chargeable to Investment and $50. to Expenses; ledger value of property retired 2j>3,209., of which $2,968. chargeable to Accrued Depreciation, $141. to Expenses and $100. to M0H. W. 0. #421, issued May 26, 1941; Yermo, Calif.; retirement of Lot 21, Block 5, Tract 1867, sold to M. M. Dodson, covered by Deed Audit No. 4490. Authorized by Vice President, Dec. 30, 1924. Ledger value of property retired and not to be replaced oreditable to "investment in Road and Equipment", $1.00; sale price $100.00; creditable to "Credits from Retired Road and Equipment", $99.00. W. 0. #422, issued June 19, 1941; Las Vegas, Nevada; retirement of Lots 15 and 16, Block 24, Clark’s Las Vegas Townsite, together with four-room house thereon, known as 629 South Second Street, sold to Archie Jones under lease with privilege of purchase Audit No. 10115, dated April 1, 1941. Ledger value of property retired and not to be Replaced creditable to "investment in Road and Equipment", $2,397.; Accrued Depreciation, $1,422., and Sale Price of Property, $2,500.; Creditable to "Profit on Sale of Real Estate", $1,525. W. 0. #423, issued June 19, 1941; Las Vegas, Nev.; lay 270’ of 6" new cast iron water mains from point on Charleston Blvd., south along street known as Third Place in Block F of Park Place Addition, known as Beckley Subdivision, to serve new residential subdivision, for Mr. Guy Mathis. Total estimated expenditure, $754, chargeable to Investment. 1 -30-